The dogs of the last 12-months, Banks & Telstra, help the market higher (BAL, CYB, DMP, OZL)

WHAT MATTERED TODAY

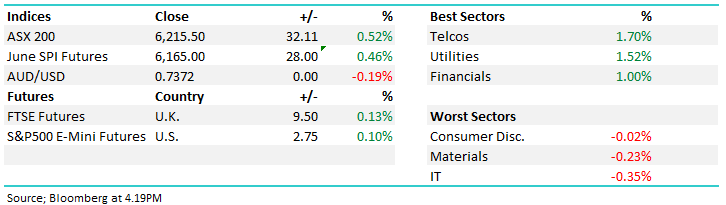

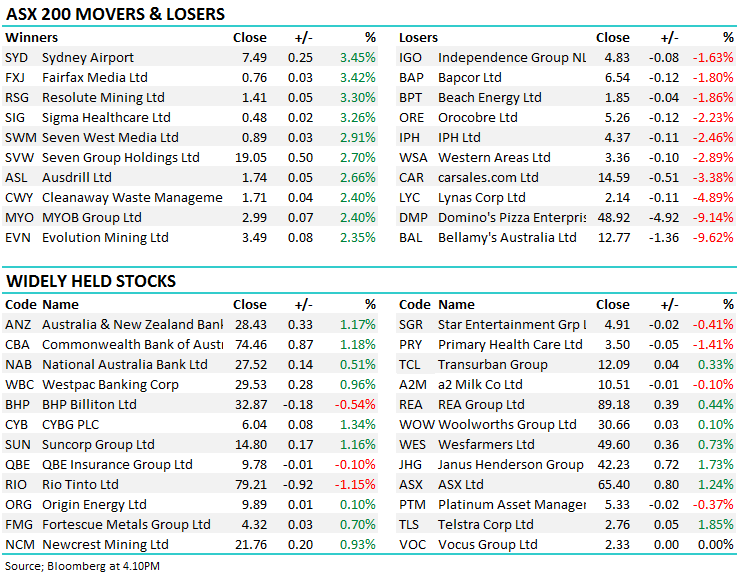

The banks helped the index higher as the local market chose strength after the US was closed last night for 4th of July festivities. Resources were mostly lower although energy was higher thanks to slower than expected ramp up in Saudi supply. Telstra continued its recent rally with another 1.8% gain today, helping the telco sector top the boards. The best performer on the index was Sydney Airports – up 3.45%, although half of that came from a very suspect looking end of day match where the stock jumped 13c on almost a third of the day’s volume - looks like an operator error.

Bellamy’s was down heavily again, the worst performer in the top 200 – off 9.6%, down almost 30% in just 2 weeks! While there hasn’t been a great deal of news flow to explain the quick drop, investors are fearing China may not grant approval for its products, the big growth area for the company and the reason why it trades at such a high multiple. Stay tuned to see if these fears are realized.

Bellamy’s (BAL) Chart

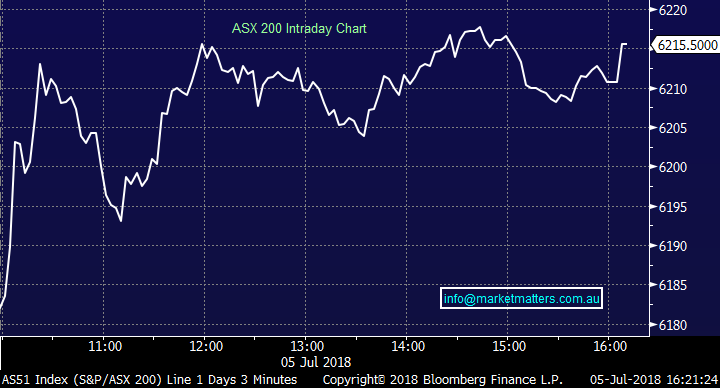

Overall, the market added 32points, or 0.52% to 6215 – it has now remained inside a 90point trading range between 6161-6251 for 2 weeks

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Domino’s Pizza was the big loser today, thanks to Citi & Credit Suisse both dropping the stock to a sell, the later reducing their target price by 13% and now clearly the most bearish view in the market. Credit Suisse pondered a range of risks to the Domino’s business model – franchise industry under pressure in general, delivery aggregators/disruptors such as UberEats, high expectations out of Europe and unproven in Japan – and heavily discounted future earnings as a result. In our view, DMP is a consumer staples stock on a high growth multiple (35x PE) in an environment that isn’t really supportive, technically looking weak with an initial target below $40.

ELSWHERE….

· Audinate Group (AD8 AU): Rated New Speculative Buy at Evans and Partners

· Domino’s Pizza Enterprises (DMP AU): Cut to Underperform at Credit Suisse

· Elmo Software (ELO AU): Rated New Speculative Buy at Evans and Partners

· Jumbo Interactive (JIN AU): New Speculative Buy at Evans and Partners

· Nanosonics (NAN AU): Cut to Hold at Morgans Financial; Price Target A$3.12

Oz Minerals (OZL) $9.14 / -1.08%; we spoke about copper this morning, with one eye on our Oz Minerals target entry below $9. It briefly dipped into that territory this morning, before rebounding ~1.5% to close at $9.14, just missing our chance to get in while CYB was being sold. There was plenty of chatter about the copper price in the office today – often a barometer of economic activity, is the decline in copper price predicting a downturn in economic activity or is the weakness just volatility as a result of trade war tensions, and a chance to buy into weakness given our overall view of growth and inflation. We have to agree with the later, and are likely to pull the trigger on OZL if we see another dip below $9. Click here to read the morning report for a more detailed view

Oz Minerals (OZL) Chart

OUR CALLS

We sold out of CYB in the Growth Portfolio today after it reached our $6, for a ~10% profit – although we like the Virgin Money deal, and the UK interest rates exposure, it has run hard and selling strength makes sense in regards to our overall view. We may look to buy any significant pullback

Clydesdale (CYB) Chart

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here