Buyers dry up, oil tensions rise (PLS, RMD)

WHAT MATTERED TODAY

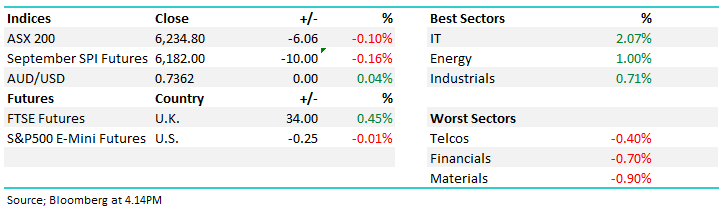

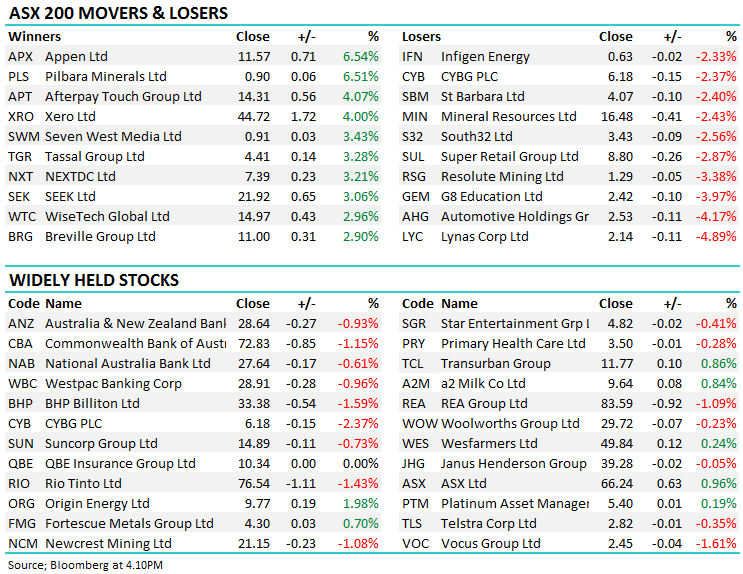

Early strength was sold into today, as the market finished lower despite a strong lead and a positive open. It was the IT sector that performed the best today, putting on an impressive 2% following the overnight move from the NASDAQ which rallied on Apple’s strong result. Energy also added a solid 1% with fears global supply may be restricted as US-Iran tensions rise and Iran steps up military exercises in key oil shipping lanes.

On the flipside, the bigger market weights of materials and financials dragged the market lower. After seeing some support early, the big names rolled over and sent the index into the red. CBA was up over 0.5% early, only to close -1.15%, while BHP was flat in the morning but seen -1.59% lower on the close.

Overall, the index closed down -0.1% or -6 points today to 6234 – down 66 points / -1.04% on the week

