Aussie stocks show reasonable fortitude (TLS, FMG, APT, S32)

WHAT MATTERED TODAY

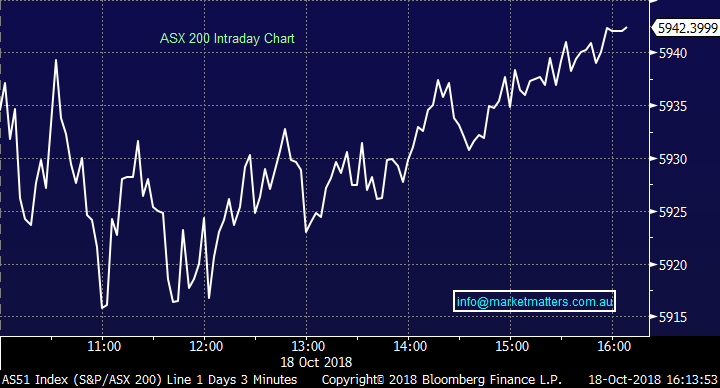

A pretty robust session on Oz today with the market grinding up from early weakness to finish more or less flat on the day despite weakness throughout Asia plus US Futures traded lower through our time zone – a rare bit of fortitude shown locally thanks mostly to buying in the banking stocks following strong employment numbers out at 11.30am this morning. Unemployment printed 5% v 5.3% expected which is a strong outcome even though the participation rate ticked lower. Without harping on about this too much, employment is very important for Australian housing and whether or not we see a soft or hard landing. Today’s data is another cog in the wheel that supports the soft landing call while a bearish note out from AMPs chief economist on housing is probably another sign that a hard landing is unlikely!

Australia employment data – out at 11.30am this morning.

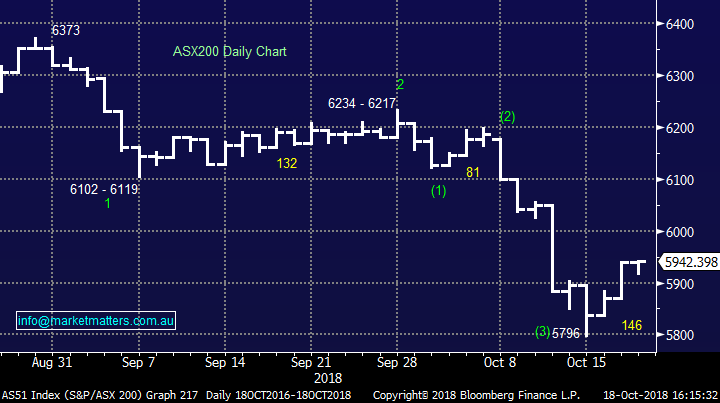

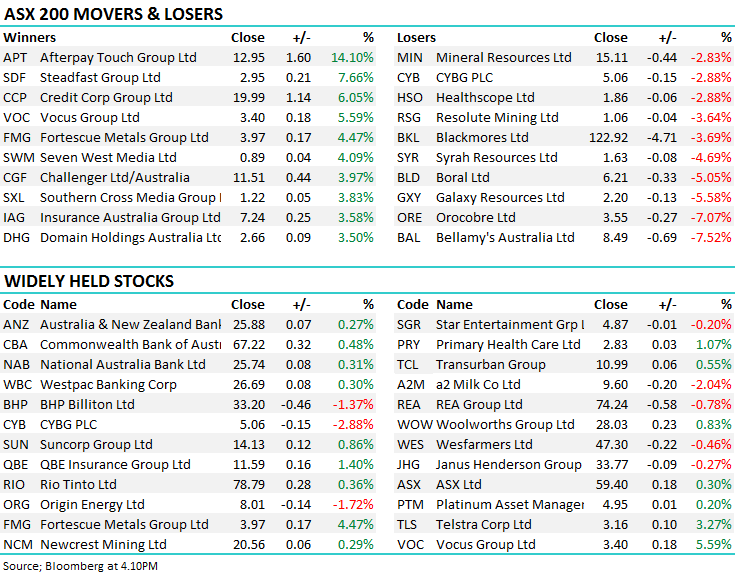

Today the ASX 200 closed up +3 points or +0.06% at 5942. Dow Futures are down -78pts/-0.34%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Super Retail (SUL) was upgraded today by Morgan’s to an Add, which is their equivalent of a BUY. We added this to the Income Portfolio recently, and the stock was up +2.52% today at $9.35

RATINGS CHANGES:

