Galaxy helps lithium names power higher (GXY, KGN)

WHAT MATTERED TODAY

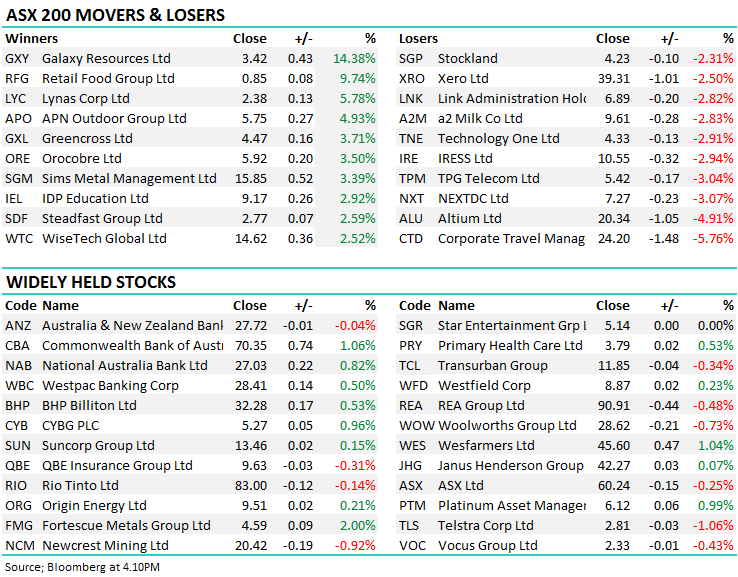

A reasonable open to trade this morning with the index bouncing nicely from sub 6000, banks doing a lot of the grunt work before a selloff across Asian markets put a cap on the advance. Still, we saw some big stock moves once again. Galaxy Resources putting on +14.38% after announcing the sale of an asset – that also helped the other players in the sector with Orocobre (ORE) and Kidman putting on 3.5% and 3.18% respectively. On the flipside, online retailer Kogan (KGN) which has had a phenomenal run since listing making Ruslan Kogan a very wealthy individual saw some selling – down -6.67% to $8.40 - the trend in that stock now looks very weak

Kogan.com (KGN) Chart

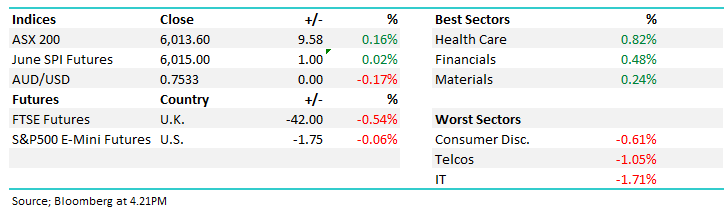

Overall, the ASX 200 added 9 points or +0.16% today, with the index finishing at 6013

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

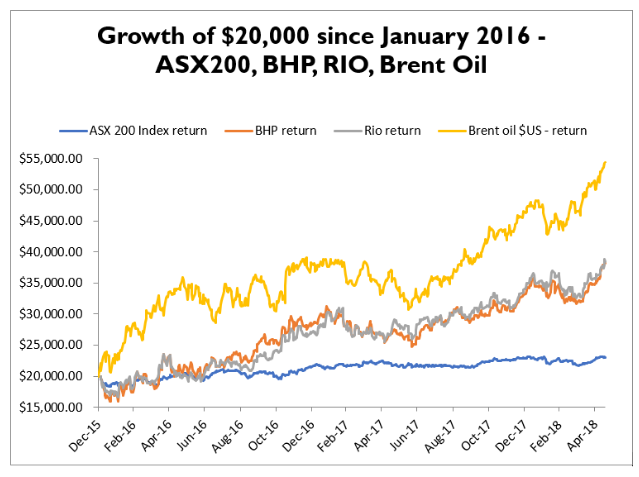

There was a very good article on www.livewiremarkets.com from PM Capital today looking at the return contribution from the resource stocks relative to the rest of the market. From the chart below it’s clear that resources have been the driving force behind returns since the start of 2016. Commodity / Energy price tailwinds on the back of improving global growth dropping down to good earnings and therefore good share price performances have underpinned strength while the rest of the market has been somewhat subdued.

