Buyers come out of the woodwork to support the index (VOC, BOQ, WES, BPT)

WHAT MATTERED TODAY

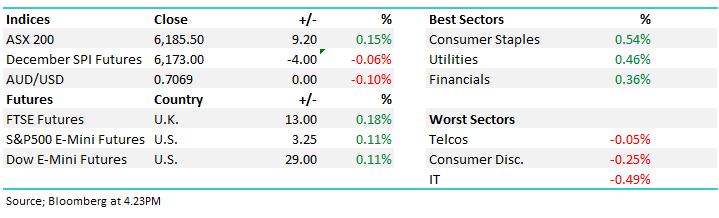

Once again the Aussie market fared much better than overseas counterparts today. While all US indices were over 1% lower overnight, the morning’s negative sentiment disappeared early in the session. Retail data hit the screens today with a slight beat to expectations, retail sales were up 0.3% month on month although this failed to lift the consumer market. Consumer staples topped the sectors as a result of demerger talks, IT was the weakest following the Nasdaq lower.

Wesfarmers (WES) is pushing ahead with the Coles demerger, looking to complete the deal in November. Wesfarmers will hold onto 15% of Coles and 50% of Flybuys in the proposed deal to be put to shareholders on the 15th of November. The stock traded up slightly (+0.28%) on the day, although the news isn’t really new for the market. Beach Energy (BPT) gave back some of its recent gains following the sale of a stake in their Victorian gas asset Otway. The proceeds are to be used to pay down debt, while also partially funding their capital expenditure pipeline. The stock fell -3.65% as a result.

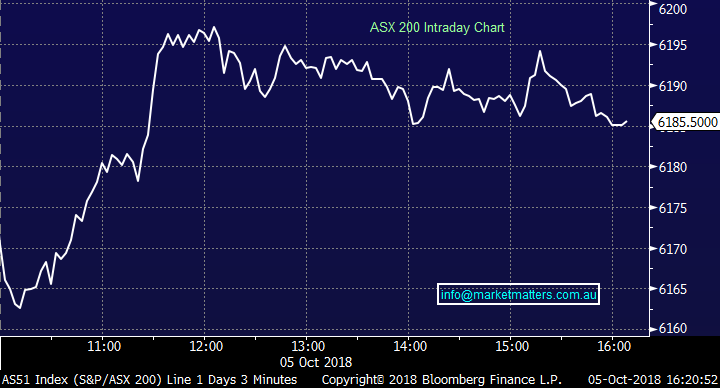

Overall, the index closed up +9 points or +0.15% today to 6185 – down just -0.3% on the week. Dow Futures are trading slightly up, +0.1%/30pts, while Hang Seng (HK) off -0.05%/14pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

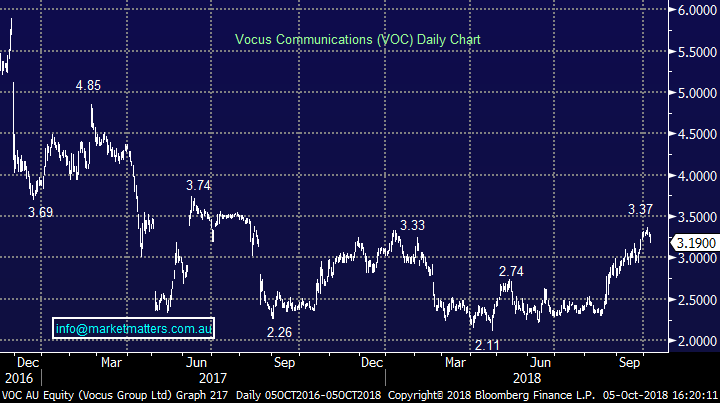

Broker Moves; A busy day from the analysts with a bunch of changes to ratings. Vocus (VOC) took a beating, down -2.74%, after JP Morgan turned neutral on the stock on valuation grounds, staying cautious while the new management team settle in.