· Z Energy Downgraded to Neutral at Macquarie; PT NZ$7

· Steel & Tube Downgraded to Underperform at Macquarie; PT NZ$1.20

· Reject Shop Downgraded to Neutral at Goldman

· Insurance Australia Raised to Outperform at Credit Suisse

· Treasury Wine Upgraded to Neutral at Credit Suisse; PT A$16.45

· Super Retail Upgraded to Add at Morgan’s Financial; PT A$10.44

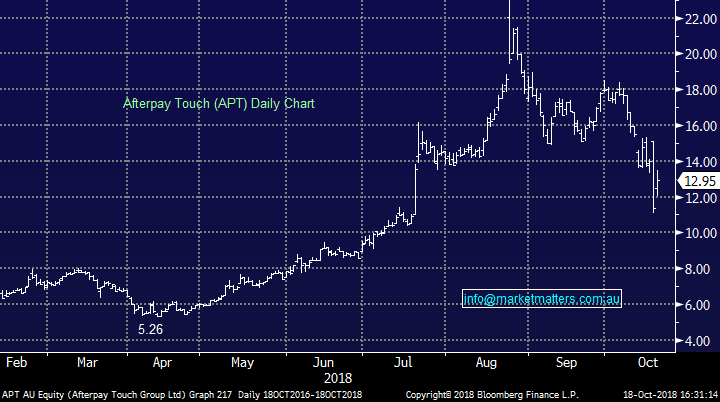

Money stocks; Afterpay (APT) rebounded +14.1% today while Z1P added +3.76% recovering some of yesterday’s decline following the SMH article that said a Senate Enquiry into the sector was likely. APT and Z1P came out on the front foot today + they had the support of some analysts with Bells who are big on Afterpay saying that… We consider ASIC’s review as the bigger concern, not the Parliamentary Senate Enquiry. We see the current short-term sell-off as a Buying opportunity, as we do not consider the space in the same vain as Pay Day Lending.

Shaw’s is a bigger supporter of Z1P and they wrote… Z1P are well prepared for any review/inquiry and in Shaw and Partners’ view, offer ‘best-in-class’ transparency, systems, checks and ethical behaviour (Z1P are very strong advocates of consumer protection – after all, a sustainable and recurring business and revenue model is critical). It is also an opportune time for Z1P to again clearly enunciate its differentiated offering in the market and why it shouldn’t be lumped in with the aforementioned players (APT, FXL, etc).

Afterpay (APT) Chart

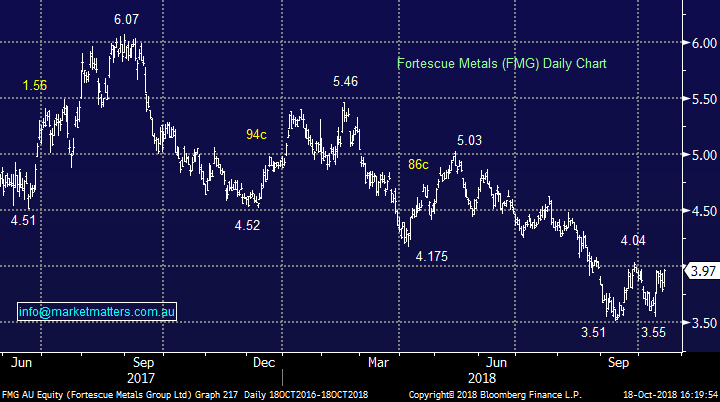

Fortescue (FMG) $3.97 / 4.47%: FMG is now threatening to break $4.00 and a break of that resistance seems likely. Long Iron Ore v short Energy seems a play at the moment as the price of Crude unwinds. This could also be played through BUY RIO, SELL BHP as a pairs trade.

Fortescue Metals (FMG) Chart

Telstra (TLS) 3.16 / +3.27%; A good session for the much hated Telco today with some talking up the prospect of TLS buying the NBN resulting in the reinstatement of Telstra's fixed line monopoly. As we suggested yesterday, back to the future for the Telco! From the Age today… Two sets of comments this week, from Telstra chairman John Mullen and Labor's shadow minister for communications, Michelle Rowland, illustrate how the preconditions for a restructuring of the fixed line segment of the telecommunications sector are starting to form. It was apparent from the moment Telstra chief executive Andy Penn unveiled his "T22'' strategy earlier this year that Telstra is positioning itself for an acquisition of NBN Co once the national broadband network rollout is completed. Source The Age

That of course would come at massive cost to the tax payer and I can’t help but think about Kerry Packers response to a parliamentary enquiry back in 1991… "I'm not evading tax in any way shape or form. Of course I'm minimising my tax. If anybody in this country doesn't minimise their tax they want their head read. As a government I can tell you you're not spending it that well that we should be paying extra." Never a truer line spoken!

Telstra (TLS) Chart

South 32 (S32) $3.85 / +0.79%; the diversified miner rounded out quarterlies for the three biggest miners today which came with few surprises, reiterating full year guidance across the deck of operations. Coal was likely the focus in the release as the market was keen to see how labour issues in the previous quarter had impacted ongoing production, but the figure was strong with both mines running at full tilt for the quarter.

The annualized met coal rate shapes up to be 7.6mt vs guidance of 5.8mt, although with maintenance planned the company didn’t upgrade guidance here. The company also noted a slight discount to the price received for alumina, and expects the discount to continue with maintenance impacting the output quality. All-in-all, nothing to write home about but also nothing really to worry the market either

South 32 (S32) Chart

OUR CALLS

No changes in the MM portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.