CBA remains long wealth (CBA, MOC, AFG, RHC)

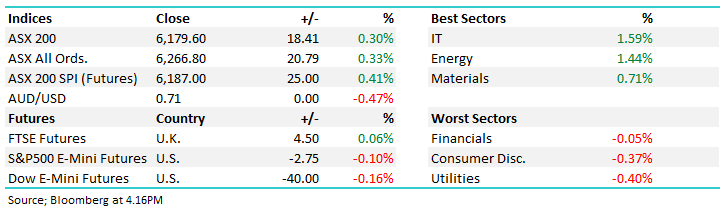

WHAT MATTERED TODAY

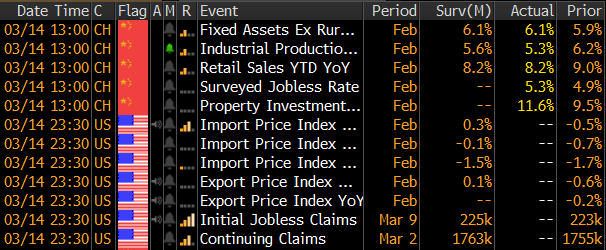

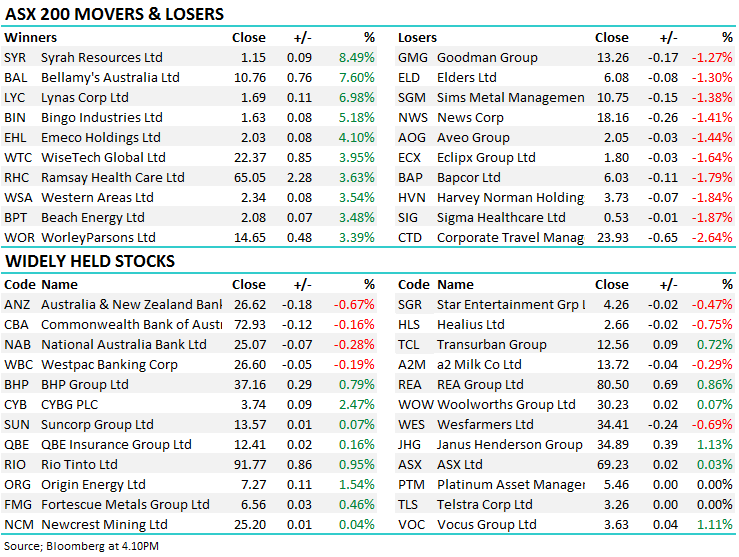

Another choppy session for the Aussie market with stocks sold down early only to recover late in the day. The banks provided a drag, more so early however on however what was noticeable, is that some of the beaten down ‘dogs’ are starting to again come into focus. Emeco (EHL) enjoyed a strong reversal while Bingo (BIN) closed up through the $1.60 level – both look good technically.

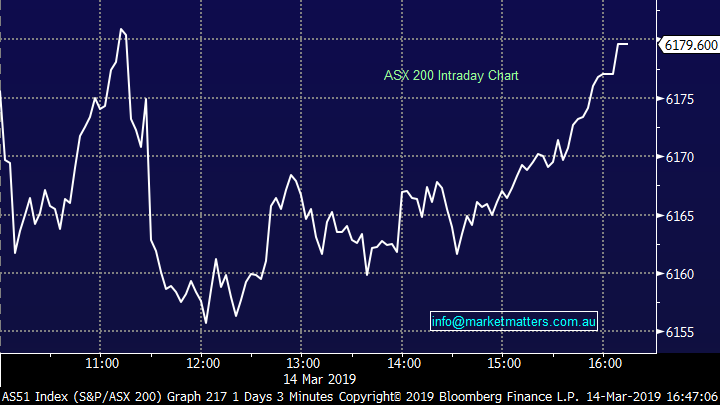

Chinese data was out around lunchtime and on the whole was fairly positive – retail sales inline, industrial production a touch soft while fixed asset investment was smack on. A fair amount of data out of the States tonight with employment the key after a weaker than expected non-farm payrolls print last start.

