Flight Centre lands in a heap (FLT)

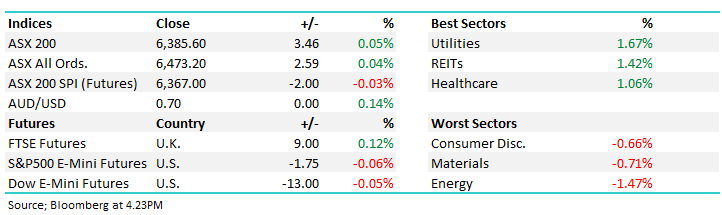

WHAT MATTERED TODAY

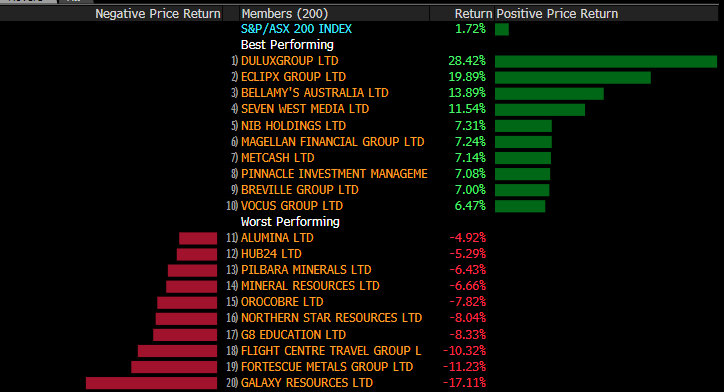

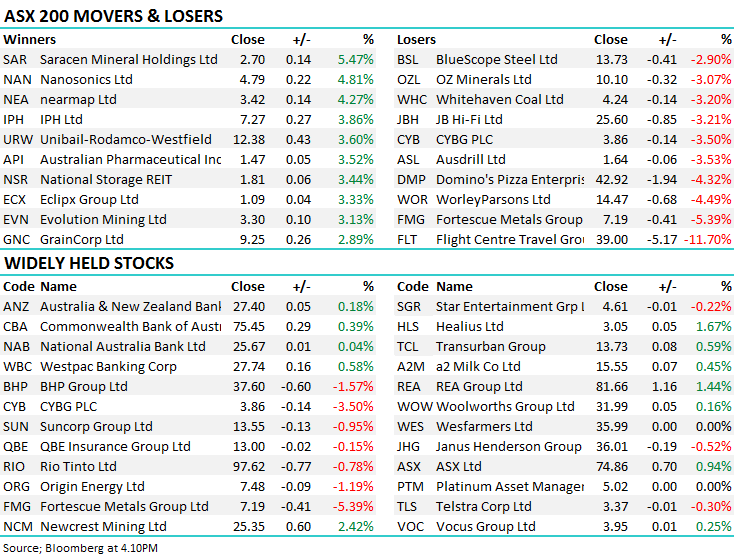

I felt like I was one of only a handful in the city today with the Easter School Holidays overlapping ANZAC Day and creating the perfect excuse to take or extend holidays. The market reflected it with the index closing flat. Gold stocks did well today on the back of a positive gold price overnight + they’d all been hit fairly hard in recent months. Evolution (EVN) +3.13% Saracens (SAR) +5.47% now looking bullish while Newcrest (NCM) +2.42% has bounced higher without pulling back into our ~$24 target. We’ll take a deeper dive into Gold in a note soon…

Resources have now pulled back from recently frothy highs – BHP -1.57% today to $37.60 while Fortescue (FMG) -5.39% to $7.19, the heat really coming out with the index being flat - banks doing some of the lifting. Quarterly reporting is currently underway in the US and overnight there were some interesting / bullish comments from US Iron Ore miner Cleveland Cliffs (CLF.US) as they beat 1Q19 earnings expectations…the CEO saying there is a massive shortage of iron ore and pellets in the international markets, also with winter out of the way, "we enter the three strong quarters of a 2019 that is shaping up to be another multi-year high in adjusted EBITDA," says Chairman, President and CEO Lourenco Goncalves, citing "robust manufacturing activity in the U.S., stimulated by a still under-appreciated tax reform and a massive shortage of iron ore and pellets in the international markets." A bullish update which implies the pullback in the Iron Ore stocks in the last week or so will ultimately present a buying opportunity…certainly an area to keep a close handle on.

