Markets hit again thanks to US Fed (ORE, IVC, AZJ)

WHAT MATTERED TODAY

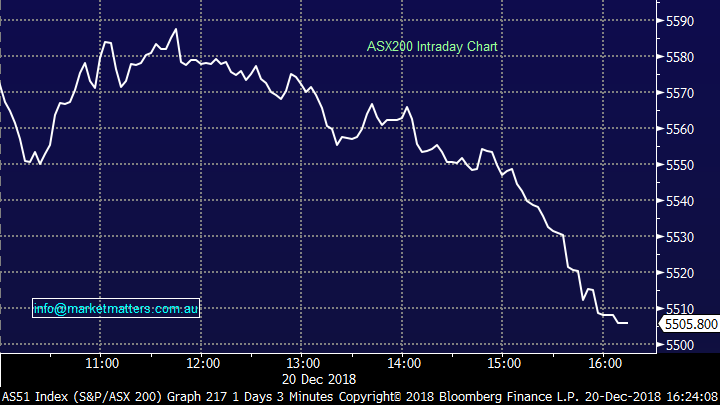

Another tough day for stocks with the market doing well early on only to see the index slip lower into the close. Double expiry in the options market today with index options expiring this morning and stock options this afternoon, hence some big volumes going through the bourse. Much of the talk today is about the interpretation of the Fed move overnight, and the fact that J Powell emphasised the natural run off of bonds from the Fed balance sheet. Effectively it means less liquidity in the system, something around $50bn a month matures and that’s having an impact in the high yield credit market with spreads increasing – all pretty bearish stuff to head into Christmas. In terms of flow across the desk, a few banks were keen to buy decent put option volume on the index today, effectively spraying different strikes which seemed to apply a lot of pressure on the market, while US Futures were also trading down over the course of the day.

Asian markets were weak, Japan off 3% and Hong Kong down -2% - simply a day where risk off built on itself and the market closed on the lows.

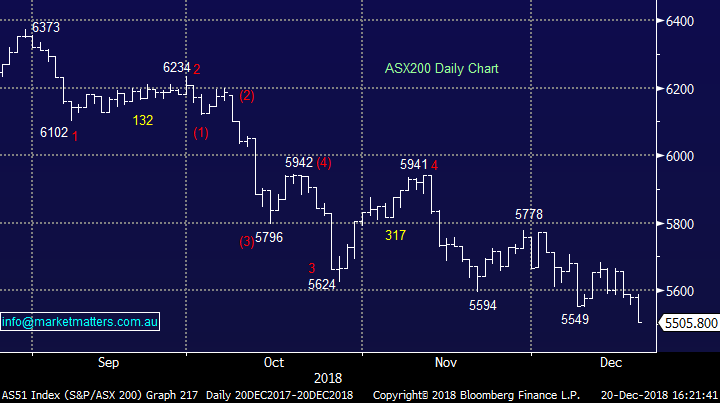

Overall today, the ASX 200 closed down -74 points or -1.34% to 5505. Dow Futures are currently trading off by -170pts or -0.74%.

ASX 200 Chart

ASX 200 Chart

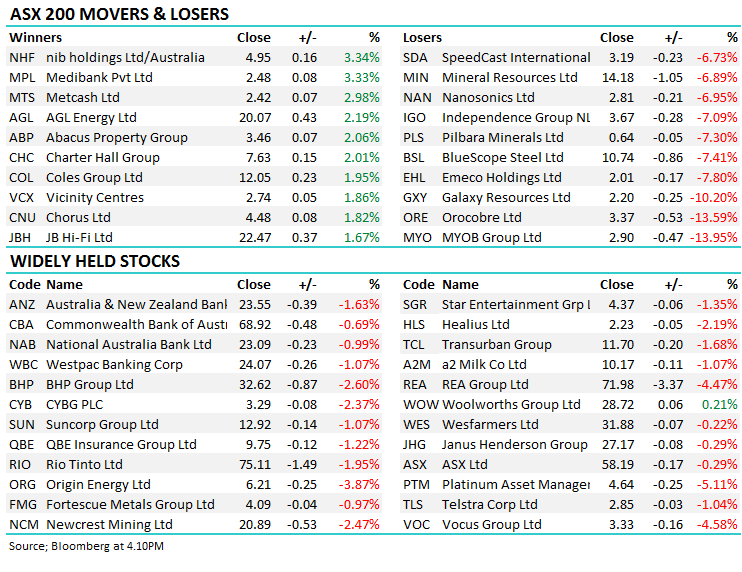

CATCHING OUR EYE;

