Markets down but rally from lows (FMG, NCM)

WHAT MATTERED TODAY

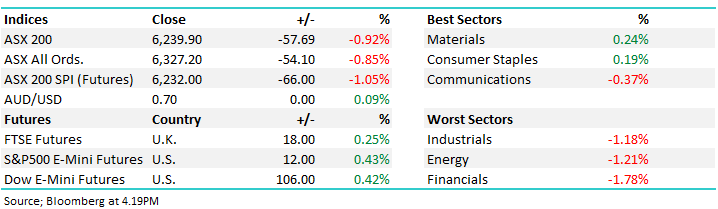

US markets were hit hard overnight, the Dow Jones down ~700pts at the worst while the tech stocks were hit harder – the Nasdaq down nearly ~3.50% on the session thanks to Chinese retaliation to US tariffs. It was always going to be a tough open locally, futures were down -54points which seemed undercooked and that proved to be the case as the market quickly sold off to a 10.45am low, down ~97point / 6239 low. From then on though, buyers stepped up and the index moved higher into the after, eventually finishing about mid-range of the day.

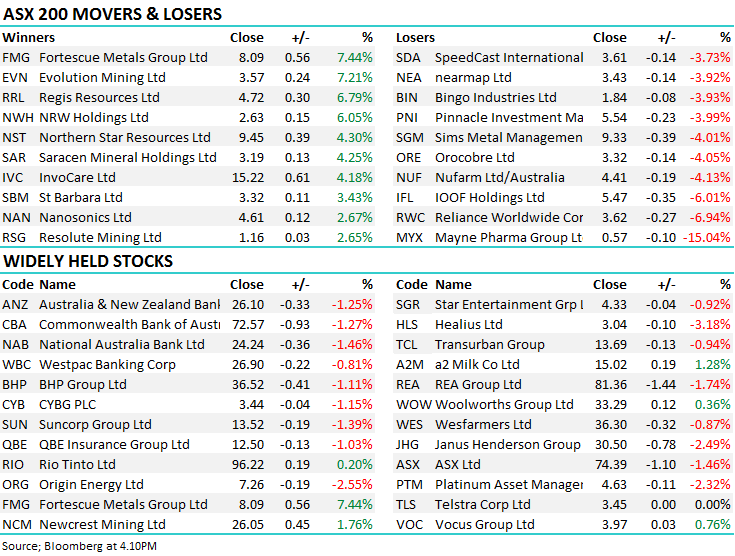

US Futures moved higher, Asian markets were down but traded up from their lows and the early morning volatility petered out into the afternoon session. Material stocks held up well led by Fortescue Metals (FMG) after it announced a big special dividend while financials were the weakest link. The sell in May bears have their claws out and certainly won the argument today – although not emphatically.

Overall today, the ASX 200 lost -57 points or -0.92% to 6239. Dow Futures are trading up 106pts / +0.42%.

ASX 200 Chart – hit hard early but recovered

ASX 200 Chart

CATCHING OUR EYE;

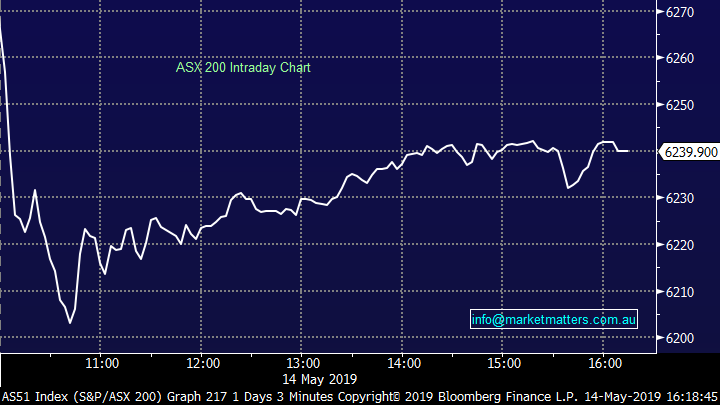

Fortescue Metals (FMG) +7.44% big mover today thanks to a surprise dividend of A60cps announced this afternoon – it equates to a A$1.85 billion payout to be paid June 14 – meaning the dividend will be paid and franking benefit received this financial year. It will take the payout this FY to A90c + FMG has guided to paying between 50-80% of post tax earnings as dividends into the future, meaning that if the Iron ore price remains high then more big payouts are likely – FMG the cash cow. I spoke about FMG and the mining sector last week in a video with Peter O’Connor - the No 1 ranked FMG analyst. Click here to view

Fortescue Metals (FMG) Chart

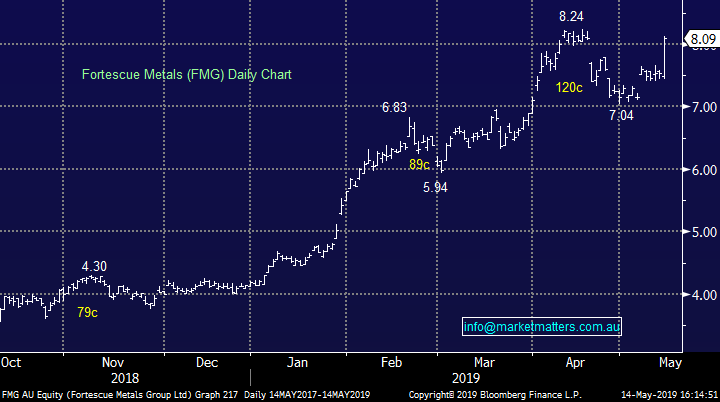

Gold stocks rallied today across the board as the save haven sees some buying on US/China trade tensions. Gold should perform well in this environment on safe haven buying but also as an inflationary hedge, since tariffs are ultimately inflationary. The other areas of safety are low volatility assets such as bonds and defensive shares but valuations here are high hence it’s easy to see gold move higher.

Newcrest Mining (NCM) Chart

Broker moves:

· Integral Diagnostics Upgraded to Buy at Ord Minnett; PT A$3.30

· New Hope Upgraded to Outperform at Credit Suisse; PT A$3.50

· Ansell Downgraded to Hold at Deutsche Bank; PT Set to A$27.19

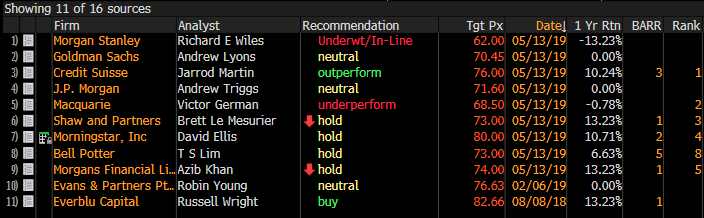

· Fortescue Upgraded to Outperform at Credit Suisse; PT A$8.20

· Liquefied Natural Gas Rated New Buy at Gabelli

· Sims Metal Cut to Equal-weight at Morgan Stanley; PT A$10.50

· CBA Downgraded to Hold at Morgans Financial; PT A$74

· CBA Downgraded to Hold at Shaw and Partners; PT A$73

· Reliance Worldwide Cut to Hold at Morgans Financial; PT A$3.94

· SIG Combibloc Upgraded to Buy at UBS

· CYBG Upgraded to Buy at Investec

Here’s the rundown of CBA calls post update

Source; Bloomberg

OUR CALLS

We bought MQG & ILU in the Growth Portfolio and added Rio Tinto (RIO) to the Income Portfolio.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.