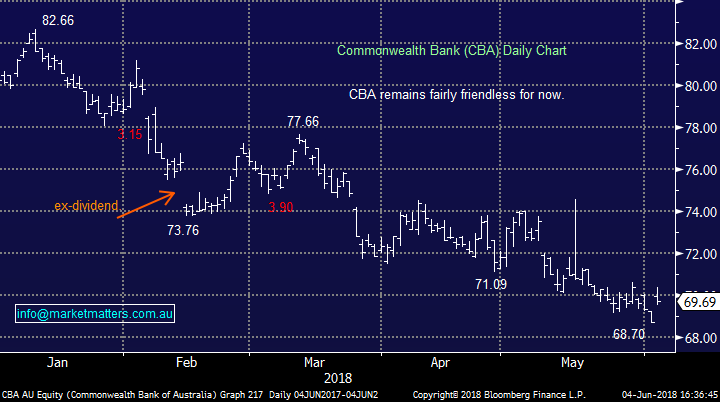

CBA settles its AUSTRAC case and rallies (CBA, CYB)

WHAT MATTERED TODAY

Some money flowed back into CBA today after they settled the AUSTRAC case with the regulator for $700m – less than the $1bn expected and this settlement provides one less variable when considering an investment in CBA. Elsewhere, we saw some good moves in a number of resource companies – Nickel Miner Independence Group (IGO) a standout while the Gold miners were strong, Evolution (EVN) adding + 3.30% one of the stars. On an index level, the market followed Wall Street’s optimism on Friday and was supported further (+5.64 index points) from buying in CBA.

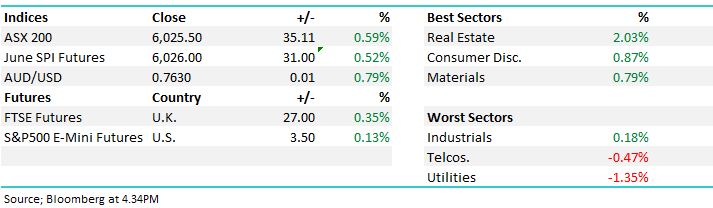

Overall, the ASX 200 added 35points or +0.59% today, with the index finishing at 6025 –back up through the 6000 level.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Last week in a MM Video Update, James and Harry speak about current portfolio positioning, focussing mainly on the resource sector – click here to view – James highlights IGO as a BUY here (we already own) and that stock has done well this week, adding another ~3% today.

Broker Moves – Macquarie penned an interesting note on the aged care stocks today, suggesting that the sector is facing negative jaws as cost of providing care seen outgrowing revenues as govt subsidies downgraded, prompting a cautious view.

• Japara Downgraded to Neutral at Macquarie; PT A$1.86

• Estia Health Upgraded to Outperform at Macquarie; PT A$3.60

• Regis Healthcare Cut to Underperform at Macquarie; PT A$3.50

• Inghams Downgraded to Hold at Morgans Financial; PT A$4.20

• Galaxy Resources Upgraded to Buy at UBS; PT A$3.95

• AACO Upgraded to Buy at Bell Potter; PT A$1.47

• Sims Metal Downgraded to Sell at Morningstar

• Domino’s Pizza Enterprises Downgraded to Hold at Morningstar

• Pendal Group Upgraded to Buy at Morningstar

• Whitehaven Downgraded to Neutral at Clarksons Platou; PT A$5.20

• AGL Energy Downgraded to Neutral at Credit Suisse; PT A$23.25

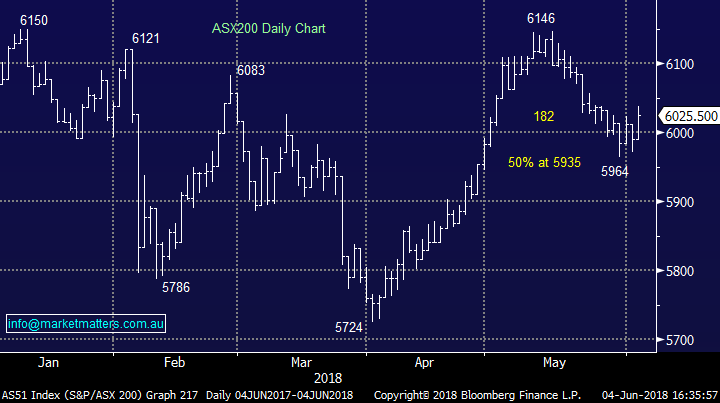

Commonwealth Bank (CBA) 69.69 / +1.44% Settled the outstanding case with AUSTRAC today for a cool $700m after admitting to more than 53,000 money-laundering law breaches - the result was a net positive for CBA given it removes uncertainty, allows them to put the saga behind them and in the context of a ~$5bn profit in the last half (and I know this sounds flippant) the payment is “not that a big deal” given the bank’s current financial metrics. CBA had already provisioned for some of the cost and the shares rallied today on the back of the news.

Commonwealth Bank (CBA)

CYBG (CYB) $5.30 / 6%; Rallied strongly today after news this morning it has revised its proposed merger terms with Virgin Money and the two companies are in discussions regarding an all-share combination. This would create a big mid-sized bank in the UK. Under the new proposal, the offer implies a 23% premium to Virgin Money shareholders (previously 15%) and the deal is all scrip, with Virgin shareholders coming out the other side with 38% of CYBG. The market is keen on this deal- as we are, and any sign that it’s going ahead is a positive.

CYBG (CYB) Chart

OUR CALLS

We added Fortescue (FMG) to the Growth Portfolio today as a shorter term trade, targetting ~$5.30

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 4/06/2018. 4.28PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here