Aged Care now in the sights of a Royal Commission (EHE, JHC, REG, BWX, OML, HT1)

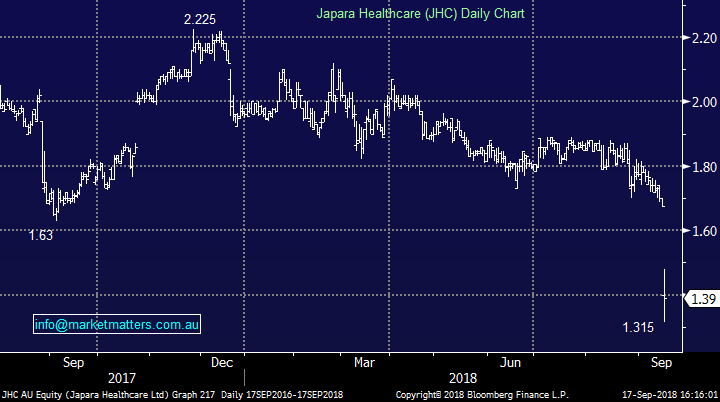

WHAT MATTERED TODAY

The market rebounded strongly from a soft open to trade higher from around 11am onwards. The banks led the charge with NAB doing well despite losing their Head of Consumer Banking due to the backlash from the Royal Commission – potentially the market reacting positively to signs of perceived remediation coming from the banks. And just as one Royal Commission is wrapping up, another is being developed, this time into Aged Care, which dragged healthcare stocks significantly lower today. More on this later. We also discuss the fizzled management bid for BWX.

Elsewhere, Rio Tinto was slightly softer today, although broadly in line with other material names, after announcing Hydro had pulled a bid for their Aluminium assets following feedback from the European Commission – relatively small portion of Rio’s portfolio, however it will delay the capital returns shareholders were likely expecting. Kidman resources plummeted -13.44% today after revealing the Perth Mining Warden had objected to exemption applications for expenditure obligations within the companies Mt Holland project. The applications had been reviewed for almost a year, and although potential fines will be small to the projects bottom line, it may result in significant delays. Lithium producer Pilbara jumped 3.27% on an update by the company showing they are on track to ship lithium out of their Pilgangoora project this month.

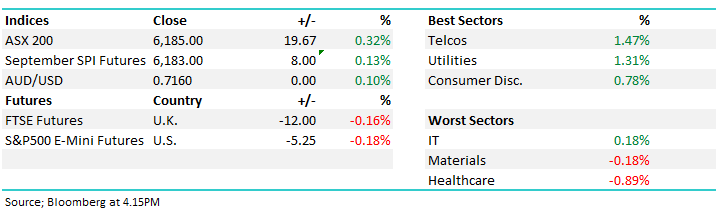

Overall, the index closed up 19 points or 0.32% today to 6185. Dow Futures are currently trading down -43pts/-0.16%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; the media names garnered some attention from the analysts at Credit Suisse today following a couple of months of strong corporate activity between the local and international names. HT&E (HT1) was bumped up to a hold with some upside (or less downside) to the company, particularly if it can resolve their tax issue caused by their NZ branch. HT&E recently sold Adshel to oOh!media (OML), which the broker threw a buy onto today saying that OML should see double digit earnings growth as a result of the acquisition. HT&E (HT1) fell -1.39%, while OML closed up just +0.39% - although it did trade as high as +4.31% above Friday’s close.

oOh!media (OML) Chart

RATINGS CHANGES:

· oOh!media Reinstated at Credit Suisse With Outperform; PT A$5.80

· HT&E Upgraded to Neutral at Credit Suisse; PT Set to A$2.95

· Primary Health Upgraded to Overweight at JPMorgan; PT A$3.30

· Pushpay Rated New Buy at Deutsche Bank

BWX Limited (BWX) $4.00 / -2.20%; Skin and haircare product company BWX was volatile today after they announced that their hostile management takeover bid had fallen over. The company, which owns brands such as Sukin & Mineral Fusion, had faced a bid from the MD John Humble & Finance Director Aaron Findlay along with private equity firm Bain Capital at $6.60 in May, however a binding proposal has failed to eventuate and the parties have walked away from the table. Both John & Aaron have left the company as a result of the hostilities. In the announcement, the company reiterated FY19 expectations looking for revenue growth across all brands, while the board welcomed the removal of this distraction where the “management’s time is better spent focussing on the substantial growth opportunities.”

