ASX:AMP 04/07/2018

AMP – cheap, but not cheap enough

I spoke with Alan Kohler recently for his talking finance podcast and one of the topics was AMP being a cheap income stock. At the time I suggested it was cheap, but not cheap enough, while the dividend is clearly at risk. It currently trades on 10.82x consensus earnings for next year with an expected grossed up yield of 11.24% - seems too good to be true and it probably is.

According to Bloomberg, the consensus price target on AMP is $4.08 v its current price of $3.57, leaving about 14% return potential. Analysts are fairly divided on the stock which is not surprising, with the most bearish at Shaw and Partners suggesting its worth $3.00, while the most optimistic call sits at Evans and Partners at $5.03 The bigger firms mostly congregate around the mid $4’s.

Analyst calls on AMP

The divergent views around AMP is largely built on whether or not we see the regulator act to ban grandfathered commissions. If we do, then $3.00 may be a conservative downside target.

The divergent views around AMP is largely built on whether or not we see the regulator act to ban grandfathered commissions. If we do, then $3.00 may be a conservative downside target.

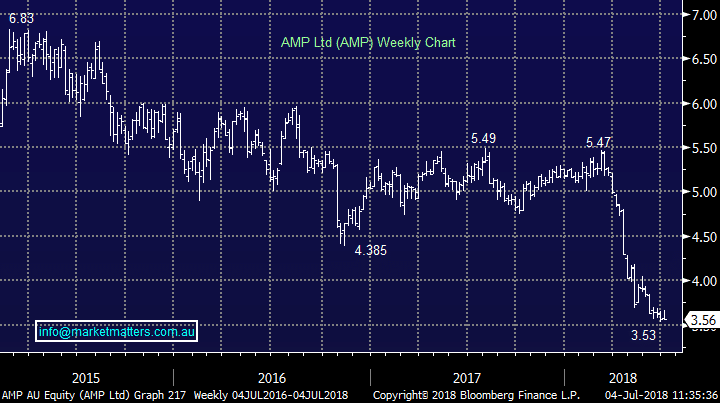

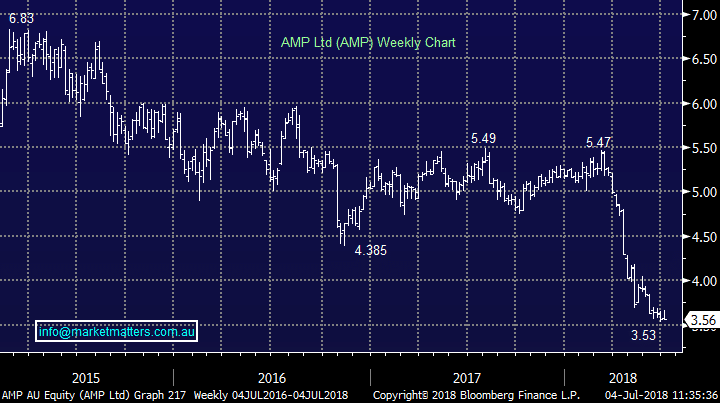

AMP Chart

3 main things that concern us about AMP

1. The removal of grandfathered commissions

2. The buyer of last resort (BOLR) facility that AMP makes available to their network which included 1454 planners at end of 2017 – this is a great facility (for the adviser!), but a big potential liability for AMP

3. The usual restructuring changes and then the overhand of fines and class actions that seem very likely.

Grandfathering:

Westpac got the jump on their competition announcing plans to end the practice for their salaried sales staff. Macquarie have joined suit and this is clearly a way of putting pressure on their competitors while also appearing to be good corporate citizens – a win win! AMP and IFL have a lot more to lose than WBC or MQG by doing this. In the case of AMP, Shaw and Partners AMP Analyst Brett Le Mesurier - who is the most bearish in the market - on the stock, reckons it will cost AMP around $250M pre-tax, which is significant.

The Buyer of Last Resort Facility:

What a great facility, for the adviser! In broad terms, the facility allows AMP planners to receive a payment of 4 times the revenue of their practice if they can’t sell it elsewhere. According to Brett’s numbers, if the average payment per planner is $1M then the potential liability for AMP is $1.5B ). A potentially huge liability and given AMP has no material excess capital then if they were called on this, they would likely need to lower dividends and/or raise capital.

Restructuring charges, class actions and fines:

AMP is in the market for a new CEO. Call us cynical however history has shown that new CEO’s like to re-base earnings pretty quickly, draw a line in the sand for their tenure and build up from there. There is obvious risk of AMP doing this when they find themselves a new leader. Furthermore, last week, ASIC launched civil penalty action against AMP Financial Planning which could result in further fines

Conclusion

Clearly, these issues are real, and they could be potentially large. Throw in the fact that AMP will struggle to attract new planners – or even retain existing ones, while they will also find it hard to grow funds under management.

The divergent views around AMP is largely built on whether or not we see the regulator act to ban grandfathered commissions. If we do, then $3.00 may be a conservative downside target.

The divergent views around AMP is largely built on whether or not we see the regulator act to ban grandfathered commissions. If we do, then $3.00 may be a conservative downside target.