Trump stirs markets

WHAT MATTERED TODAY

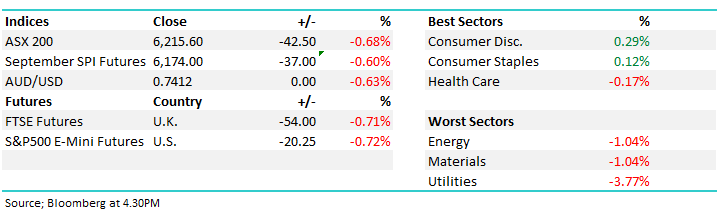

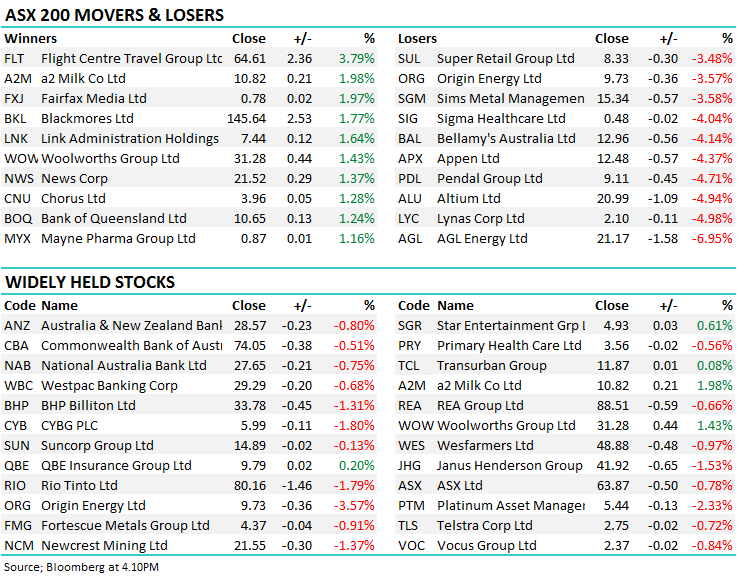

As expected, the market rolled over following the Trump trade war tweets this morning with international global growth based stocks getting hit hard early. The market didn’t ever meaningfully recover from the 11AM lows, spending most of the day around the 6215 level. The consumer facing stocks rose as credit expanded (which surprisingly didn’t help the banks – more on this later), while energy/utilities/materials all dragged as global growth was put at risk.

Oz Minerals was just 1c away from our buy target, however copper fell through support today below the $US275/lb level so we are unlikely to pull the trigger here at this stage. Today’s weakness also reduced the risk/reward scenario for the European facing ETF’s as we took the prudent/lower risk position with a wait and see approach watching how this trade war plays out.

Overall, the index fell 42 points, or -0.65% to 6215

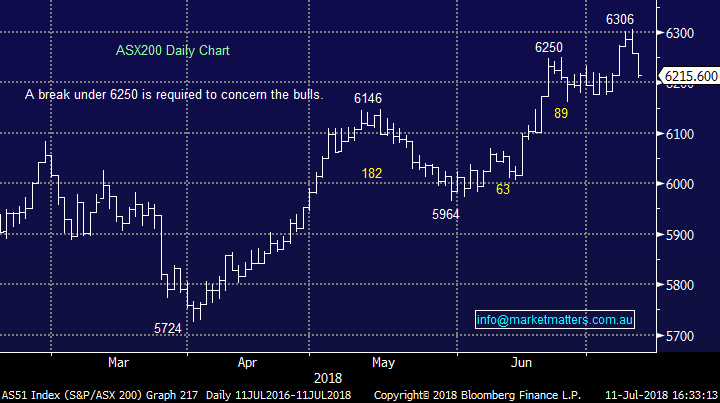

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Nothing out of the ordinary from the brokers today, with Pendal downgraded following the FUM update discussed in yesterday’s report, while CYB was downgraded after a stellar performance over the past few weeks.

· Pendal Group (PDL AU): Pendal Group Downgraded to Hold at Morgans Financial; PT A$11

· CYBG (CYB AU): CYBG Downgraded to Underperform at KBW; PT 3.30 Pounds

Banks; there was a clear switch occurring today from the big 4 to the regional lenders across the board today with tailwinds working two fold for the regional banks. Despite today’s credit data showing a 1.1% uplift in home loans for the month, the bigger banks were down significantly with the AFR reporting underlying weakness in the ability for at least 1 million borrowers to repay loans as rates rise. As the credit market expands, the market expects regionals to earn a larger share of the increasing market, while they are also seen as better lenders and more protected in a rising bad debt charge environment. ANZ was down -0.8% while Bank of Queensland was particularly strong, rising 1.24% in a falling market.

ANZ Chart

Bank Of Queensland (BOQ) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here