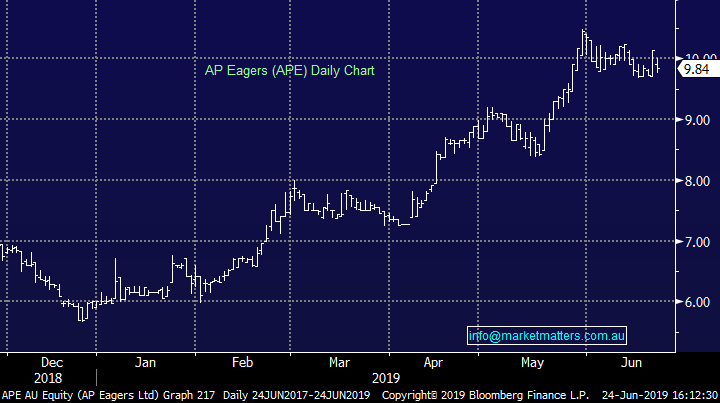

Metcash shares dumped (MTS, ASL, APE, AHG)

WHAT MATTERED TODAY

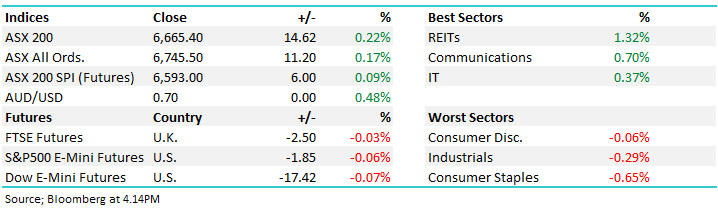

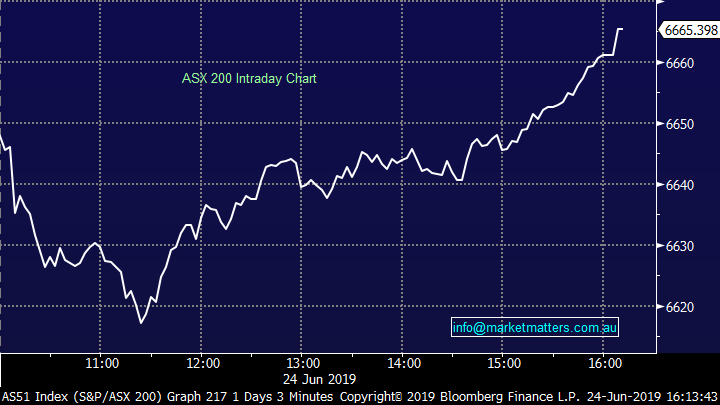

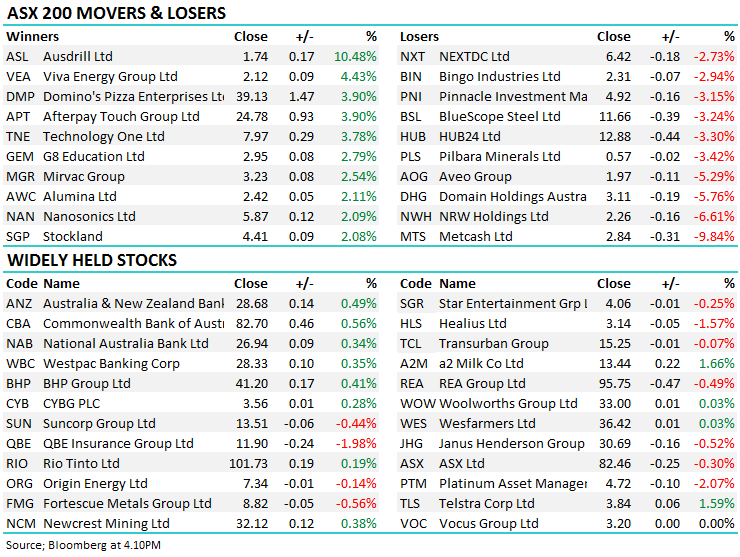

Friday’s gradual sell-off continued through the morning today as the index headed lower in the first 90-minutes of trade. Selling was seen in both banks and resources which took 33 points off the ASX200 before buyer slowly wore out the sellers so that by day’s end the market was trading back in the green – an impressive 48pts from the low.

Telstra was in luck with a broker upgrade from Macquarie, taking their rating to neutral, which led to the telcos outperforming today. REITs also continue to outperform as the low rate environment forces prices of bond like assets higher in the chase for yield. Consumer names clearly the worst off with the Metcash result weighing on the sector today.

