The market rout continues, Telstra bucks the trend (TLS)

WHAT MATTERED TODAY

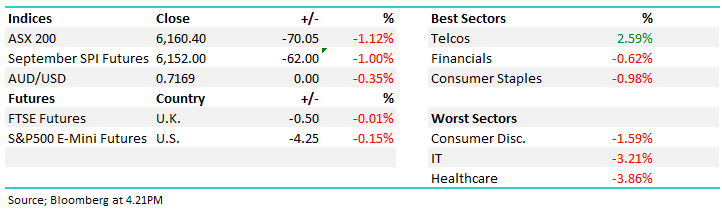

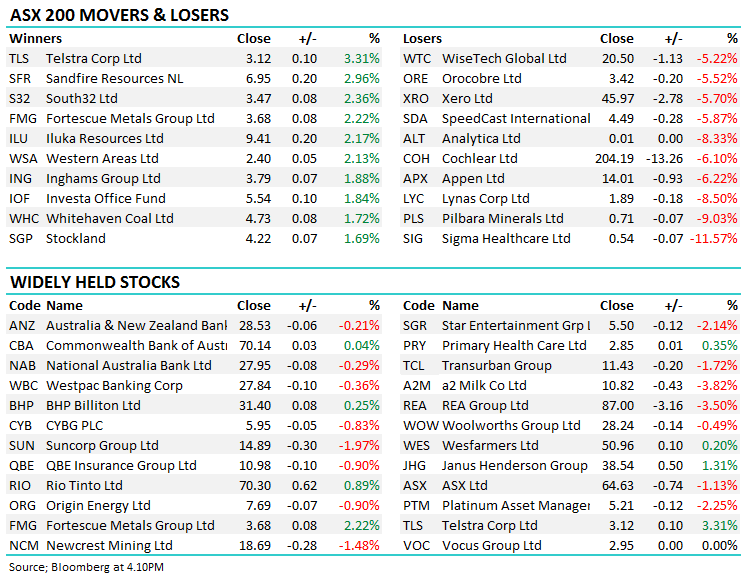

The market lacked support once again today and for the second day in a row the local index was down more than 60pts. It was the growth stocks hit particularly hard today, with anything quality left out of the rout – CBA for example actually ended the session higher, up 3cents / +0.04%, nothing to write home about but still 1.16% outperformance of the top 200. While on the growth end, anything with a high PE was sold indiscriminately – CSL -4.52%, COH -6.1%, WTC -5.22% & ALU -5.95% to name a few.

Telstra managed a strong day, holding to telcos to the top ranking sector, despite downgrading guidance – more on this anomaly later. Sigma Health Care, which was the best on the index yesterday, was the worst today – falling -11.57% on a soft first half result. The banks were all reasonable considering the tough day elsewhere on the market, helped by the interest rate rise from CBA & ANZ – WBC moved their home loan rates higher last week, and now investors await NAB’s announcement who will almost certainly follow the other 3 banks with an out of cycle hike.

Overall, the index closed down -70 points or -1.12% today to 6160.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

- Megaport (MP1 AU): Reinstated at Morgans Financial With Add; PT A$4.44

- Orocobre (ORE AU): Upgraded to Outperform at Macquarie

- Rio Tinto (RIO AU): Upgraded to Buy at Investec; Price Target 43.44 Pounds

- Star Entertainment (SGR AU): Cut to Neutral at Credit Suisse; PT A$5.60

- Wagners Holding (WGN AU): Downgraded to Sell at Wilsons; PT A$3.10

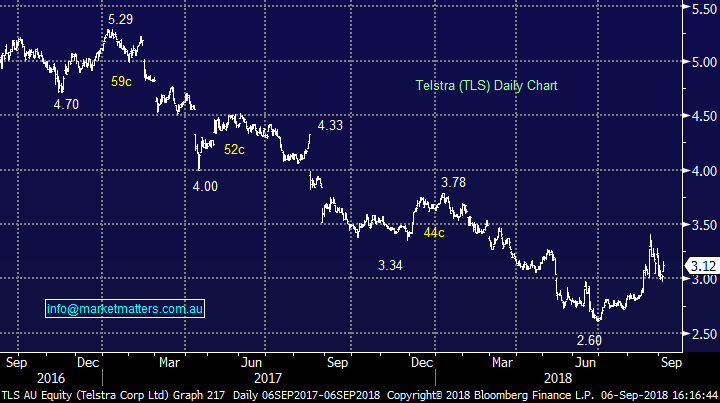

Telstra (TLS) $3.12 / +3.31%; Telstra revised FY19 guidance on lower NBN connection payments, but the stock has bounced on the back of the news. It what was initially feared as just another TLS downgrade – something the market has become accustomed to in recent years – traders actually welcomed the news which saw Telstra reduce EBITDA guidance range fall $100m to $8.7b-$9.4b, more or less immaterial. The fall has been blamed on NBN connection numbers being revised lower in the NBN’s corporate plan announced on Friday, and hence one-off payments to Telstra for these connections will be delayed until 2020. This is partially offset by customers then remaining on the Telstra copper system for longer.

So why the bounce? Firstly the downwards revision is minor – 1.1% fall in EBITDA – and the receipts will still be paid. This is not a downgrade on lost business, just a slight delay. Secondly, the statement said “changes will be financially positive to Telstra over the full rollout.” Many in the market having been looking for signs the worst is behind Telstra, and these comments clearly suggest that.

Telstra (TLS) Chart

OUR CALLS

No trades across the MM Portfolio’s today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.