Markets edge higher, but not convincingly so (APT, BOQ)

WHAT MATTERED TODAY

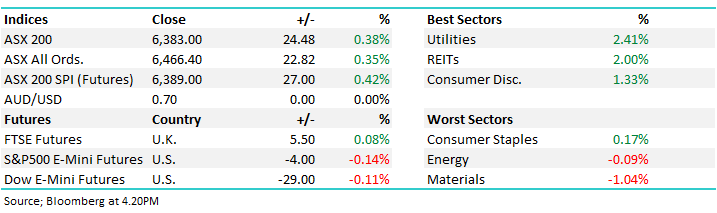

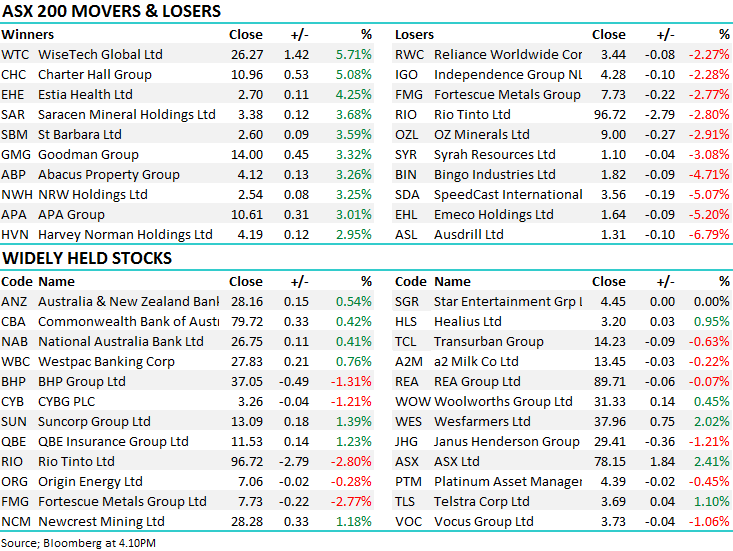

The market edged higher again today – up around +20pts although it was a narrower move than yesterday with the resource sector a meaningful underperformer. BHP off -1.31%, Fortescue (FMG) -2.77% & Rio Tinto (RIO) -2.8% on the back of a 2% decline in Iron Ore futures. Asian markets were mostly down today, although only marginally while US Futures were sold off early, down around -100pts on the Dow as news that the U.S & Mexico had failed to agree on terms - before rallying back to be largely flat into our close.- seems US stocks want to trade higher despite the various pockets of negativity. As we’ve said in the past, the Trump, Powell & Xi puts remain active!!

We’re starting to see tax loss selling play out in stocks that have had a poor FY19 to date. Emeco (EHL) fits into that list with the stock down -5.2% on the session to close at $1.64 making new yearly lows. We’ll look at other candidates in a note shortly. Banks on the other hand remained firm today, all up around ~0.5% with Westpac being the best performer amongst the majors, although both BOQ & BEN outpaced those gains with BOQ announcing a new CEO.

At the sector level, the defensive areas did best led by utilities while the real-estate trusts were also well bid – low rates continuing to support the bond proxies, while weak performances from Energy & Materials shows the markets distrust of growth sectors – for now at least.

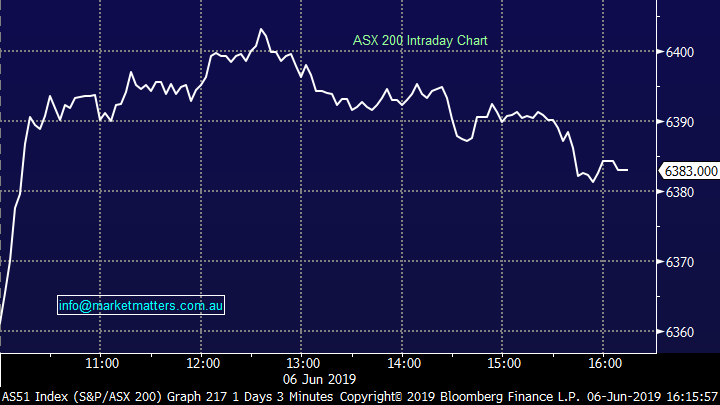

Not a lot else happening on the market today – volumes was weak – about $6bn - and it seems many are winding down for the long weekend – traffic was a breeze getting to the office today…

Overall today, the ASX 200 added +24 points or +0.38% to 6383. Dow Futures are trading down -30pts / -0.11%.

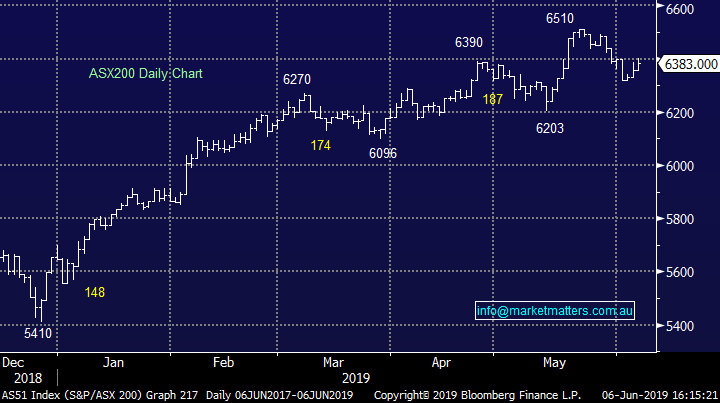

ASX 200 Chart

ASX 200 Chart – the current bounce doesn’t seem to have a lot of backbone – we remain neutral unless the mkt pushes up through 6450

CATCHING OUR EYE;

Afterpay Touch (APT) -1.88% down today after they said that they were in discussions with the regulator over compliance with anti-money laundering and counter-terrorism (AML/CTF) laws. While there was no outcome / update in terms of specifics, I know from the focus internally around AML / CFT that this is a big and growing issue in any company dealing with funds.

APT had tweaked their AML structures last year to include identity verification and a bunch of other things, however it seems like there is more work to do. It’s hard to write anything negative about this stock that’s not about valuation and they’ve executed really well, however regulatory scrutiny is one area that could create an issue in the future. APT peaked at $28.70 recently & is now trading $22.96, off 20% from recent highs…We have no interest to buy APT at these elevated levels.

Afterpay (APT) Chart

Bank of QLD (BOQ) +0.96% - announced a new CEO today confirming Westpac's outgoing head of consumer banking George Frazis would take the top job. While I met the last CEO (John Sutton) a number of times, I’ve never met George however he’s resume seems solid for the job. That said, talk across the desk today wasn’t that complimentary from those that do know him, however we’ll wait to make our own minds up.

The regionals are facing some massive challenges as regulatory costs tick higher, and while we own BOQ in the Platinum & Income Portfolios from lower levels, this is more a play on corporate activity than the strength or otherwise of the underlying franchise. We own in both portfolios looking for some forced amalgamation amongst the regionals.

Bank of QLD (BOQ) Chart

Broker moves:

Not a lot happening from broker sphere today – long weekend fast approaching. Markets should be pretty quiet tomorrow as well

· WorleyParsons Upgraded to Buy at UBS; PT A$16 – we view WOR as an accumulate around current levels

· Bravura Re- initiated at Macquarie With Outperform; PT A$5.50

· Monadelphous Rated New Buy at Bell Potter; PT A$20.80

· Santos Upgraded to Neutral at Credit Suisse; PT A$6.35

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/06/19

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.