Trump tests China on trade – markets react (CIM, WBC, MQG, FMG)

WHAT MATTERED TODAY

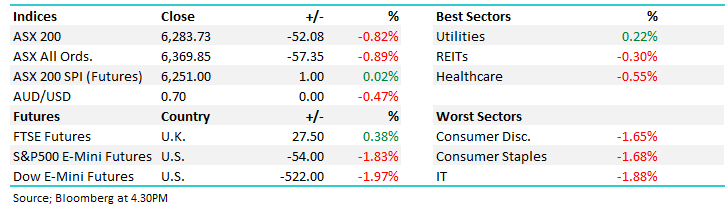

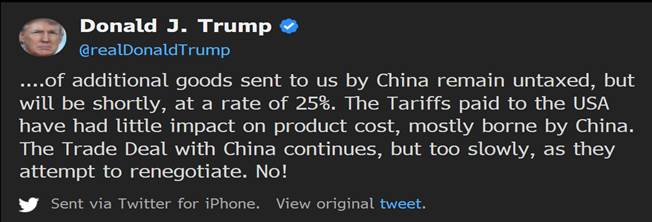

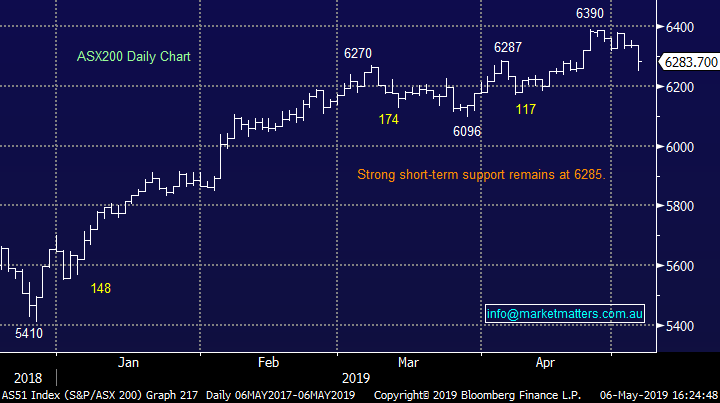

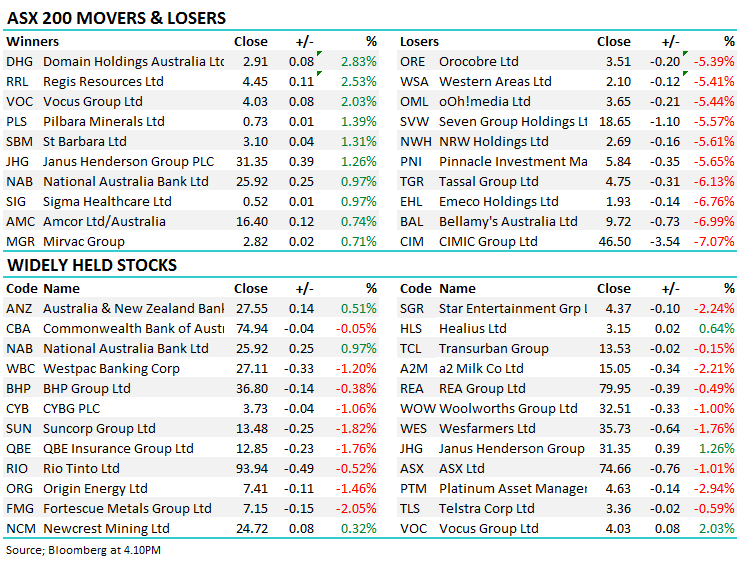

A weak session today for the local market with the index down ~90pts at its worst thanks to Trumps tweets around China / US Trade…

China responded saying they are considering cancelling trade talks with the U.S. after the Trump threats and this prompted sharp selling in US Futures which were down ~2% during our time zone while Asian markets were hit harder, China stocks down around 6% at their worse while other Asian markets were softer. We were worse early, but recovered some of the day’s losses to close down 52points which wasn’t a bad result really with a few bright spots in a sea of red. In the banks, NAB & ANZ were actually up on the session, CBA was fairly flat, while WBC underperformed following their 1H19 results – more on that below.

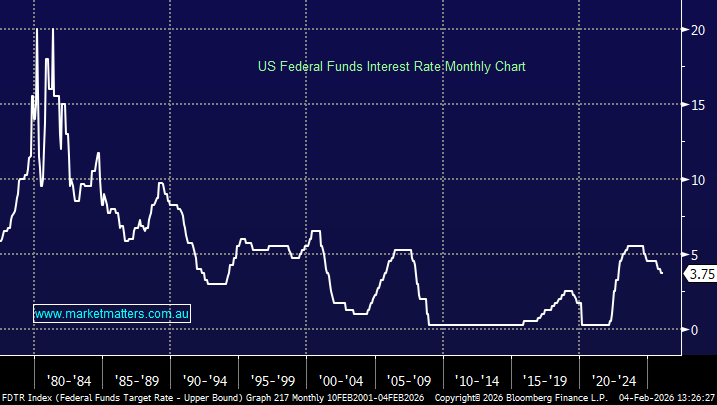

Understandably, it was the China facing stocks that felt most pain today while stocks that could benefit from a potential rate cut tomorrow held up okay. (RBA decision tomorrow afternoon @ 2.30pm) .

