Markets ignore trade tariffs and edge higher

WHAT MATTERED TODAY

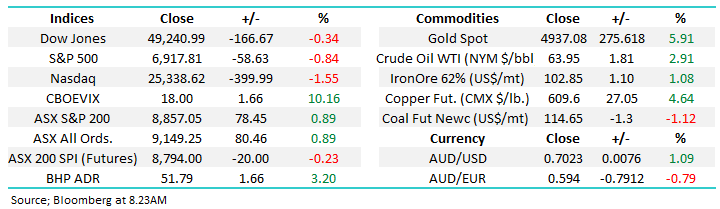

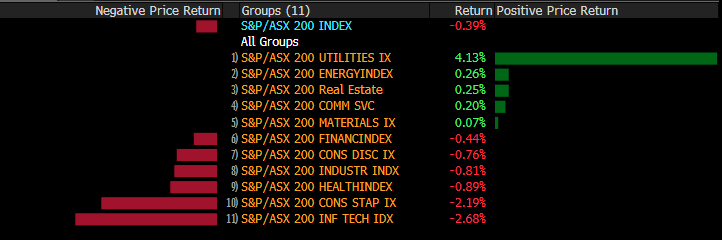

Another busy week in the mkts wrapped up on a positive note this despite the US this afternoon imposing an increased 25% tariff on about $200 billion of Chinese goods, up from 10% before as trade negotiations continue in the US. News reports saying that day one of talks between top Chinese and U.S. economic officials in Washington ended with little progress – however, the markets have applied a more optimistic spin with US Futures now ticking up into the green while Asian markets moved higher – Chinese Futures now up ~4% at time of writing – optimism of a deal maybe building again. No doubt a lot to keep an eye on over the weekend, along with the usual election diatribe.

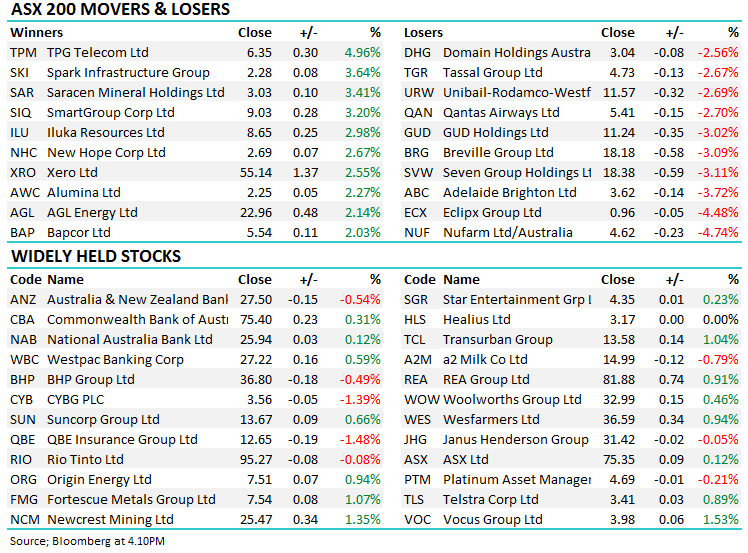

All up, a reasonable session today, BHP caught my eye given a decent turnaround in price from the daily lows while the banks were bid into the afternoon session. Golds were also strong – Saracen (SAR) had a stormer adding 3.41% however the sector was generally strong.

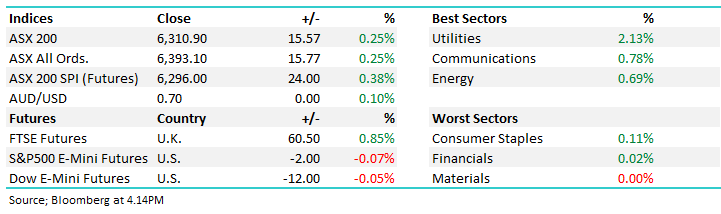

Overall today, the ASX 200 added +15pts or +0.25% to 6310. Dow Futures are trading flat.

ASX 200 Chart

ASX 200 Chart

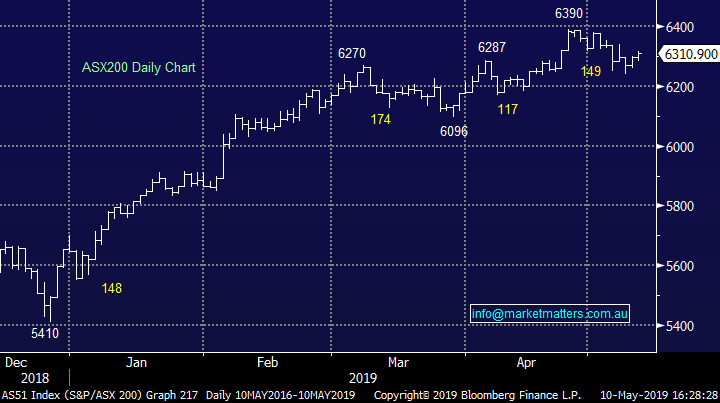

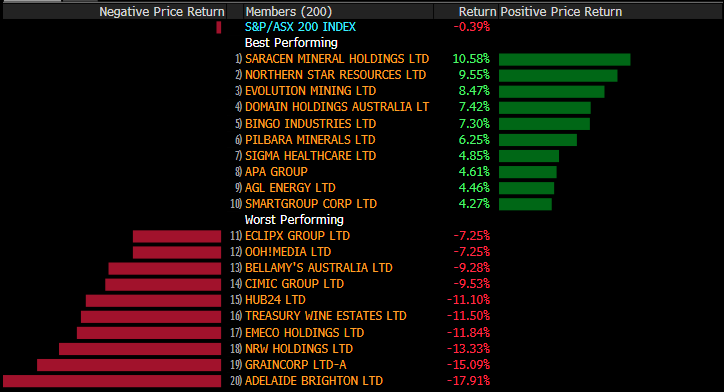

Sectors this week;

Stocks this week;

Broker Moves;

· Adelaide Brighton Downgraded to Sell at Citi; PT A$3.50

· Adelaide Brighton Cut to Neutral at Credit Suisse; PT A$3.90

· Orica Upgraded to Neutral at Citi; PT A$20

· Orica Downgraded to Sell at Morningstar

· Orica Downgraded to Neutral at Credit Suisse; PT A$19.24

· Qantas Downgraded to Neutral at Macquarie; PT A$5.75

· Temple & Webster Rated New Outperform at RBC; PT A$1.75

· GrainCorp Upgraded to Hold at Morgans Financial; PT A$7.57

· TPG Telecom Upgraded to Overweight at JPMorgan; PT A$6.90

· Evolution Raised to Overweight at JPMorgan; Price Target A$3.50

OUR CALLS

No changes today

Watch out for the weekend report. Have a great night,

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.