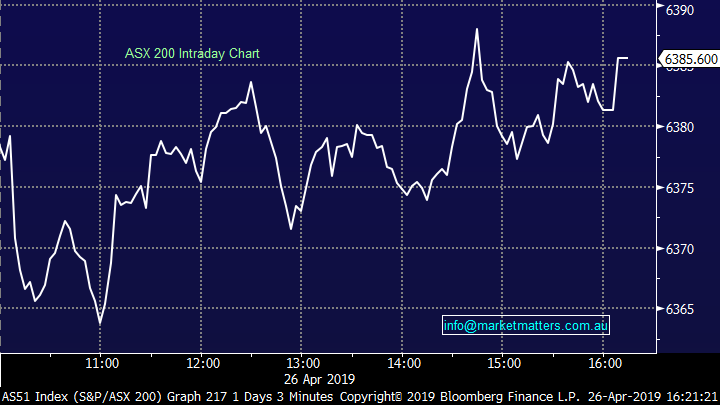

Overall today, the ASX 200 added +3pts or +0.05% to 6385. Dow Futures are trading flat…

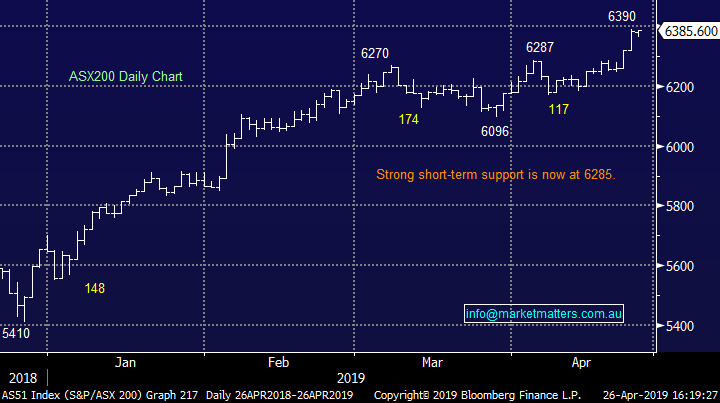

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Flight Centre (FLT) –11.70% to close the day at $39.00 down about the same quantum as its earnings downgrade so the market giving them the benefit of the doubt and not-rerating the P/E lower as well. The corporate business still doing well however the retail operation is struggling. The stock traded between a low of $38.22 and a $39.87 high before closing mid-range. The decline in earnings shows how tough the Aussie consumer is doing which is why we’re now talking about interest rate cuts locally. We think it gets worse before it gets better for FLT and have no interest here.

Flight Centre (FLT) Chart

Stocks we own on the move; Healius (HLS) +1.67% closed at $3.05 and has now broken out – the stock trading like it’s got some positive news bubbling away in the background while on the flipside, PactGroup (PGH) is trading poorly, down -1.54% and near the lows of the day. As we suggested this AM, we remain keen on Resmed (RMD) for new highs and it was up again today +1.25% while our other health related exposure NiB (NHF) also had a decent session adding +1.21%.

On the Income side, Perpetual (PPT) was weak after a downgrade from Bell Potter to sell, the stock off -2.81% however after trimming our weighting here recently, we remain comfortable – not a lot else happening in that portfolio today.

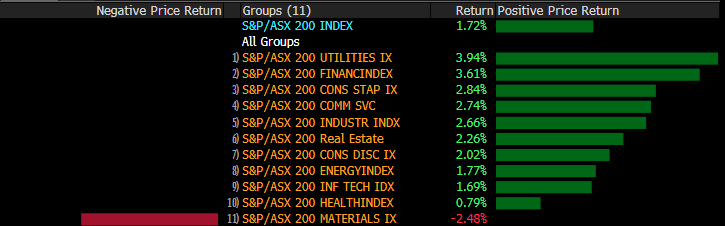

Sectors this week;

Stocks this week;

Broker Moves;

• Perpetual Downgraded to Sell at Bell Potter; PT A$35.17

• Netwealth Downgraded to Hold at Bell Potter; PT A$9.91

• CYBG GDRs Downgraded to Hold at Bell Potter; PT A$4.35

OUR CALLS

No changes today

Watch out for the weekend report. Have a great night,

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.