Will Santos bid for Oil Search? (OSH, STO, NEA)

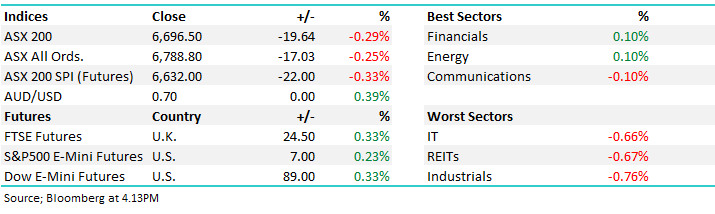

WHAT MATTERED TODAY

Another day where the market ebbed and flowed in a reasonable range, typical of a low volume ‘school holiday’ sort of session. Not a lot happening across the desk today in terms of volumes however there was a couple of interesting stock moves that played out. We covered Energy / Oil prices in the AM report today highlighting that crude oil prices bottomed in mid-June and Wednesday’s sharp 4.3% kick higher is a reasonably bullish sign, not only for oil but also for bond yields. Historically when crude oil rises US bond yields follow suit although there’s usually a lag while investors take their time to become convinced that oils rally is real / sustainable.

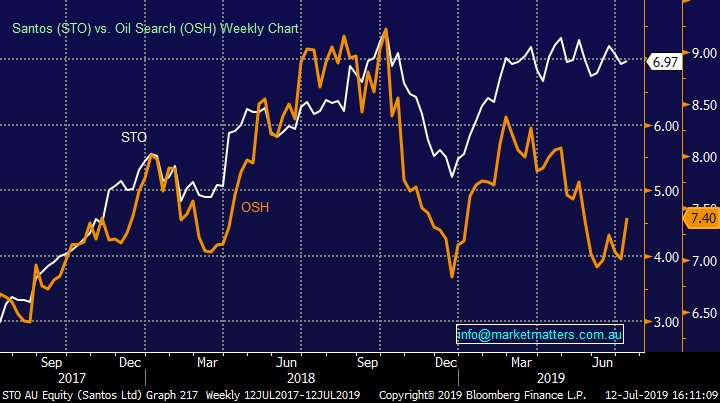

Oil Search (OSH) +3.5% was one of those stocks in focus today on reports that Santos (STO) could be considering a takeover bid for the company. No sources were really given and both companies denied the rumors however it makes sense given the relative outperformance of STO v OSH over the past 12 months - if it’s a scrip deal. Oil Search has been hit by political uncertainty in Papua New Guinea, where the bulk of its operations are, and the expected departure of its long-standing Managing Director Peter Botten while STO is looking for growth opportunities. OSH is capped at$11bn, STO at $14bn while WPL remains dominant at $34bn

Oil Search (OSH) v Santos (STO)

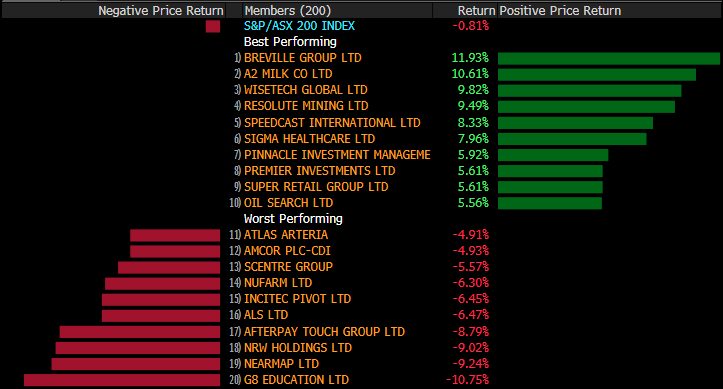

Aerial mapping business NearMap (NEA) was also one of the movers today down by ~9% at the close however they traded in a big ~15% trading range. They were out with some prelimiary numbers that hit the high notes on first read through however they were clearly helped by a depreciating AUD which juiced up their growth numbers. A stock on a huge mutiple, and management clearly conscious of delivering big growth to justify it, but the underlying numbers today weren’t as upbeat as the headlines imply + they also changed accounting standards to throw more complexity into the mix. It’s obviosly been a wionderful performer however this is the type of stock we’re avoiding at this jucture.

Nearmap (NEA) Chart

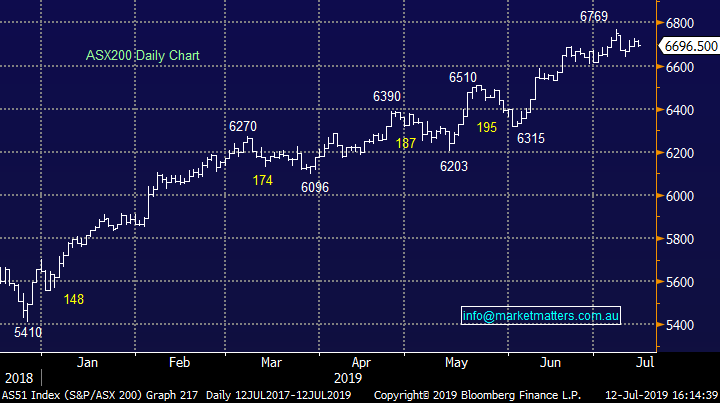

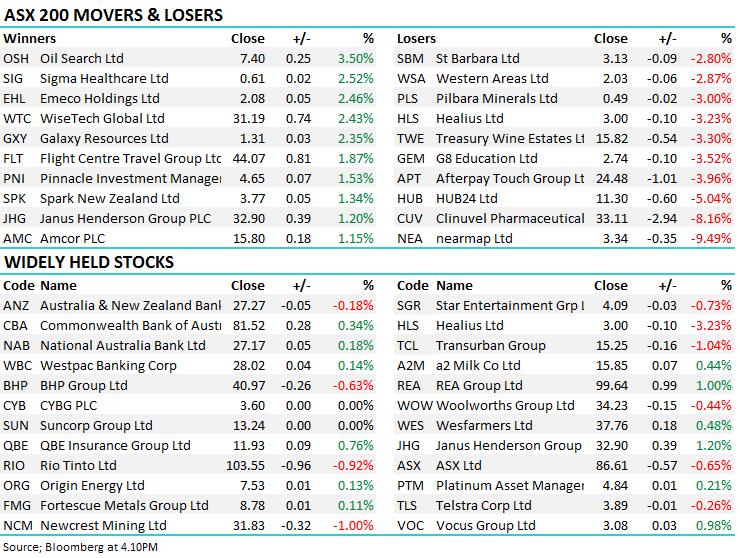

Overall today, the ASX 200 closed down -19pts or -0.29% at 6696. Dow Futures are trading up +89 points or 0.33%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE:

Sectors this week:

Stocks this week:

Broker Moves;

· BHP Group PLC Upgraded to Neutral at JPMorgan; PT 20.70 Pounds

· Santos Upgraded to Outperform at Macquarie; PT A$8.20

· G8 Education Downgraded to Hold at Canaccord; PT A$2.80

· Newcrest Downgraded to Hold at Shaw and Partners; PT A$28.70

· Evolution Downgraded to Hold at Shaw and Partners; PT A$3.90

OUR CALLS

No changes today across the portfolios.

Watch out for the weekend report. Have a great night,

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.