The Royal Commission fizzles, banks rally

WHAT MATTERED TODAY

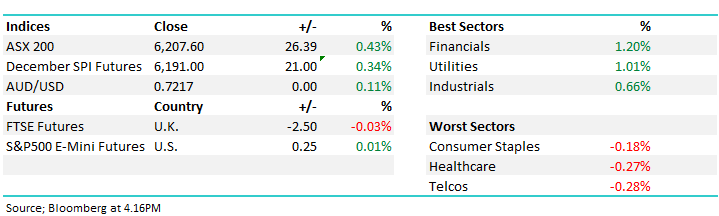

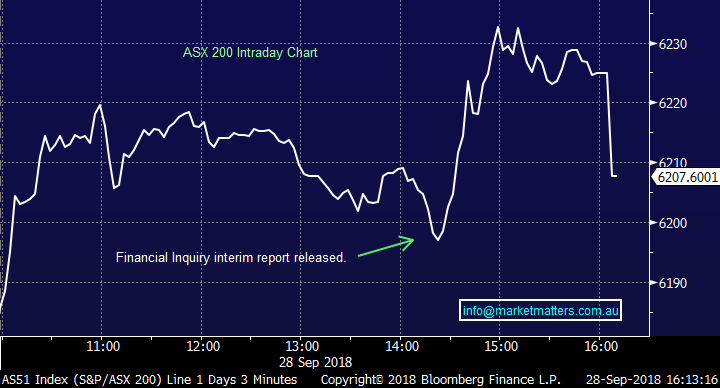

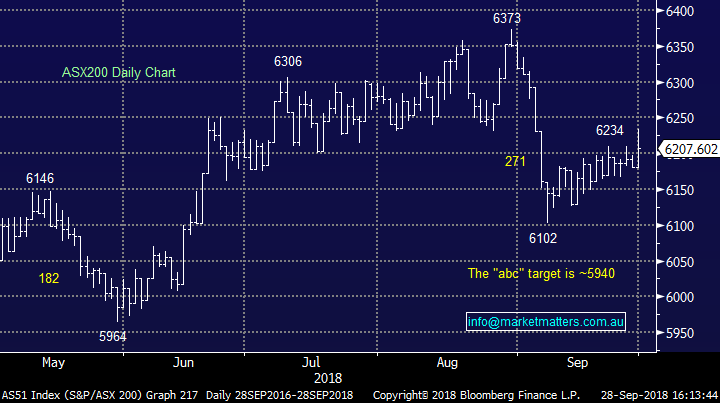

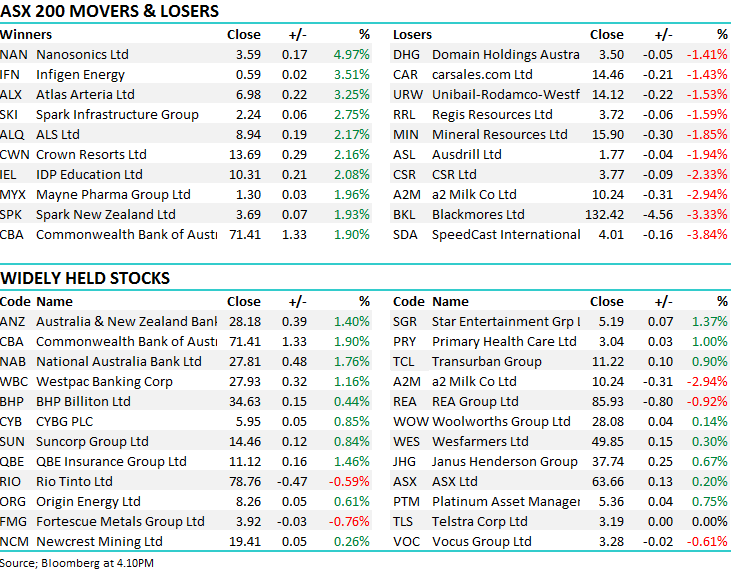

A reasonably solid day on the market today which followed overseas indices higher and the market received a second kick higher following the largely uneventful release of the Royal Commissions interim report – a few notes on this release below. As a result, the banks rallied, recovering most of the losses in what had been a tough week up until the last few hours. Real estate was under pressure today in what was largely a quiet day of trade with the Melbourne Grand Final public holiday subduing volumes.