Lithium Stocks;The sector was smashed today after Orocobre (ASX:ORE) reported a very weak realised price for their Dec quarter production with the company saying…..The pricing achieved recently has been affected by soft market conditions in China having a direct impact on shorter term contracts resulting in December quarter prices of approximately US$10,800 per tonne. That’s a very negative read through for the sector with ORE down -13.59%, KDR down -12.93%, MIN down -6.89% and PLS down -7.3%

Orocobre (ASX: ORE) Chart

Broker Moves; Evans and Partners initiated on Aristocrat this morning, with an equivalent of a BUY recommendation and $28.60 price target. It had very little impact on the stock today which was sold down again, off -3.71% to close at $21.00.

ELSEWHERE:

· Austock Rated New Buy at Moelis & Company; PT A$0.80

· Australian Pharma Raised to Equal-weight at Morgan Stanley

· Seven West Upgraded to Buy at Morningstar

· Healthscope Upgraded to Buy at Morningstar

· Aristocrat Rated New Positive at Evans and Partners; PT A$28.60

· Saracen Mineral Downgraded to Sector Perform at RBC; PT A$2.50

· NIB Holdings Upgraded to Neutral at Credit Suisse; PT A$4.90

· Beach Energy Upgraded to Hold at Shaw and Partners; PT A$1.50

· Bega Cheese Upgraded to Hold at Morgans Financial; PT A$5.01

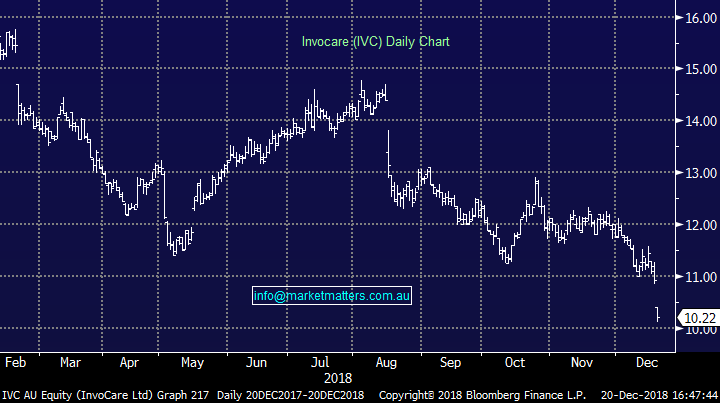

Invocare (ASX:IVC) $10.22 / -6.5%;Seems to be less people kicking the bucket these days by the look of the IVC share price which fell to a 4 year low today. It’s smaller rival Propel Funeral Partners (ASX:PFP) said it expects flat year-on-year operating profit growth in 1H19 as below-trend funeral volumes have persisted since October. They say weak industry volume trends continued in Oct t and given that Invocare’s already losing market share to smaller players, they have a bigger issue with the deteriorating trends…IVC is a stock we discussed recently that looked good technically, we failed to pull the trigger given weak trends across the industry and are happy spectators for now.

Invocare (ASX:INV) Chart

Aurizon (ASX:AZJ) $4.18 / -3.24%; UBS handled a massive AZJ trade today valued at $738.1m at $4.11 today instigated by a major seller – about a 4% discount to mkt at the time, although not clear yet who it was. Big ticket for the UBS guys and some Christmas cheer going on there no doubt this afternoon…

Aurizon (ASX AZJ) Chart

OUR CALLS

No changes today.

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.