Golds rally, Fortescue hit by broker downgrade (FMG)

WHAT MATTERED TODAY

A reasonable season overall from the market today recouping some of yesterday’s declines with some corporate activity to boot – Vicinity (VCX) selling ~$630m assets to SCA Property (SCA) and SCA subsequently raising capital provided some interest and we covered that in the Income Report today – click here

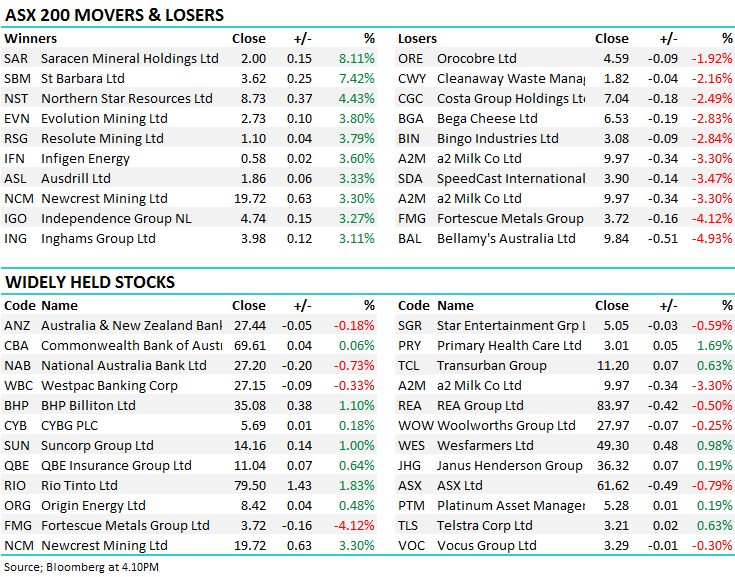

Gold stocks were strong on the back of a rise in the precious metal overnight – it traded back up above US$1200/oz which makes sense following recent trends around wage growth in the US, inflation and growing uncertainty globally. Gold has struggled in recent times, thanks largely to strength in the US currency, and as we suggested this AM – click here, that has become a crowded trade. Gold trades inversely to the $US so by definition, the crowded long US Dollar trade would imply the market is short Gold and therefore gold is susceptible to a move on the upside if / when the US dollar pulls back.

While gold was strong today, we think one more spike in the $US currency is needed to provide better risk / reward into the Gold stocks. Today we saw Northern Star (NST) add +4.43% while Newcrest (NCM) put on +3.30%...Gold stocks are now worth putting on the radar.

Elsewhere, Morgan Stanley initiated on Fortescue Metals (FMG) and had a negative view, the stock lost -4.12% as a result while A2 Milk (A2M) suffered at the hands of further Director selling – this time it was Independent Non-Exec Director Peter Hinton who offloaded NZ$300k worth of stock. Sometimes a stock just doesn’t feel right and at the moment, A2 certainly fits that bill.

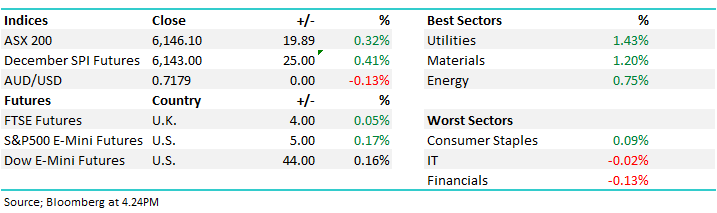

Overall, the index was reasonable with the ASX200 adding +20 points or +0.32% today to 6146. Dow Futures are currently trading up +58pts /+0.22%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Shaw was out again pushing the bearish thesis on AMP although the stock is remaining somewhat resilient (sort of) above $3 for now. We think that won’t last and in the not too distant future AMP will have a 2 handle on it. Laf over at Bells upgraded IOOF (IFL) from a completely negative view to a less negative view. He’s called that stock well and has some decent following in that area of the market – IFL was up +2.93% as a result to $8.07 and although in the short term we could see a relief rally, the longer term picture for this business remains poor following the purchase of ANZ’s Wealth business right before the Royal Commission was unleashed.

RATINGS CHANGES:

· Fortescue New Underweight at Morgan Stanley; PT A$3.30

· CYBG Assumed at UBS With Sell; PT 3.11 Pounds

· IOOF Holdings Upgraded to Hold at Bell Potter; PT A$7.70

· SCA Property Upgraded to Overweight at JPMorgan; PT A$2.65

· Mirvac Group Upgraded to Hold at Morningstar

· Sanford Downgraded to Neutral at Forsyth Barr; PT Set to NZ$8.30

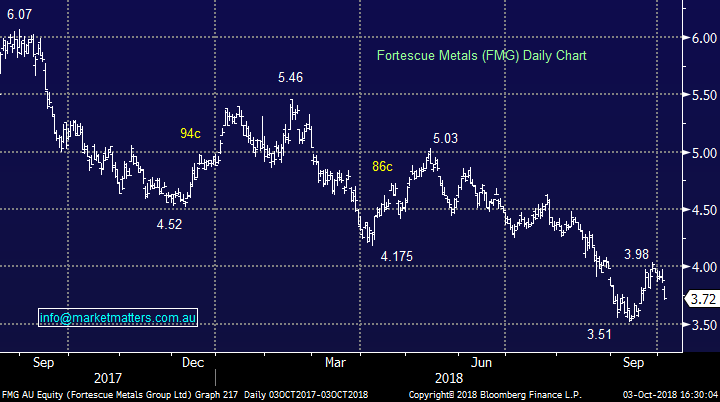

Fortescue (FMG) $3.72 / -4.12%; the iron ore miner took a hit today following the release of Morgan Stanley’s (MS) deep dive into the business and the iron ore market. MS initiated coverage on the stock with the equivalent of a sell and a price target that was ~16% below yesterday’s close. The investment bank cites the discount being applied to Fortescue’s lower grade ore as the biggest headwind to the company’s earnings. Chinese steel mill margins remain high and MS expect this to continue as outdated mills slowly go offline, leading to the blow out of the discount for Fortescue’s 58% fe product vs the standard 62% index which peaked at over 40% resulting in FMG missing out on the recent ~20% rise in iron ore price rally.

Fortescue have stated in the past that they believe this large discount is a cyclical event and demand for their product will return helping to support earnings, although this is the company talking its own book. They recently announced a launch of a higher quality blended product which will go some way to lift the company’s realized price, although this will only be a small portion of the company’s sold product.

Fortescue FMG) Chart

OUR CALLS

No trades across the MM Portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 3/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.