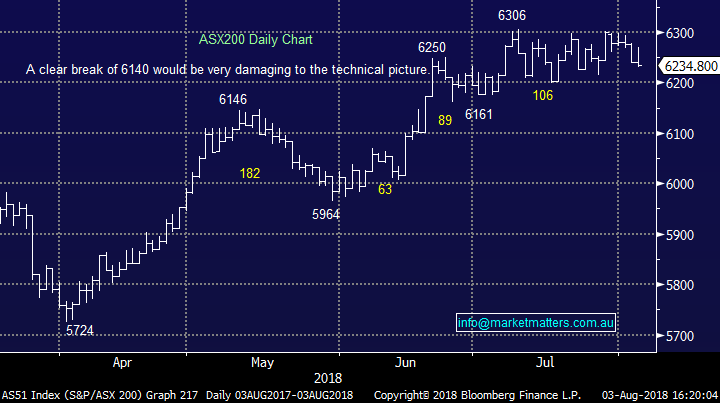

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

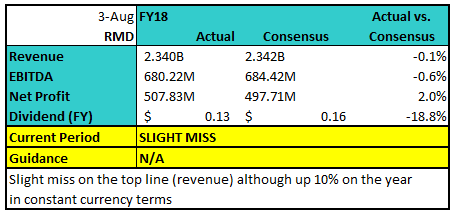

Resmed (RMD) $14.45 / +0.35%; Resmed today announced their 4th quarter and full year results, with the full year coming in as a slight miss to consensus on the revenue and EBITDA lines however it was a beat at the Profit line. The respiratory and sleep disorder company is all about growth, so the revenue line here is important – for FY18 it grew by 12% which is a strong number for the year however the currency added around 2% of the gain. On a forward PE of 29.3x with the market expecting +9.5% growth in sales in FY19, RMD is in the expensive bucket.

Resmed (RMD) Chart

Pilbara Minerals (PLS) $0.90 / +6.51%; Lithium miner Pilbara has bucked the sectors weakness today to push higher following the release of a feasibility study for their Pilgangoora project. The mine looks to have a 17 year life, producing 800,000-850-000 tons of high-quality lithium containing spodumeme per annum. The Western Australian project has an expected capital cost of $231m, but is expected to generate $6.3b of EBITDA over the mine’s life. Other lithium names were flat to lower as lithium has come under some pressure recently over fears that future supply will outstrip demand in the immediate term.

Pilbara Minerals (PLS) Chart

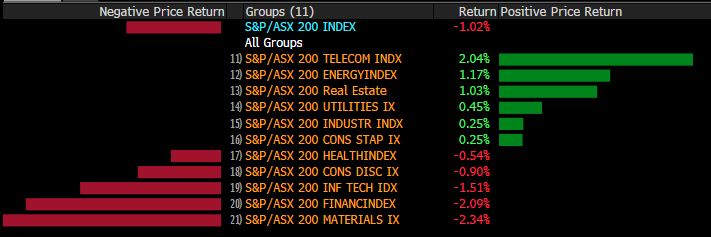

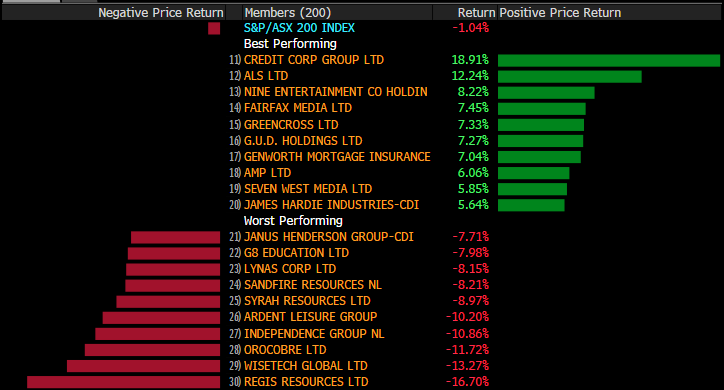

Weekly Moves – Stocks & Sectors;. A mixed bag for Aussie sectors throughout the week – Energy remains strong, Telcos bounced back into fashion while some poor quarterly updates and weak prices saw materials lower.

Sectors over the past Week

At a stock level, a reasonable result from Creditcorp earlier in the week saw the stock rally hard while Regis’ poor quarterly has it languishing in last place.

Stock moves over the week

Broker calls;

· Ardent (AAD AU): Downgraded to Underweight at JPMorgan; PT A$1.54

· Money3 (MNY AU): Money3 Cut to Accumulate at Hartleys Ltd; Price Target A$2.14

· Netwealth Group (NWL AU): Netwealth Group Downgraded to Sell at Wilsons; PT A$6.49

· Pact Group (PGH AU): Pact Group Downgraded to Hold at Morningstar

· REA Group (REA AU): REA Group Upgraded to Hold at Morningstar

· Super Retail (SUL AU): Downgraded to Neutral at JPMorgan; Price Target A$9

OUR CALLS

No changes the portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 3/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here