Overall, the index closed up +26 points or +0.43% today to 6207 – up 0.21% on the week

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Wilsons caused a stir in Nanosonics today, with the company topping the best performer as a result. Elsewhere, RBC is chasing the run in Beach Energy after the company set another intra-day all time high today before easing - the stock did still manage to close higher for an all-time high close.

RATING CHANGES;

• Beach Energy (BPT AU): Upgraded to Sector Perform at RBC; PT A$1.95

• Brickworks (BKW AU): Upgraded to Hold at Morningstar

• Nanosonics (NAN AU): Upgraded to Buy at Wilsons; PT A$4

• Otto Energy (OEL AU): Reinstated Buy at Argonaut Securities; PT A$0.13

• PSC Insurance Group (PSI AU): Rated New Outperform at Taylor Collison

• Sigma Healthcare (SIG AU): Downgraded to Hold at Morningstar

• Xero (XRO AU): Downgraded to Underweight at JPMorgan; Price Target A$42

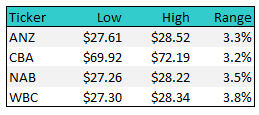

Royal Commission; the release of the interim report had been built up for the past week as the catalyst for the banks to resume the selloff, instead they rallied after the report was more or less insignificant. The commissioner made some top level comments around the culture within the financial system which ultimately lead to the Royal Commission, blaming greed as the main motivator which saw thousands of Australian’s given poor advice. Hayne also noted the lack of work the regulator had done to bring some justice calling the penalties often handed to the banks as insufficient and insignificant to the banks bottoms line. All in all not the report many feared and a classic sell the rumour buy the fact scenario played out with the banks rallying through the afternoon.

ASX200 Financials Index Chart

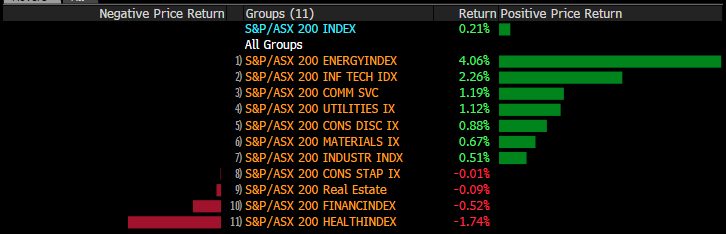

Weekly Moves – Stocks & Sectors;. On a sector level, energy was the big gainer for the week as the oil price rallied. Health was down, joined by the financials although neither was all that significant.

Sectors over the past Week

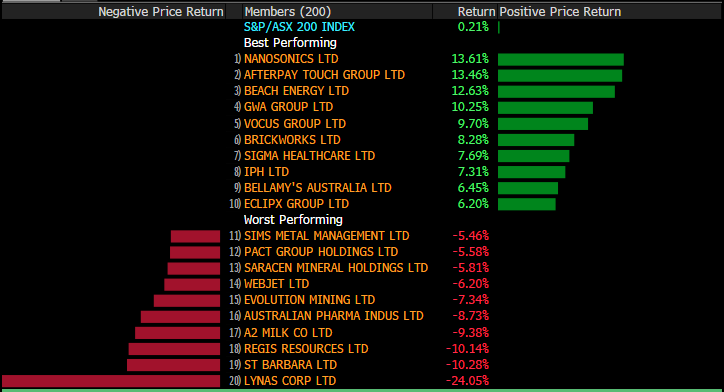

On a stock level, growth found a bit of support after some broader weakness with Nanosonics, Afterpay and Beach all rallying strongly. NAB was also in the top 10. On the downside, Webjet tracked lower post the Thomas Cook downgrade, and A2 Milk struggled after the CEO announced she had sold shares – we are watching this closely.

Stock moves over the week

OUR CALLS

No changes the portfolios today.

Watch out for the weekend report. Have a great night,

Harry / James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and

Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.