The ASX tests 10-year highs (WOW, VOC, EHL)

WHAT MATTERED TODAY

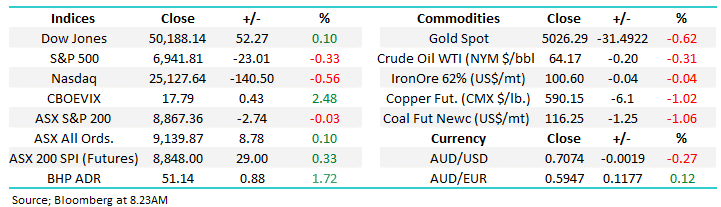

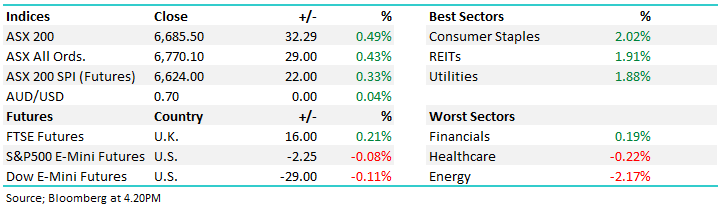

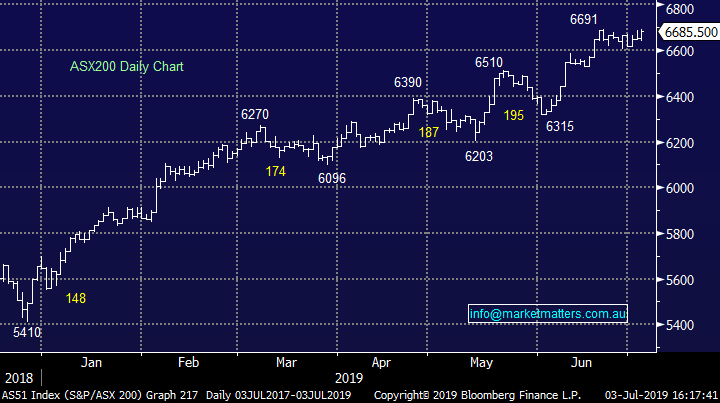

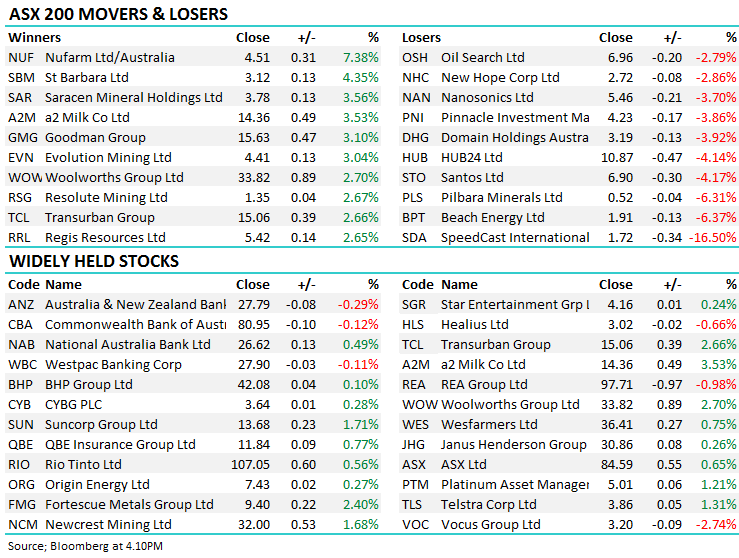

The local market had another crack at new highs today, setting a new intraday high at 6692 before setting at 6685, a tickle below the 10-year high set about a fortnight ago at 6687. The resources were supported early – iron ore continued its rally overnight, and gold joined the party as well. Oil, and subsequently the energy names, were left behind today after Brent dropped 4% overnight on an OPEC meet which left oil traders fearing a demand slowdown with global growth stumbling.

The banks also saw selling continue after yesterday’s rates decision left investors fearing margin squeeze. Each of the banks passed on the bulk of the cut and now the discussion turns to the big 4’s ability to recoup the lost income for their loan books. Consumer staples rallied on the move by Woolworths to spin off their liquor and hotels business, while REITs and Utilities were strong as investors chase yields in equities.

Economic data today was more positive than it has been. Building approvals were down 19% yoy, however this is a big recovery from last month’s -24% decline and was actually a +0.7% improvement month on month. Trade balance was also better than expected, coming in with a $5.7b surplus vs $5.2bn estimates. The beat was driven by Australia’s biggest export with the rally iron ore prices continuing to lift the surplus.

