Jitters return to the ASX

WHAT MATTERED TODAY

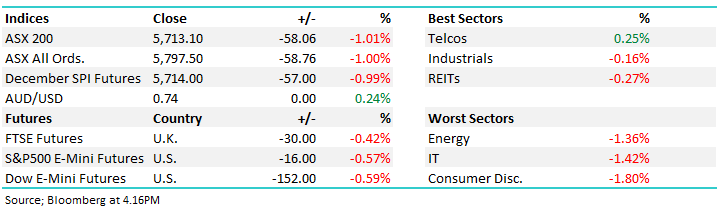

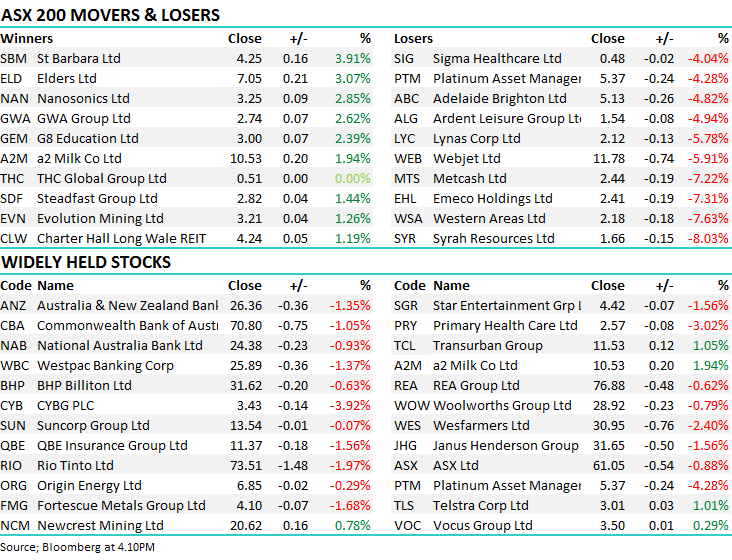

The rally seen yesterday ran out of steam pretty quickly, with the market giving back around half of yesterday’s gains. The market opened slightly softer this morning, broadly expected after a keen 100+ point gain, however sellers leant on stocks throughout the session and the market eventually closed down -1.01%, on the low of the day. Weakness was seen across the board, with only gold names & Telcos (lead by Telstra (ASX: TLS) bouncing back above $3) catching any kind of bid. Construction leveraged names were on the nose once again. Cement supplier Adelaide Brighton (ASX: ABC) tumbled to a near two year low, Bingo (ASX: BIN) followed suit – both falling over 3%. Most of the selling stemmed from concerns being raised about the actual extent of any Trump-Xi talks along with the flattening of the yield curve – a topic we’ll discuss in more depth tomorrow.

A couple of days of extreme volatility makes this a great time to flag tomorrow’s MarketMatters webinar – click here for access (registration not required). Join our Primary Contributor James Gerrish where he will be discussing the outlook for the last few weeks of 2018 as well as the road ahead for 2019!

Overall, the ASX 200 closed down -58 points or -1.01% to 5713. Dow Futures are currently down -152 points or -0.59%.

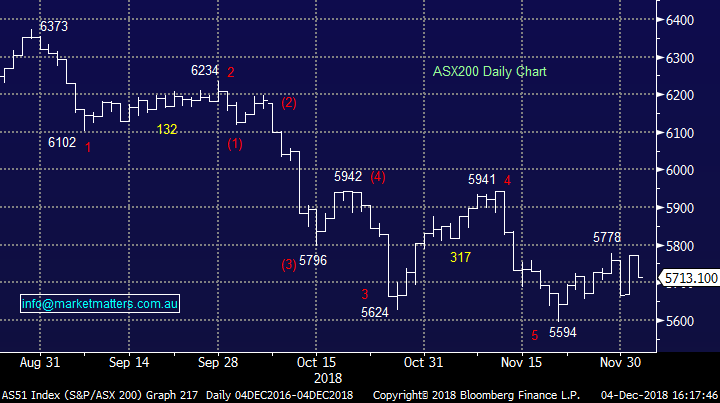

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Re-ratings on Metcash (ASX: MTS) from the brokers flowed through today, with Macquarie taking the most bearish stance, cutting their price target by a huge 24% and moving to a hold. The broker has been a long term believer of the Metcash story, but finally threw the towel in following a difficult year which has seen the stock fall from a May high of $3.73 to close today at $2.44, down -34.6% in that time.

Citi Bank 2019 Outlook; before the books have closed on 2018, Citi starting pushing their 2019 outlook pieces, kicking off with pieces on political risks and the economic outlook in to next year. The bank went on to discuss the impacts of a move from quantitative easing to tightening around the world, leading to a rise in volatility – something we have already seen start to play out. BREXIT also another obvious concern for markets which will play out early next year, as well as the rise of populism in Europe – all of which will add to market volatility particularly while central banks look to tighten up their balance sheets. All in all, Citi see 2019 as shaping up as a year for the active investor – a point we at MM have been pushing for some time!!

RATINGS CHANGES:

· Air NZ Upgraded to Neutral at Forsyth Barr; PT NZ$3.30

· Argosy Cut to Neutral at Forsyth Barr; Price Target NZ$1.08

· Metcash Downgraded to Underperform at Macquarie; PT A$2.41

· Metcash Upgraded to Hold at Morningstar

· Metcash Upgraded to Neutral at Credit Suisse; PT A$2.60

· APA Group Resumed at Morgan Stanley With Equal-weight; PT A$8.88

· Boart Rated New Buy at Foster Stockbroking

· Eroad Upgraded to Outperform at First NZ Capital; PT NZ$3.30

· Redbubble Downgraded to Hold at Morgans Financial; PT A$1.19

· Scentre Group Raised to Overweight at Morgan Stanley; PT A$4.30

OUR CALLS

No changes today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 4/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.