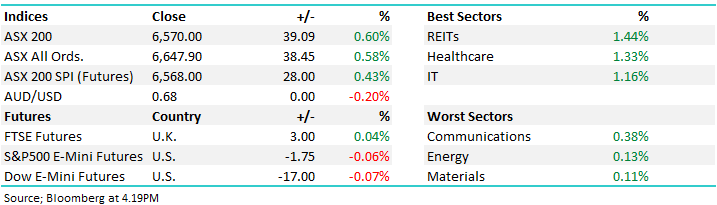

RBA Minutes drive the ASX to another high (COL)

WHAT MATTERED TODAY

Once again, the expectation of lower interest rates was enough to drive stocks higher today, with comments from the RBA that implies rates were more likely to go down than up from here…"Given the amount of spare capacity in the labour market and the economy more broadly, members agreed that it was more likely than not that a further easing in monetary policy would be appropriate in the period ahead," the minutes said.

While lower rates are indicative of a weak economy, the initial decline in rates is generally supportive of asset prices – like equities. While official cash rates are now at 1.25%,interest rate futures are implying a cash rate below 0.80% by December. That makes investing for income very difficult without taking on more risk, but it also makes equity income more appealing from those companies that can generate consistent returns. Coles is a case in point today, with a decent strategy update implying that they can grow revenue around 3% and improve earnings by more through productivity gains – more from Harry below on COL.

Elsewhere , Emeco (EHL) rallied for a second day on decent volume, up 8.82% to $2.16 while Afterpay Touch (APT) recovered from recent weakness to finish up by 4.93%, however it was Gold producer Silver Lake Resources (SLR) that was the standout today topping the leader board on a new Gold discovery.

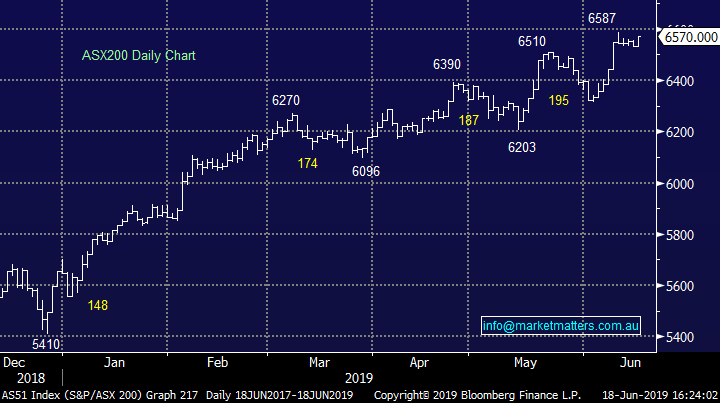

Overall, the ASX 200 added 39points or 0.60% to 6570 – the best close since 2007. Dow Futures are trading down -17pts / -0.07%.

ASX 200 Chart

ASX 200 Chart

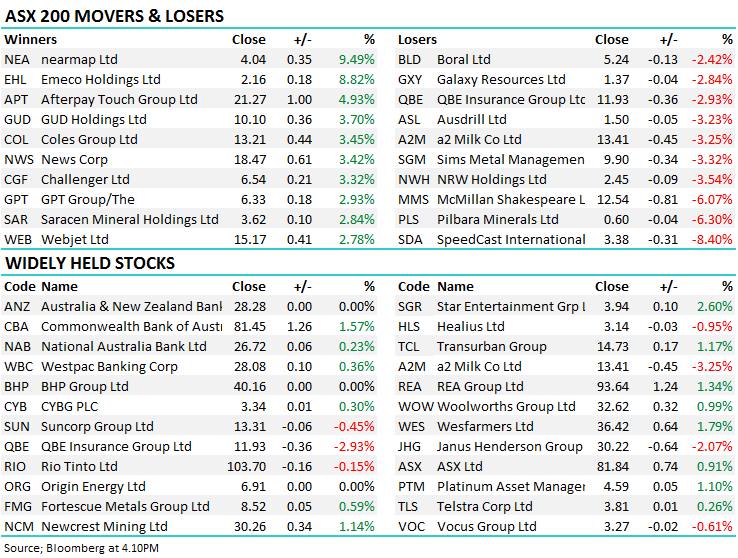

CATCHING OUR EYE;

Coles (COL) +3.45%; traded up to all-time highs today, snapping a 3-session losing streak with the market digesting the first investor day for the new standalone company. CEO Steve Cain has unveiled a number of new plans that aim to increase profitability and growth to Coles which has lagged behind rival Woolworths (WOW) in recent years. Convenience will be a key part of Coles’ new strategy and is now looking at introducing meal kit style options. The company also recently partnered with UberEats to increase delivery flexibility and in the midst of developing its online store with UK based Ocado. Data targeting is also front and centre for Coles as it looks to take advantage of the huge data pool that is FlyBuys.

While all this is happening, Coles is spending $700m-$800m to build out 2 distribution centres while they also look to cut $1bn worth of costs out of the business by FY23, largely through automation. The company noted 4th quarter sales had been reasonable, with growth coming in between the 2nd quarters 1.8% and the 3rds 2.1%. Coles is looking to match revenue growth to market growth which is estimated to be around 3% each year, while maintaining a payout ratio of 80-90%. Increasing competition is obviously a threat which Coles clearly recognize, hence their investment in a more efficient supply chain along with growing automation. Managing costs and improving efficiencies the key from here.

Coles (COL) Chart

Broker moves:

· AGL Energy Upgraded to Neutral at Macquarie; PT A$20.58

· Alacer Gold Reinstated at Macquarie With Outperform; PT C$4.50

· Nearmap Rated New Outperform at Macquarie; PT A$4.22

· Nanosonics Downgraded to Hold at Morgans Financial; PT A$4.99

· McMillan Shakespeare Cut to Neutral at Macquarie; PT A$12.62

· McMillan Shakespeare Cut to Negative at Evans and Partners

· Aristocrat Downgraded to Sell at Morningstar

· Qube Downgraded to Sell at Morningstar

· Freedom Foods Rated New Buy at Goldman; PT A$6.15

· Accent Group Upgraded to Add at Morgans Financial; PT A$1.51

· CBA Upgraded to Buy at Bell Potter; PT A$86

· QBE Insurance Cut to Hold at Bell Potter; Price Target A$13.20

· Senex Upgraded to Outperform at Credit Suisse; PT A$0.37

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/06/19

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.