ASX 200 cracks back up above 6300 (BKL, CTX)

WHAT MATTERED TODAY

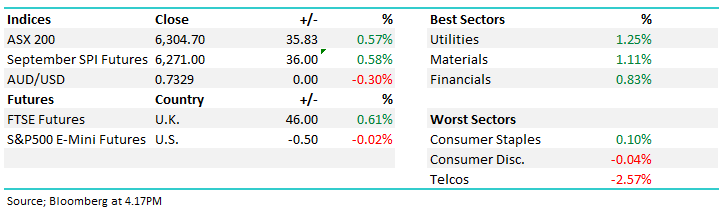

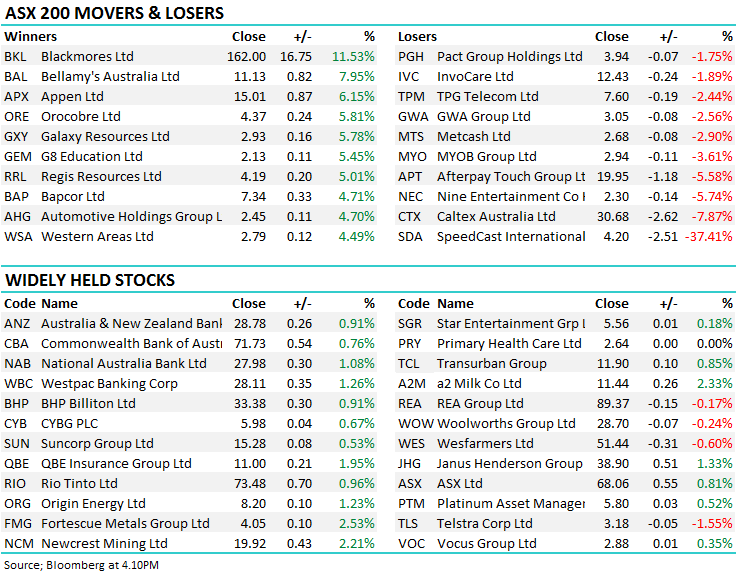

The local market followed the US higher today following their ~1% move higher overnight, buoyed by the trade deal workings of Donald Trump and Mexico. The banks once again found some form today as the distraction from Canberra wains, while resources continued their bounce – Rio is now up over 3% from its Friday lows with our $71 downside target looking the goods at the moment.

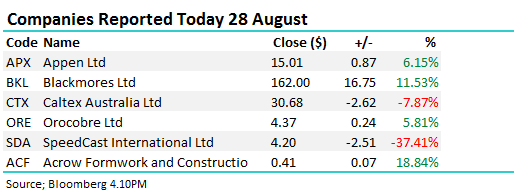

Reporting season threw up some more curve balls. Satellite comms provider Speedcast fell from the sky today on a soft first half and downgraded guidance, down a huge -37%. Elsewhere, Blackmore’s vitamins are working, the stock up strongly on the result & Caltex was under the pump – more on these later on.

Overall, the index closed up +35 points or +0.57% today to 6304.

Some big variance in company reports / reactions today; For a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

· Adairs (ADH AU): Upgraded to Buy at Goldman; PT A$3.10

· Iress (IRE AU): Rated New Hold at Morgans Financial; PT A$14.52

· Kelly Partners Group (KPG AU): Raised to Add at Morgans Financial

· Mayne Pharma (MYX AU): Upgraded to Hold at Wilsons; PT A$1.02

· NetComm (NTC AU): Downgraded to Hold at Canaccord; PT A$0.90

· Reliance Worldwide (RWC AU): Downgraded to Hold at Bell Potter; PT A$5.40

· Transurban (TCL AU): Rated New Sell at Insight Investment Research

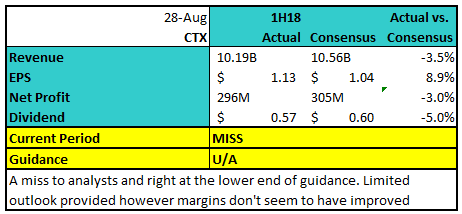

Caltex (CTX) $30.68 / -7.87%; the first half result missed market expectations for Caltex and the stock has traded sharply lower throughout the day. The numbers were weak, showing the falling appetite for premium fuel, lower refining margins and a soft retail sales result within the business which posted a first half profit of $296m, sneaking into the bottom end of guidance at $295-315m. Key to the result was convenience retail earnings falling 14% to $161m, while acquisitions in NZ and the Philippines were not enough to offset the issues.

The result also came with commentary around its property and fuel portfolios as company conducts asset reviews in an attempt the extract value from current assets. Caltex owns around $2b worth of freehold petrol stations, and announced plans to begin selling down its stake to retail real estate investors rather than going down the IPO route others have used. Initially looking to sell a $500m stake, Caltex eventually plans to be a minority holder of the property business it now owns, seeing strategic property partnerships the way forward to sustainable growth.

Caltex (CTX) Chart

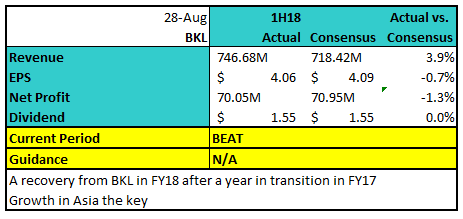

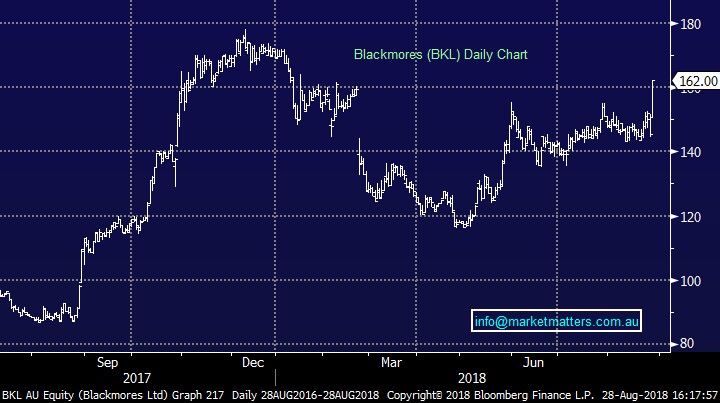

Blackmores (BKL) $162.00 / +11.53%; This morning Blackmores reported their full year results and they were above market expectations, with revenue rebounding strongly from FY17 to FY18 (up 9%) and NPAT increasing by 19%. It’s been a volatile few years for the vitamin maker however it seems management have now re-aligned the business, optimised the cost structure and are now pushing hard into Asia.

The composition of the result was interesting, with Q4 revenue a strong point while they also had the added benefit of expanding margins.

Blackmores (BKL) Chart

OUR CALLS

No changes to either portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here