The stock was down sharply early in the day before rebounding and trading higher around midday, although all gains were given back. The failure of a bid to eventuate could signal a number of issues, especially as the data room was available to any interested party – it could mean performance has been poor since the announcement in May or any number of other underlying issues are stirring beneath the surface.

BWX Chart

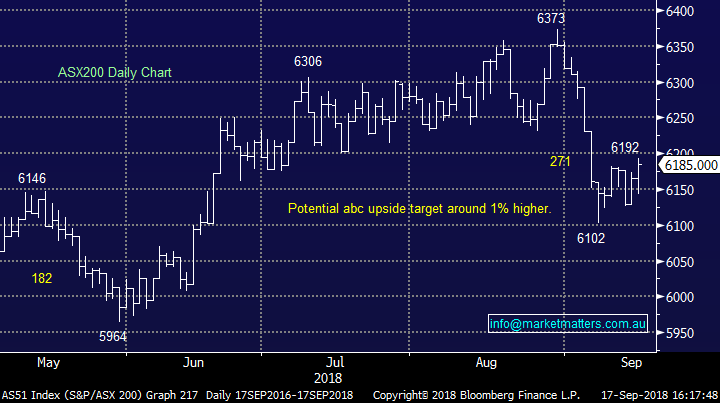

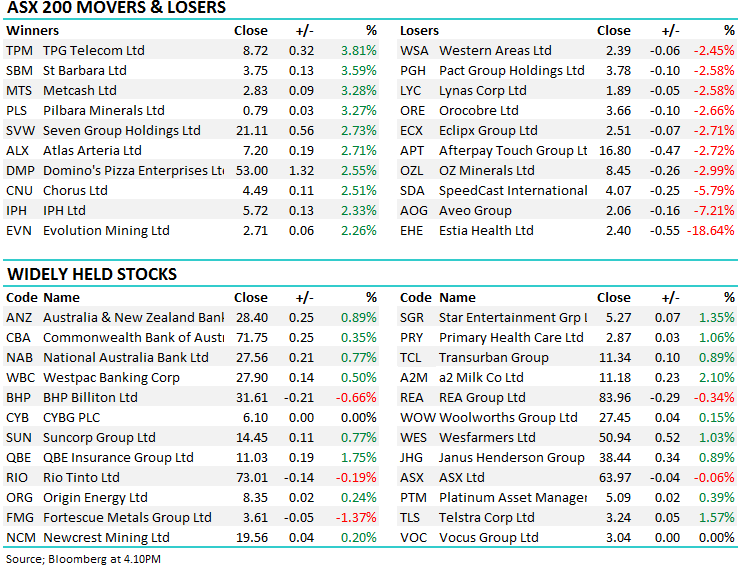

Estia Health (EHE) $2.40 / -18.64%, Japara Healthcare (JHC) $1.39 / -17.01% & Regis Healthcare (REG) $3.00 / -17.13%; The three listed aged care providers were all whacked over 17% today on the back of new PM Scott Morrison’s push to open a Royal Commission into the sector. There has been many investigations into care provided to the elderly across all providers for some time now highlighting the structural and systemic issues facing the industry and as the Australian population ages, the issue looks to only be getting worse as funding falls and demand rises. While the Royal Commission has not formally been launched, it appears it has bipartisan support as Bill Shorten announced he believed action was overdue. Terms of the commission will need to be created, and it will likely target both for & not-for-profit providers to try and reduce the growing complaints backlog that has seen the regulator close nearly one facility per month.

Four Corners will also be highlighting on the failings of aged care in a two part series starting tonight as more than 4,000 people responded to their call to contribute to the investigation – touted as the biggest contribution to an ABC investigation. The series will focus on a number submissions from the public regarding the poor care residents have received and further enhance the calls for the Royal Commission.

The listed companies have taken a battering, and although the commission will focus on all providers to aged care, listed companies often face the most scrutiny as they can been seen as the public face for backlash. Although demand for aged care services will continue to rise – around 1000 Australians turn 85 each week – these stocks will likely come under pressure while they face the public scrutiny through a Royal Commission.

Estia Health (EHE) Chart

Japara Healthcare (JHC) Chart

Regis Healthcare (REG) Chart

OUR CALLS

No trades across the MM Portfolio’s today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.