The index tips higher to close out a solid week

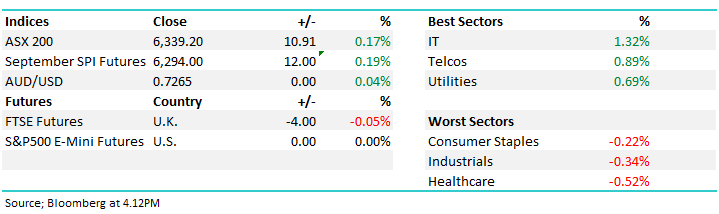

WHAT MATTERED TODAY

The markets were supported today as both the banks and materials edged higher, the index making fresh 10-year highs above the close of Wednesday.

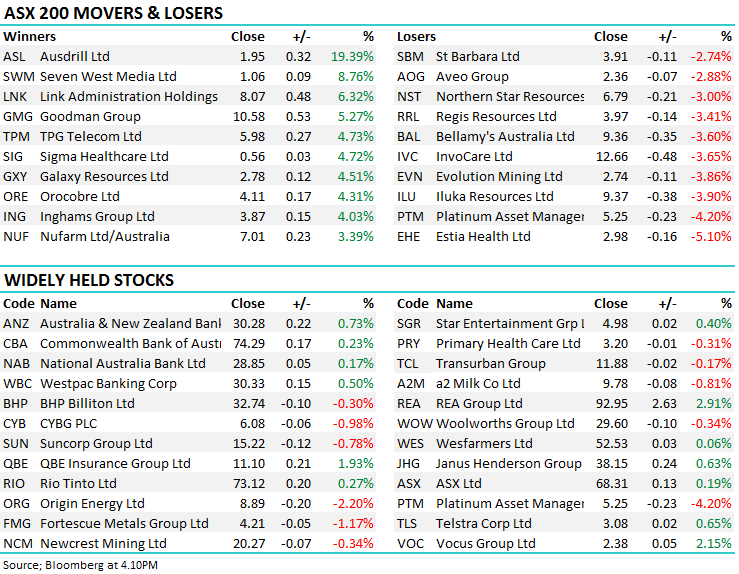

Buying followed through for both TLS, NCK & QBE following good results today. Estia health was the worst performer today after brokers rant he ruler over their results yesterday, while Ausdrill jumped as progress is made with their capital raise to purchase mining contractor Barminco.

Overall, the index closed up +0.17% or +10points today to 6234 – up 61 points / +1.0% on the week

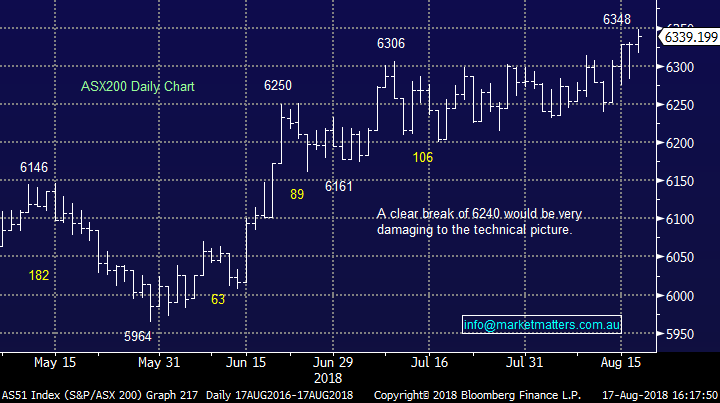

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

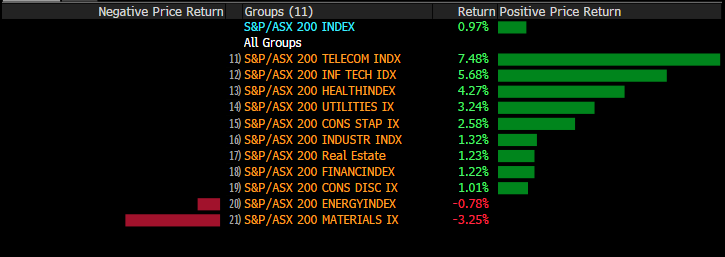

Weekly Moves – Stocks & Sectors;. On a sector level, Telstra did the hard yards for the Telcos, while general weakness in resources saw materials and energy names sink to the bottom of the week’s performance.

Sectors over the past Week

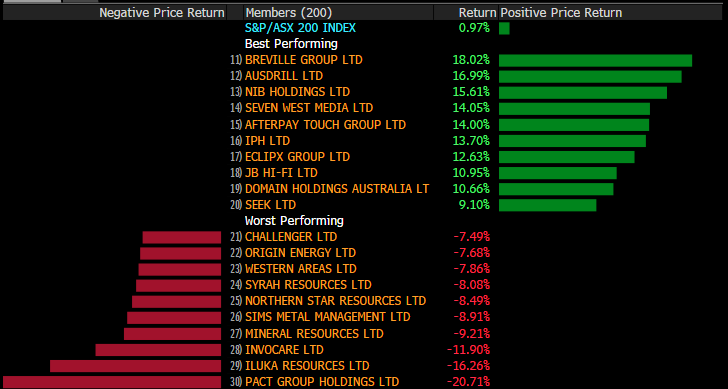

At a stock level, it was the reporting companies that showed the most volatility. Pact Group at the bottom following a 21.9% fall on Wednesday on a weak result, while the other end of spectrum was Breville and NIB on strong results

Stock moves over the week

Broker calls;

· Downer EDI (DOW AU): Upgraded to Outperform at Credit Suisse; PT A$8.25

· Growthpoint (GOZ AU): Downgraded to Underweight at JPMorgan; PT A$3.45

· Origin Energy (ORG AU): Downgraded to Neutral at Credit Suisse; PT A$9.70

· Sonic Healthcare (SHL AU): Cut to Underperform at Credit Suisse

· Telstra (TLS AU): Upgraded to Buy at HSBC; PT A$4.30

· Treasury Wine (TWE AU): Cut to Equal-weight at Morgan Stanley; PT A$20

OUR CALLS

No changes the portfolios today.

Watch out for the weekend report. Have a great night,

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here