Energy names were mixed today, but we did see a turnaround in fortunes for Caltex (CTX) and Viva Energy (VEA). Viva initially slumped on a soft 1st half update however the market gave them the benefit of the doubt after slamming the stock down 8% on Thursdays poor first half update from Caltex. Viva finished +4.43%, while was CTX +1.82% for the day.

Overall, the ASX 200 added +14 points or +0.22% to 6665. Dow Futures are trading down -17pts / -0.07%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Ausdrill (ASL) +10.48%; Easily the best on ground today was Ausdrill on the back of an announcement subsidiary Barminco had won a 5-year, $800m contract with a copper mine in Botswana. The mine is in its early stages and Barminco has been brought in to establish and develop infrastructure, training, diamond drilling and have production up to a rate over 3mt/year.

The contract further validates Ausdrill’s push into the international mining market and the acquisition of Barminco that was completed late last year is already paying dividends. To put this contract into perspective, revenue for Ausdrill in FY18, prior to the Barminco acquisition, was around $1bn with EBITDA margins of around 20%. We own ASL in the Growth Portfolio targeting the $2 area.

Ausdrill (ASL) Chart

Metcash (MTS) -9.84%; The grocery and hardware wholesaler slumped following the release of their full year results for the 12 months to April. Despite swinging back into a profit on a statutory basis, the result has missed expectations. Underlying NPAT fell 3% to $210m where expectations were looking for a number in line with last year’s. For the group, EBIT came in at $330m, slightly below last year’s figure and just about in line with expectations. On a segment level, hardware was the standout adding 17%, while food continues to struggle, falling 3% at the EBIT line.

The outlook for Metcash is a little worse than many had hoped. Key to the Metcash plan is continued cost out initiatives but the company seems to be hitting some roadblocks on the way, noting that benefits from repricing “onerous lease obligations” is expected to be less than anticipated to the food category. In the hardware business, costs savings aren’t expected to offset a slowdown in construction activity. Upside can be seen in the liquor business with continued ‘premiumisation’ of the market and the Porters brand rollout to help, however this is now the smallest contributor to EBIT for Metcash. The market doesn’t seem to have bought Metcash’s swing into a more growth focussed model at this point in the cycle.

Metcash (MTS) Chart

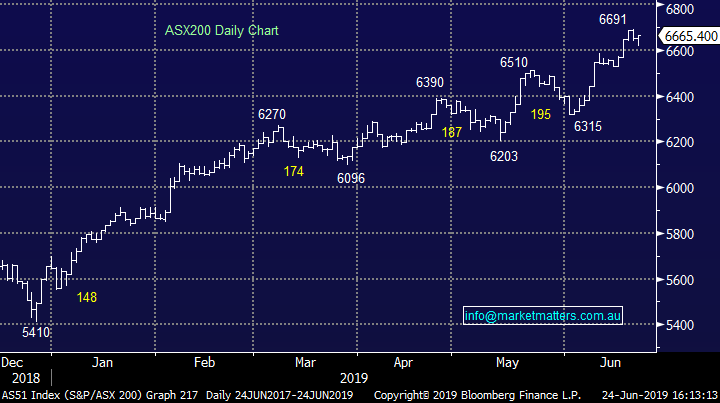

AP Eagers (APE) -2.86%; ACCC threw a little spanner in the works between the merger of AP Eagers (APE) and Automotive Holdings (AHG) today, with both stocks closing lower as a result. The car dealership names have been in talks since early April to combine the businesses but cold water was poured on the deal with concerns being raised about the competition, particularly in the Hunter Valley region of NSW. Combined, the business would own 90% of dealerships in Newcastle, and nearly 80% in the wider Hunter Region. While not ideal, the ACCC comments do leave the door open – they will likely recommend a divestment of some of the sites to ease concerns.

AP Eagers (APE) Chart

Broker moves;

- Nanosonics Rated New Buy at UBS; PT A$6.30

- Telstra Upgraded to Neutral at Macquarie; PT A$3.75

- Domino’s Pizza Enterprises Upgraded to Buy at Citi; PT A$44

- Santos Downgraded to Hold at Morningstar

- G8 Education Upgraded to Buy at Morningstar

- Flight Centre Upgraded to Hold at Morningstar

- MC Mining Reinstated at Mirabaud Securities With Buy

- Johns Lyng Rated New Buy at Goldman; PT A$1.70

OUR CALLS

No changes today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.