Overall today, the ASX 200 lost -52 points or -0.82% to 6283. Dow Futures are trading down -492pts / -1.86% which is where they’ve traded for much of our session

ASX 200 Chart – recovered +33points from the morning low

ASX 200 Chart

CATCHING OUR EYE;

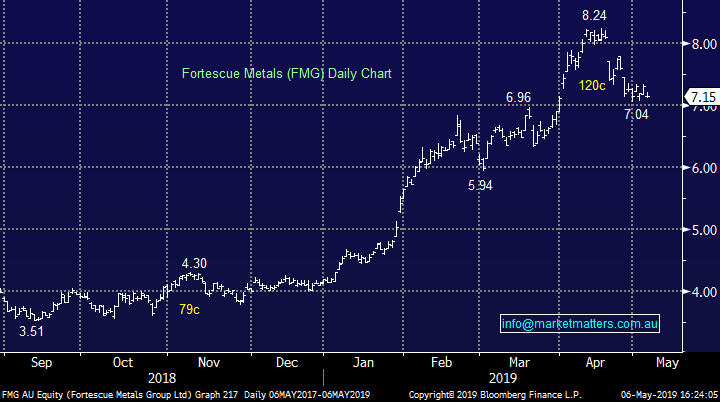

Iron Ore Stock Piles - Data out today showed stockpiles declined for a 4th week, hitting the lowest since Oct 2017, “offering further evidence that supply disruptions and robust demand are tightening the global market.”(BBG) Inventory fell 1.8 percent to 133.6mt (Steelhome). Volumes of both Brazilian and Australian ore fell, with material from the nearer shipper leading the drop. Clearly the mkt remains tight hence the proposed foray into Fortescue Metals (FMG) today.

Westpac (WBC) –1.20% Reported 1H19 results this morning and the stock had a volatile day – ultimately underperforming the sector in an overall weak market. They reported pretty much as per expected with no growth in net interest income from 2H18 to 1H19 which reflected little loan growth and a slight decline in net interest margin (NIM), excluding notable items. While they maintained the dividend, they introduced the discount on its DRP to support capital generation during a period of earnings weakness - this results in more shares being issued. The other notable parts to the result included a very low bad debt charge which creates questions over sustainability of that charge and the quality of the result. As our guy said today in summary… nothing to impress here and no changes to forecast.

One aspect worth noting, and this could be supportive from here is not only did WBC maintain their dividend at 94cps v 83cps for NAB and 80cps for ANZ, WBC is the only bank to pay its dividend this financial year and thus , it’s the only dividend not exposed to the impacts of a potential change in government policy from franking. Plus the franking benefit can be claimed straight away given the payment date of the 24th June 2019.

Westpac (WBC) Chart

Cimic -7.07% - hit hard today on the back of a report from aHong Kong research firm accusing CIM of inflating profits by a massive $1 billion over two years. "We estimate CIMIC has inflated reported pre-tax profit by roughly 100 per cent over the past two years, or $A1bn in total, through a combination of aggressive revenue recognition, acquisition accounting and avoiding losses from its Middle Eastern JV".

Obviously CIM came out and denied the claims however it refocusses attention back on the dark science of accountancy in the contractor space. Cimic is the old Leightons and their former CFO Peter Gregg was found guilty of falsifying the books some 10 years ago.

While these claims were clearly a negative today – the stock off 7% by close, it was down more early on – it’s not a new claim and CIM’s response around audited accounts etc is fairly standard.

The negative sentiment flowed through to other mining contractors while the ~6% drop in the Chinese market also provided a headwind . Emeco (EHL) -6.76%, Ausdrill (ASL) -4.7%, Monadelphous (MND) -3.5%

Cimic (CIM) Chart

Broker moves: Macquarie (MQG) -2.48% saw some downgrades today and the stock fell again taking the total decline from recent highs to around 7.5% - the stock closing sub $126 today and starting to look interesting.

· Ramsay Health Cut to Underweight at Morgan Stanley; PT A$58

· ResMed Upgraded to Buy at UBS; PT $119

· Pendal Group Downgraded to Hold at Morningstar

· Macquarie Group Cut to Neutral at Evans and Partners; PT A$126

· Macquarie Group Downgraded to Neutral at JPMorgan; PT A$130

· Cromwell Property Downgraded to Sell at Morningstar

· Tabcorp Cut to Neutral at Credit Suisse; Price Target A$5.05

· Janus Henderson GDRs Downgraded to Sell at Goldman; PT A$29.32

Macquarie Group (MQG) Chart

OUR CALLS

We put an alert out this morning to buy Fortescue Metals (FMG) with a $7.10 limit. The stock traded to a $7.11 low hence we remain unfilled. We’ll re-asses and update the limit price in the AM report tomorrow.

Fortescue Metals (FMG) Chart

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.