A late sell off pushes the index below 5600 (ORI, FBU)

WHAT MATTERED TODAY

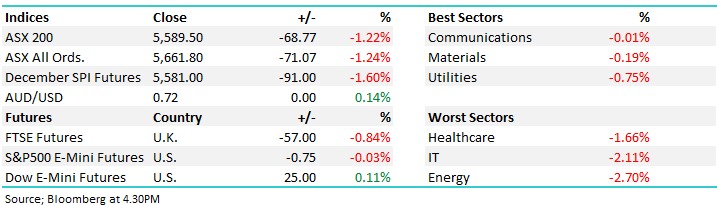

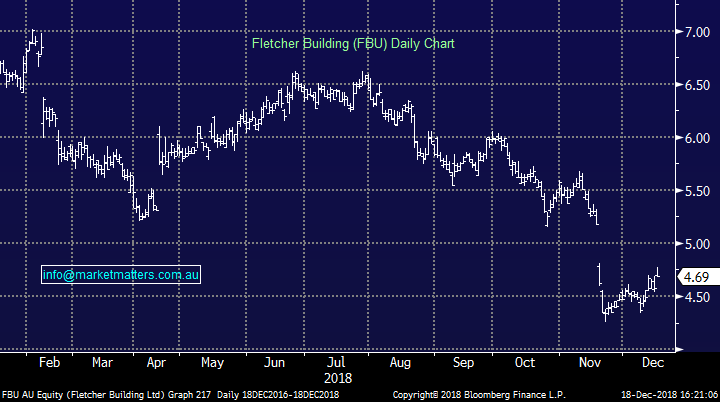

The local market faced plenty of negative influences today and despite being down more than 1%, its fair to say it held up reasonably well in the face of plenty of pressure. A poor US lead which saw the three major indexes each finish more than -2% lower on the session had the ASX200 poised to open back below 5600 – which it did, before clawing its way back above that level and enjoying most of the afternoon above it, but finally succumbing on the death as some big futures orders hit the tape, forcing the index 17pts lower in the final 10mins. The banks felt the pinch today, both NAB & Westpac tumbled to new 6-year lows. Energy also dropped as global growth fears popped up again as well as analysts posting bearish notes on the oil price as more and more non-OPEC and low cost production comes online while the Tech sector was also on the nose. Resources though were reasonably well supported in a soft market.

Media names took a hit today as reports that advertising spend had fallen 10% year on year. The other half of the consumer services index, the telcos, were strong with traders looking for defensive names, and the telcos bouncing back from the recent ACCC infused weakness. On the corporate side the news flow continues to stay subdued as many start to take holidays. Fletcher Building (ASX: FBU) was active though, selling one of their international businesses which we discuss below.

Overall today, the ASX 200 closed down -68 points or -1.22% to 5589. Dow Futures are currently trading down -3 pts or -0.01%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

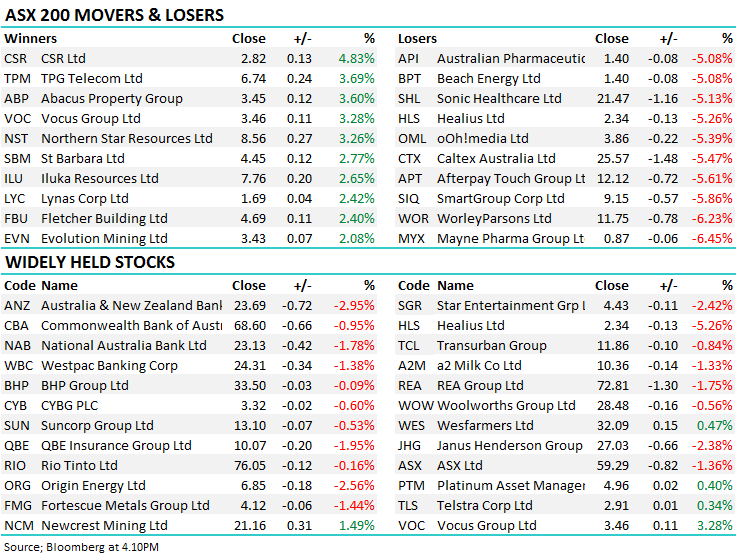

Broker Moves; UBS kicked off coverage of one of our Growth Portfolio holdings today, slapping a buy on mining services company Orica (ASX: ORI). The thesis was developed around normalizing mining activity driving demand for Orica’s explosives, with the bank seeing the stock as a leverage play on any resources boom. According to the analyst, the company also has balance sheet capacity to drive earnings with M&A activity and internal investment. Some good press here for a holding of ours and ORI managed to eke out a 9c/0.52% gain in the session, outperforming the broader market, to close at $17.34. We remain bullish ORI

Orica (ASX: ORI) Chart

ELSEWHERE:

· Sigma Healthcare Upgraded to Neutral at UBS; PT A$0.58

· Incitec Rated New Neutral at UBS; PT A$3.70

· Orica Rated New Buy at UBS; PT A$18.86

· DuluxGroup Downgraded to Sell at Morningstar

· F&P Healthcare Rated New Neutral at JPMorgan; PT NZ$12.60

· Beacon Lighting Cut to Hold at Morgans Financial; PT A$1.34

· Accent Group Downgraded to Hold at Morgans Financial; PT A$1.46

· Domino’s Pizza Enterprises Raised to Hold at Morgans Financial

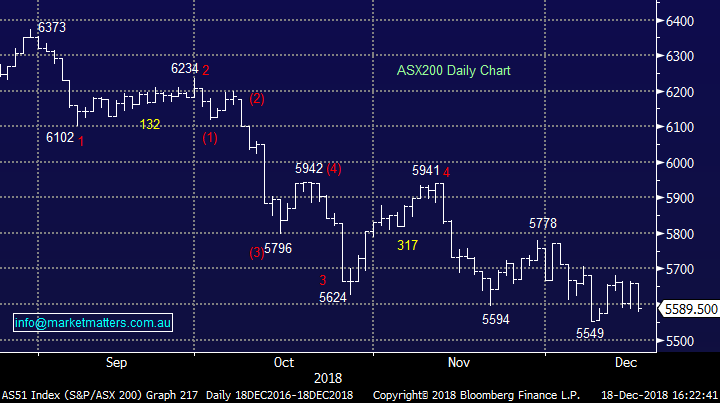

Fletcher Building (ASX: FBU) $4.69 / +2.4%; Construction product manufacturer Fletcher Building has bucked the market weakness to trade higher into the afternoon following the announcement of the sale of their Formica business. Fletcher will receive $US840m for the sale of the international laminates and panels business, that was deemed as non-core to the Fletcher business, to a Netherlands based holding company Broadview. While there are a few regulatory hurdles to jump, no hiccups are expected and the company intends to complete the sale early next year.

The deal has been seen as a positive for Fletcher with the sale price higher than the market could have expected. Just 4-weeks ago, the FBU share price fell significantly on soft guidance for FY19. The business was been squeezed by falling construction rates across Australia and New Zealand in both residential and commercial construction.

Fletcher Building (ASX: FBU) Chart

OUR CALLS

No changes today.

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.