Data – China and US

The Chinese market was actually soft today, as was much of Asia on reports that regulators had taken further steps to cool the availability of margin loans. While the broader Chinese mkt fell by around 1.5%, the small cap stocks fell by 3%. That weakness however didn’t filter into our market while US Futures were also trading in the red for much of our session.

Overall today, the ASX 200 added +18 points or +0.30% to 6179. Dow Futures are currently trading down -30pts / -0.12%. – good late buying the key similar to yesterday

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Stocks trading at 52 week highs outpacing stocks trading at 52 week lows by a factor of 5. The highs of note include ;EQT, NWH, AIA, CNU, PME, VEA, NCM, IFM while the lows include AIZ, ALG.

Mortgage Brokers: A sector for those deep value hunters out there given the political landscape appears to be improving in favour of the mortgage brokers. It now seems both major political parties have backed down on who pays commissions to brokers. The original outcome from the RC felt like a death knell for the industry, hence the short term price destruction of a few of the listed players. In essence, brokers promote competition, and competition reduces price and benefits all – which now seems to becoming obvious plus importantly, there are currently 17k brokers employing a total of 27k people which is ultimately a lot of votes. From a valuation perspective, the companies exposed here screen cheap and while there remains risk from legislation and of course the housing market, they seem priced for the current woes. That said, I suspect they trade cheap until the legislative framework becomes clearer.

Stocks in the sector to look at include;

Australian Financial Group (ASX:AFG) Chart

Mortgage Choice (ASX:MOC)

CBA, -0.16%, was in focus today after announcing they would be suspending plans to demerge the wealth management business. The bank has started to get cold feet on the spin off blaming the Hayne Royal Commission. CBA and Westpac are the two remaining banks with the bulk of their wealth management divisions still in house. Westpac poured cold water on speculation they will be offloading their business following the separation plans from the other three banks last year. We tend to think CBA is making the right move here – despite the short term negativity towards wealth management, it is still a key growth area if done right.

Commonwealth Bank (CBA) Chart

The rest big 4 also saw a bit of airtime today as New Zealand continues to take an aggressive stance on the capital positions of the NZ operations of Australian banks. The RBNZ had recently announced plans to increase minimum tier 1 capital rates of the banks to up to 18% forcing over $12b of extra capital to be held between the four banks. NZ operations have been highly profitable for the majors for some time now, with New Zealand more reliant on bank resources and lower competition from smaller players. The RBNZ move is aggressive, and likely to impact the NZ economy more so than the banks.

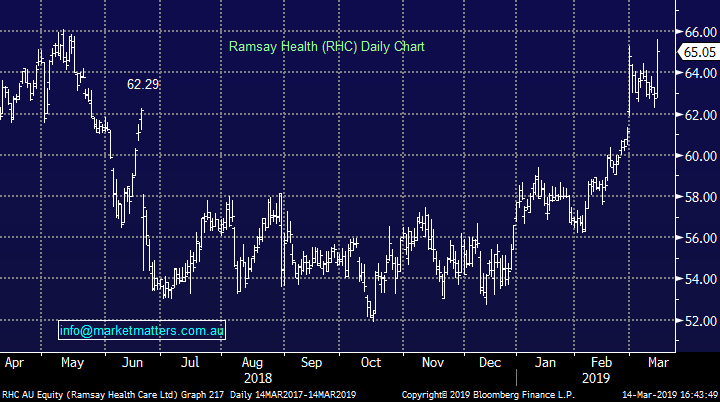

Ramsay Healthcare (RHC) +3.63% up today as more positive signs emerge in their UK operation, an area they’ve talked down for a while. They say the UK is improving in terms of both price and volume growth and as far as BREXIT goes, they’re planning for all outcomes, which seems sensible. A test of $66 seems likely for RHC however that becomes a major level…

Ramsay Healthcare (RHC) Chart

Broker Moves:

· Gentrack Rated New Outperform at Woodward Partners; PT NZ$6.30

· Iluka Upgraded to Buy at Morningstar

· Sigma Healthcare Upgraded to Buy at Morningstar

· Fleetwood Rated New Buy at Moelis & Company; PT A$2.50

· Yancoal Australia Rated New Buy at CMB International

· ANZ Bank Downgraded to Hold at Bell Potter; PT A$28.50

OUR CALLS

No changes to either portfolio today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.