In the last week though, resource stocks have suffered from selling with the likes of BHP falling ~7%. We covered the theme in the AM report this morning (click here) covering 5 of our favourite resource stocks into weakness. The conclusion from the AM report was simply that we remain short-term bearish the oil & resources space however the dream is not over – with more upside to go from the resource sector as inflation and interest rates track higher – a strong combination for resources. Recent weakness will provide an opportunity in the sector, but not yet. Our desired buy prices remain; BHP ~$29, FMG ~$4, AWC ~$2.40, IGO ~$4.40, OZL ~$9

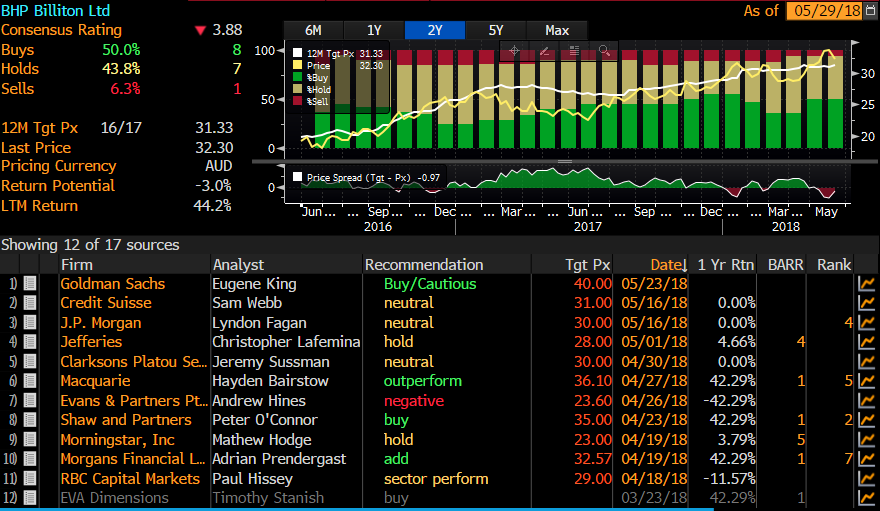

Here’s current broker thoughts on BHP – consensus target sits at $31.33 however GOLDMAN’s now the most bullish with a $40 Target Price outpacing Macquarie at $36.10 and Shaw’s Peter O’Connor at $35. – you can catch my last video with Peter O’Connor (here) – he’s the No 1 rated analyst on the stock…

Broker Moves – downgrades flowed through for Metcash today in terms of earnings numbers, but no change to current calls from what I could see, the stock down today (-0.66%) but finished up from session lows

Elsewhere…

* ALL AU: Aristocrat Upgraded to Hold at Morningstar

* BPT AU: Beach Energy Upgraded to Hold at Morningstar

* IPL NZ: Investore Property Cut to Neutral at First NZ Capital

* SGM AU: Sims Metal Upgraded to Hold at Morningstar

Galaxy (GXY) $3.42 / +14.38%; Rallied hard today after the lithium miner announced a $US280 million ($A371 million) asset sale deal with Korean giant Posco. They sold a package of mining tenements in northern Argentina + unveiled plans to work more closely with Posco on future projects. Galaxy is developing the highly prospective Sal de Vida lithium and potash brine projects in Argentina, situated in the lithium triangle where the country meets with Chile and Bolivia. The lithium triangle is currently the source of 60% of global lithium production. The deal is subject to Posco board approval, which is expected during the third quarter of 2018, however the cash will go some way in assisting GXY deliver on the potential of its resource. While we like ORE and to a lesser degree KDR in the sector at this stage, the move today in GXY was strong and flowed through to reasonable performance in the other names.

Galaxy (GXY) Chart

OUR CALLS

No changes to the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/05/2018. 4.30PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here