Telcos cop a hiding from the ACCC

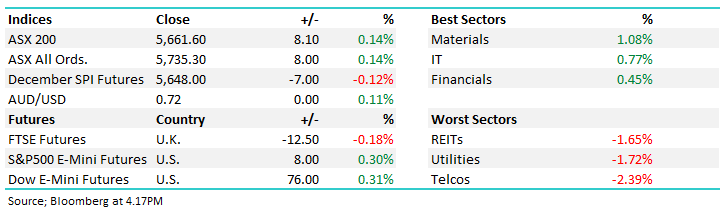

WHAT MATTERED TODAY

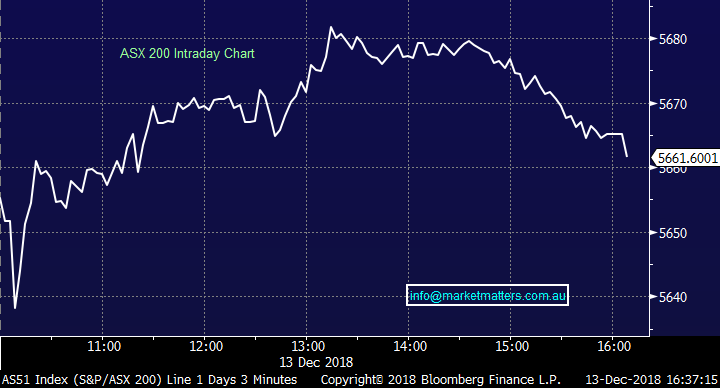

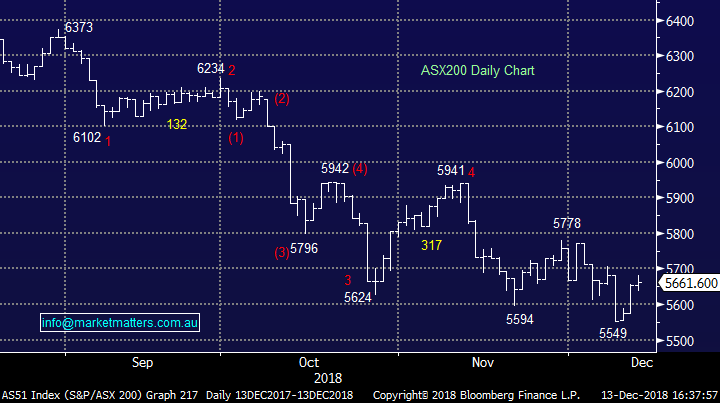

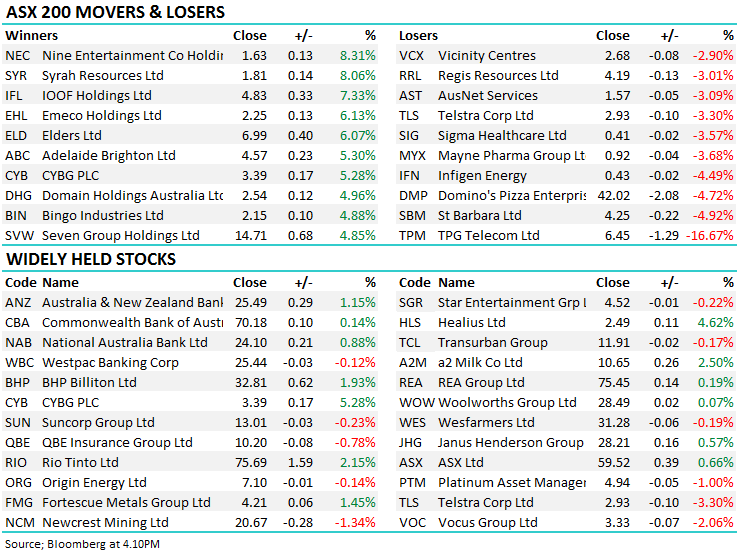

The market stumbled into the close today, despite some reasonable overseas news flow and market leads. The ASX200 opened around flat on the day, before climbing its way to a solid 28point / 0.5% gain at its 1PM peak before some nervy investors took some money off the table throughout the afternoon – eventually finishing marginally positive. IT and the financials were solid, although the resources replaced energy up the top of the sector performance today – both BHP & Rio Tinto rallied, finishing +1.93% & +2.15% up respectively. Telcos took a hit thanks to the ACCC which we discuss later in the piece.

On the banks, Westpac held their AGM yesterday and received a first strike against executive remuneration as shareholders fought back against the share price decline over the past 12-months. NAB are the next bank to hold theirs, and punters are tipping an even bigger vote against remuneration policy. Elders (ASX: ELD) had a better day after their AGM today with the agriculture company adding over 6% on positive comments from the CEO and Chairman.