Vocus (VOC) Chart

Two different views on the Bank of Queensland (BOQ) result, with JP Morgan glass half full focussing on the NIM while Goldman saw the weaker side of the result. Goldman won the first battle with the stock off -2%.

RATING CHANGES;

· Avita Medical (AVH AU): ADRs Reinstated at Lake Street With Buy; PT $4

· Bank of Queensland (BOQ AU): Upgraded to Neutral at JPMorgan; PT A$10.60; Downgraded to Sell at Goldman; PT A$10.67

· Carsales.com (CAR AU): Upgraded to Outperform at Credit Suisse; PT A$16

· Domain Holdings (DHG AU): Cut to Neutral at Credit Suisse; PT A$3.50

· Seek (SEK AU): Upgraded to Neutral at Credit Suisse; PT A$19.10

· St Barbara (SBM AU): Upgraded to Buy at Canaccord; PT A$4.40

· Transurban (TCL AU): Reinstated at Goldman With Buy; PT A$12.58

· Venturex Resources (VXR AU): Rated New Speculative Buy at Hartleys Ltd

· Vocus (VOC AU): Downgraded to Neutral at JPMorgan; Price Target A$3.30

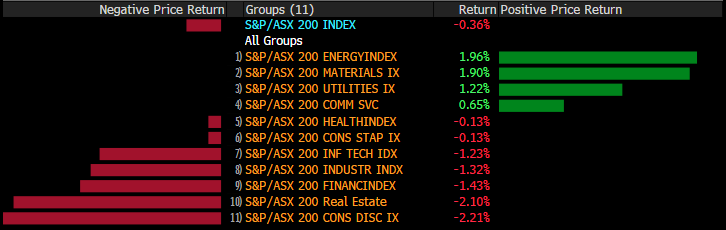

Weekly Moves – Stocks & Sectors; On a sector level, energy was once again the biggest gainer for the week, joined by materials as commodity prices rise. Interest rate sensitive Real Estate & consumer discretionary markets were the weakest.

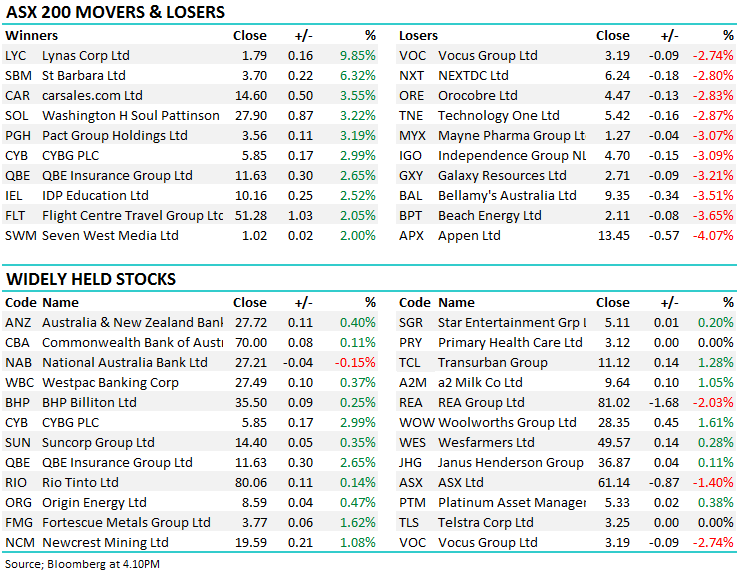

Sectors over the past Week

On a stock level, todays 9.85% jump from Lynas (LYC) saw the stock top the list, recovering much of the losses from previous weeks over the pending Malaysian review. South 32 (S32) and Alumina (AWC) caught a bid thanks to alumina/aluminium market tightening. The losers were dominated by the growth end of town – Wisetech (WTC), Bellamy’s (BAL), Webjet (WEB) and A2 Milk (A2M) to name a few.

Stock moves over the week

OUR CALLS

No changes the portfolios today.

Watch out for the weekend report. Have a great night,

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.