Orocobre delivers on June quarter production (ORE, SIG)

WHAT MATTERED TODAY

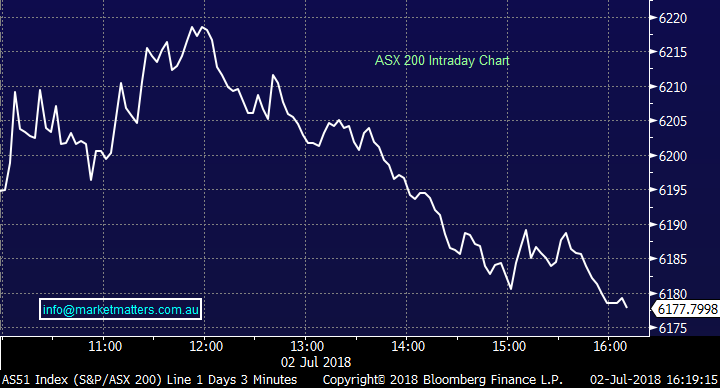

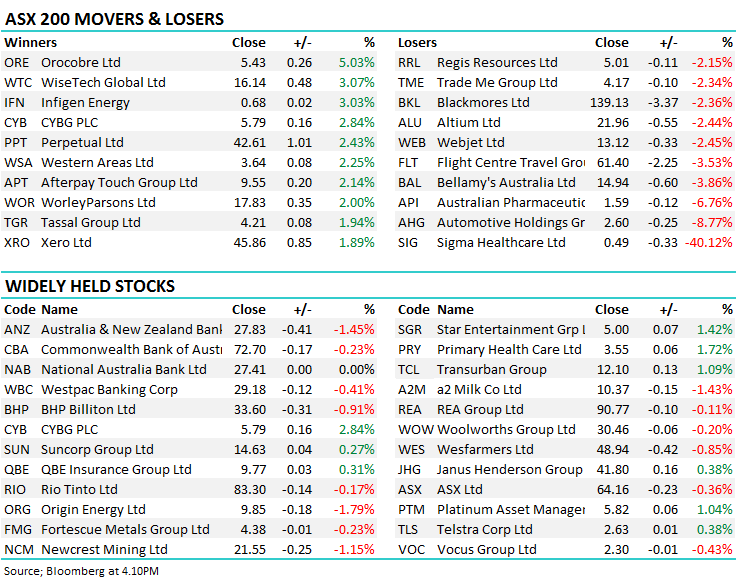

A reasonable open to trade this morning however the early optimism was sold into with the market tracking lower into the close. The index continues to feel heavy here and we’re seeing weakness play out in US Futures as we type – Dow Futures down -189pts. The defensive sectors did best today while the retailers came under pressure.

Marley Spoon (MMM) came onto the ASX today after raising $70m and had a poor start life on the exchange. They opened at $1.25 after issuing stock at $1.42, before closing at $1.195 – down 16% on the session. For those not familiar, they deliver meal kits and recipes to more than 110,000 customers in Germany, Austria, the Netherlands, Belgium, the United States and Australia under a subscription model – a growing area but one that’s very competitive.

Overall today, the index finished down - 17points, or -0.27%, to close at 6177.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Goldman Sachs have been busy in the Healthcare stocks today with an uber-bullish price target for CSL – printing $231 and a New Buy call on the stock. CSL closed at $194.46 today which is around 18% below the price target. They’re not as bullish on Cochlear (COH) with a Neutral call and $200 PT while they rate Resmed as their No 2 pic in the sector (behind CSL). Looking further afield, Morgan Stanley have become bullish on Treasury Wines (TWE), thinking its cheap relative to global peers while UBS are talking up the prospect of SCA Property (SCP buying Vicinity Centres (VCX), which is fairly typical when there are a number of bids playing out in the sector, brokers are forced to look for ‘others’ that could come into place.