Overall, the ASX 200 closed up +8 points or +0.14% to 5661. Dow Futures are currently trading up 76 points or +0.31%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

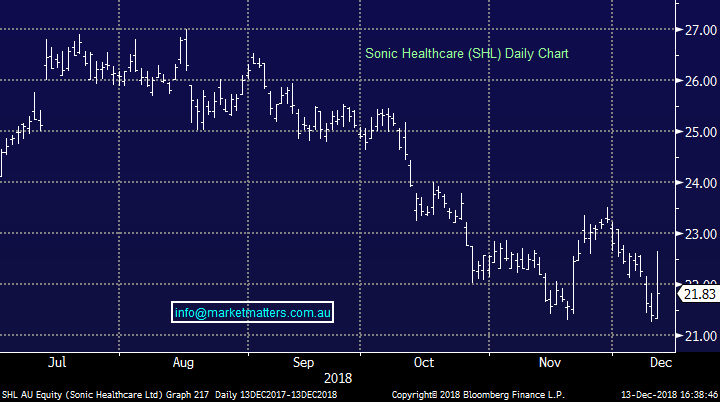

Broker Moves; Citi wrote a nice bullish piece on the Sonic healthcare (ASX: SHL) deal today, upgrading earnings but noting that the acquisition doesn’t come without risks. According to the analyst, the deal will add 1-3% EPS over the next few years, but questions why debt wasn’t used to fund the purchase of Aurora rather than raising capital at near 12-month lows. All in all however, Citi have price target of $25.25, equating to a 22.1% return over 12-months (including dividends). SHL added 2.06% today to $21.83.

Sonic Healthcare (ASX: SHL) Chart

ELSEWHERE:

· TPG Telecom Downgraded to Hold at Morgans Financial; PT A$6.65

· DuluxGroup Upgraded to Add at Morgans Financial; PT A$7.67

· Countplus Rated New Buy at Wilsons; PT A$0.94

· Freightways Upgraded to Buy at UBS; PT NZ$7.90

· Sonic Healthcare Upgraded to Buy at Citi; PT A$25.25

· Adelaide Brighton Upgraded to Neutral at Citi; PT A$4.70

· Netwealth Rated New Neutral at Citi; PT A$8.10

· Fortescue Upgraded to Overweight at Morgan Stanley; PT A$5.05

· Beach Energy Upgraded to Neutral at Citi

· South32 Raised to Positive at Evans and Partners; PT A$3.70

· Whitehaven Upgraded to Positive at Evans and Partners; PT A$5.50

· BWP Trust Downgraded to Sell at Morningstar

· Nufarm Upgraded to Buy at Morningstar

· Dexus Downgraded to Sell at Morningstar

· Wesfarmers Raised to Positive at Evans and Partners; PT A$34.95

· St Barbara Cut to Underperform at Credit Suisse; PT A$3.90

· Evolution Mining Cut to Underperform at Credit Suisse; PT A$2.55

· Panoramic Resources Rated New Add at Morgans Financial

Telcos; The telcos are struggling today after the Australian Competition and Consumer Commission (ACCC) put the TPG (ASX: TPM) – Vodafone Australia (50% owned by Hutchinson Telecommunications (ASX: HTA)) merger deal on notice. We discussed the merger back in August, at the time saying “consolidation in the sector is now on in a big way and it is likely other companies will be running the ruler through both competitors and complimentary businesses … would be less aggressive on pricing than a standalone TPG offering – chairman David Teoh had been very vocal about his aggressive pricing plans.” Clearly some comments there would raise concerns within the ACCC and today those concerns were pushed by the Chairman Rod Sims saying “Our preliminary view is the merged TPG-Vodafone would not have the incentive to operate in the same way, and competition in the market would be reduced as a result.” The ACCC also showed concerns with the combined group’s fixed line and broadband businesses, as well as its impact on innovation in the sector.

TPG Telecom (ASX: TPM) Chart

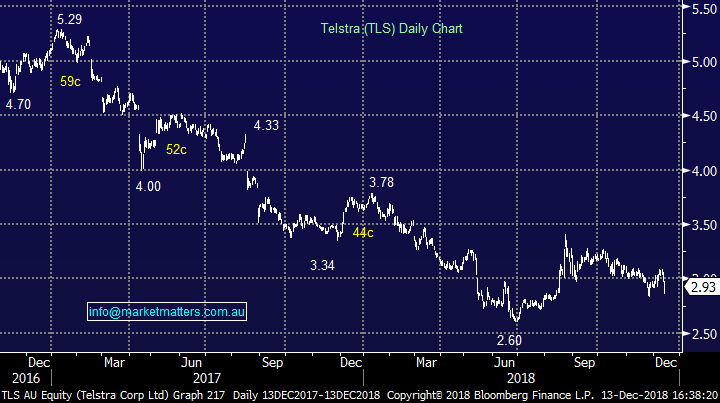

Both TPG (-16.67% to $6.45) and Hutchinson Australia (-21.43% to $0.11) took big hits today, but both still trade above their pre-merger announcement prices, showing the market believes the deal will likely eventuate, even if there has to be some concessions. Telstra (-3.3% to $2.93) has also been caught in the cross hairs. It bounced aggressively in August when the deal was announced as the market factored in lower competition, but trades lower today following the news. We own TLS and like it at these levels, we see ACCC concerns as overzealous regulation and see the deal being completed – if not in a redacted way.

Telstra (ASX: TLS) Chart

OUR CALLS

No changes today.

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.