Overall, the ASX 200 added +32 points today or +0.49% to 6685. Dow Futures are trading down -29pts/ -0.11%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Woolworths (WOW) +2.7%: rallied following the announcement they will combine the Endeavour Drinks and ALH Group into Endeavour before separating the businesses next year. A demerger has been touted if Woolworths don’t receive a competitive offer to sell what will become Australia’s biggest hospitality business. The move has been long rumored with many in the market particularly keen on seeing the pokies business moved off the groups books, seen as a stain on the ethical standards of the company. Today’s move in the share price does show how keen investors are to have pure exposure to the hospitality side of the business, given it has revenue of $10bn at 10% EBITDA margins, it’s easy to see why. The group will run 327 hotels with over 12,000 pokie licenses, and over 1,500 liquor stores.

The end result will leave Woolies and Big W under the Woolworth’s brand with the company looking to focus its strategy while stripping costs out of the business. We aren’t looking for exposure to the Australian consumer at this stage which is still under pressure despite low unemployment and low interest rates.

Woolworths (WOW) Chart

Vocus (VOC) –2.74%; fell on a soft FY20 outlook today, with the company flagging no growth over the current financial year to target $350m-$370m next year – around 5% to midpoint below the consensus EBITDA of $378m. The company did manage to maintain guidance for this year after many in the market feared a big miss heading into the result given two potential suitors for the telco had recently walked from takeover talks without offering a formal bid. The flat guidance shows the turnaround story seems to be taking a little longer than expect, leaving investors with a sour taste given the rose-coloured outlook the CEO had previously given. The company expects the retail market to see continued pressure, while the core network and cables business is expected to grow modestly. We continue to remain wary of Vocus.

Vocus (VOC) Chart

Broker moves; despite DB launching coverage on Emeco (EHL) with a buy, the stock failed to get off the ground today, closing down -0.48%. The main thesis for the analysts positive recommendation is some decent tailwinds out of the mining space – something MM has been banging the table on since purchasing Emeco. We like the stock, and continue to hold it into the result – the next catalyst will be the full year result where a meet should be enough for the stock to rally after missing 6 out of their last 7 results.

- AGL Energy Upgraded to Neutral at Credit Suisse; PT A$19.20

- Appen Upgraded to Outperform at RBC; PT A$34

- Origin Energy Upgraded to Outperform at Credit Suisse; PT A$8.50

- SpeedCast Downgraded to Hold at Baillieu Ltd; PT A$2.30

- SpeedCast Upgraded to Neutral at Macquarie; PT A$2.25

- Domain Holdings Rated New Sell at Deutsche Bank; PT A$2.70

- Seek Rated New Hold at Deutsche Bank; PT A$21.30

- Carsales.com Rated New Buy at Deutsche Bank; PT A$15.40

- REA Group Rated New Sell at Deutsche Bank; PT A$83

- Emeco Rated New Buy at Deutsche Bank; PT A$2.70

OUR CALLS

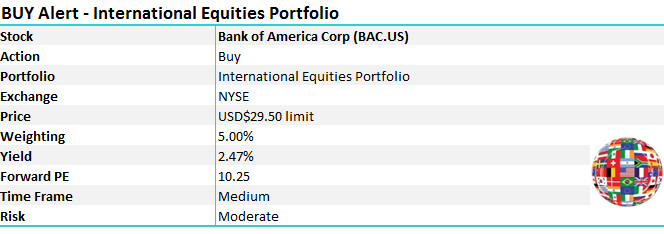

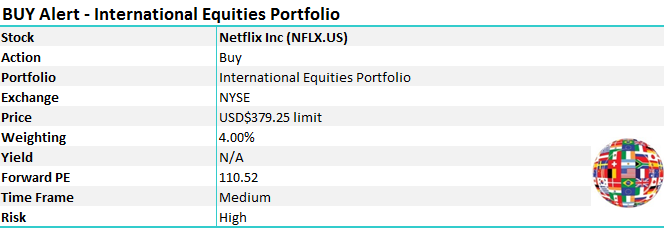

Today we added Samsung to the MM International Equities portfolio during the Asian time zone while we are adding both Netflix & Bank of America to the international Equities Portfolio this evening on the US open, assuming limit prices outlined below are achieved.

The MM Global Portfolio will be updated tomorrow.

No trades across the domestic portfolios today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 3/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.