Overseas sentiment dampens markets, Aussie fares better than Asia (REA, RFG)

WHAT MATTERED TODAY

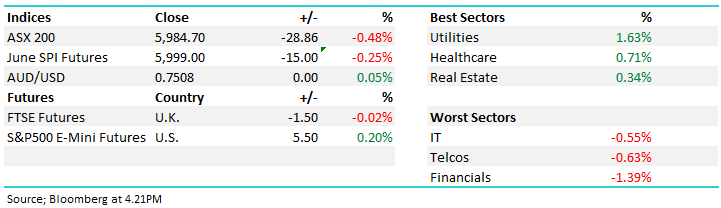

The risk off sentiment from last night flowed through to heavy selling early in today’s session, before some buyers stepped up and supported the broader market. Banks, as expected, were hit hard, along anything exposed to European markets – in particular CYB sold off -2.47%, and JHG off -2.67%. Despite the sea of red on the boards, the local market performed a lot better than Asian counterparts with China & Hong Kong both falling around 1.3% today. Westfield as we know it came to an end today, with WFD ceasing trading following the completion of the Unibail acquisition.

The best performers were the utilities today, followed closely by Health Care, while financials was the worst sector on the index.

Overall, the ASX200 fell 28 points, or -0.48% to 5984 – breaking the key 6000 level, however rebounding ~20 pts from lows.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

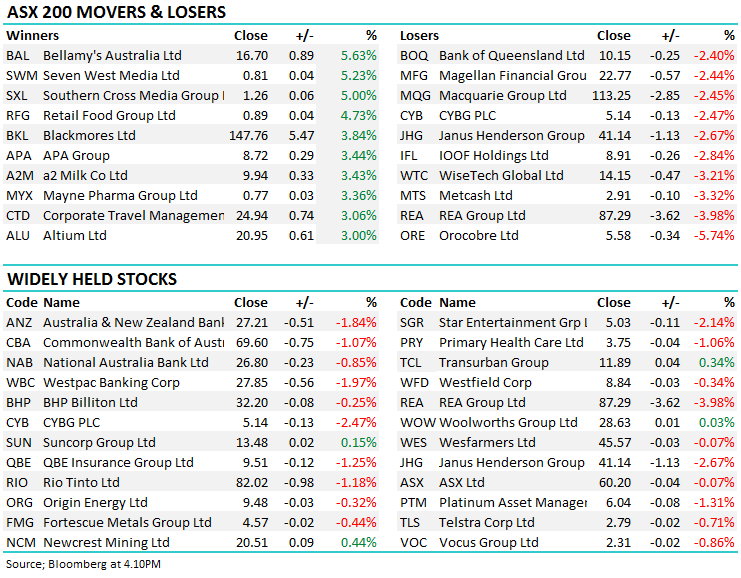

Broker Moves; REA group was particularly weak today following three different brokers turning against the “market darling.” The online real estate advertiser has been on an impressive run since the end of 2016 on the back of strong growth prospects in the booming property market. Now the chickens are coming home to roost and analysts are struggling to justify the high PE the stock now trades on – JPM & Macquarie downgraded the stock, while a UBS strategy note highlighted the risks around high PE stocks, in particular REA. The stock was off -3.98% to close at $87.29, at one stage falling to $84.80.

REA Analyst Snapshot

REA Group (REA) Chart

ELSEWHERE….

* REA Group Cut to Underweight at JPMorgan; Price Target A$78

* REA Group Downgraded to Underperform at Macquarie; PT A$86

* APA Group Upgraded to Outperform at Macquarie; PT A$8.67

* Collection House Upgraded to Hold at Canaccord; PT A$1.59

* IOOF Holdings Downgraded to Neutral at JPMorgan; PT A$10

* AMP Downgraded to Neutral at JPMorgan; PT A$4.20

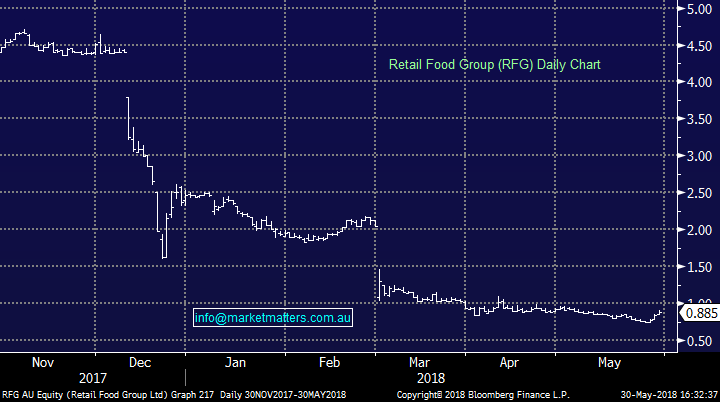

Retail Food Group (RFG) $0.885 / +4.73%; Yesterday’s announcement of the appointment of Richard Hinson to group CEO has been taken well by the market, with the franchise operator following up yesterday’s +9.74% performance with another 4.73% addition today. Richard is an internal hire (of only 4 months), having worked as the company’s franchise business chief since January, coming on after the business issues were identified by the media in December of last year. Has clearly made inroads into the problems of the franchise network, impressing the board and stake holders as he succeeds Andre Nell who lasted less than 2 years in the top job. One to watch, but not one we like at MM given the broken franchisee model and shopping centre exposure.

Retail Food Group

OUR CALLS

No changes to the MM Portfolios today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/05/2018. 4.30PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here