Elsewhere;

· Reliance Worldwide Resumed Outperform at Macquarie; PT A$6.20

· Cimic Upgraded to Hold at Deutsche Bank; PT Set to A$40.50

· ResMed GDRs Rated New Buy at Goldman; PT A$16.70

· Ramsay Health Rated New Sell at Goldman; PT A$49

· F&P Healthcare Rated New Neutral at Goldman; PT A$13.40

· Cochlear Rated New Neutral at Goldman; PT A$200

· CSL Rated New Buy at Goldman; PT A$231

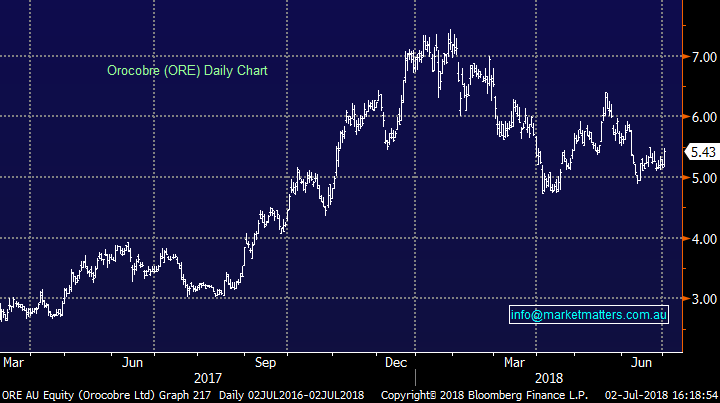

Orocobre (ORE) $5.43 / 5.03%; ORE came out with a strong set of production numbers this morning + they provided some bullish commentary around the demand outlook for electric vehicles and the associated flow through for Lithium. In terms of production, the June quarter was a strong one up 28% to 3,596 tonnes. They received US$ 13,611/ tonne for their product while they were yet to finalise their cost base, however last quarter was US$4,356 / tonne – so clearly a good margin.

They went on to talk about the demand side from the car manufactures and it seems that the bigger brands are providing more detail about their plans moving forward. Toyota for instance say they want every Toyota and Lexus vehicle to be available either as a dedicated electrified model or have an electrified version by 2025. General Motors will phase out all gas-powered vehicles for an all-electric future (without providing a time frame), Ford will invest $11bn by 2022 while Merc plan to electrify its entire portfolio by 2020 - Volvo will do it by 2019! All sounds very good for Lithium demand into the future. We remain bullish on Lithium in the longer term and continue to hold ORE in the portfolio.

Orocobre (ORE) Chart

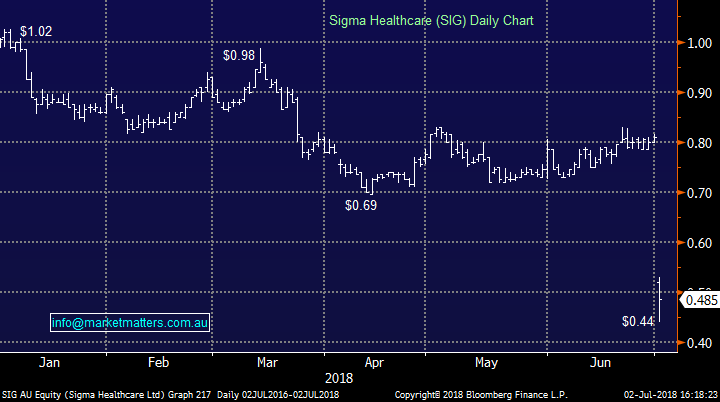

Sigma Health (SIG) 48.5c / -40.12%; Today announced negotiations to renew a supply contract for the Chemist Warehouse group had fallen through. While the contract still has another 12 months until expiry, Sigma has already identified that cost cutting will not cover the revenue loss associated with the Chemist Warehouse deal and coupled the announcement with a downgrade to their current financial year guidance (March year-end), reducing forecast FY19 EBIT from $90m to $75m – a nice ~17% downgrade – while forecasting FY20 to be between $40-$50m, ~50% below consensus at $96mil! Understandably the stock was whacked significantly today, falling 42% early. The biggest winner here has been New Zealand based health care service company Ebos Group (ASX.EBO) which has picked up the contract. Ebos shares are currently trading ~5% higher MM remain wary of the pharmaceutical space with many regulatory changes on the horizon and potential disruption to the bricks and mortar operations.

Sigma Health (SIG) Chart

OUR CALLS

No trades in the MM Portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here