China signals its ready to play hardball (OSH)

WHAT MATTERED TODAY

A day where volatility kicked hard and we saw broad based selling across local and international markets – the catalyst / straw that broke the proverbial back was an escalation in trade tensions between China and the US – Bloomberg put it best by saying…after trying to placate Donald Trump for more than a year only to face tariffs on virtually all its shipments to the U.S., China is signaling it’s ready to play hardball!

The attack came on two fronts with Beijing allowing the yuan to fall to its weakest level in a decade against the dollar, which is supportive of Chinese exports + they also instructed their state owned companies to hold back on buying U.S. agricultural products – two things that look very much like a red flag to the proverbial Trump Bull – the obvious thought is around Trump retaliation tonight.

Looking at regional performances, Asian markets were down – Hong Kong the worst of them off by ~2.5% as political unrest bubbled again while Japan was down ~1.7%, China was okay down by ~1%. US Futures were flat around our open this morning however as the day progressed they tracked lower, Dow Futures down ~300pts at their worst settling down ~250pts / -1% at our close.

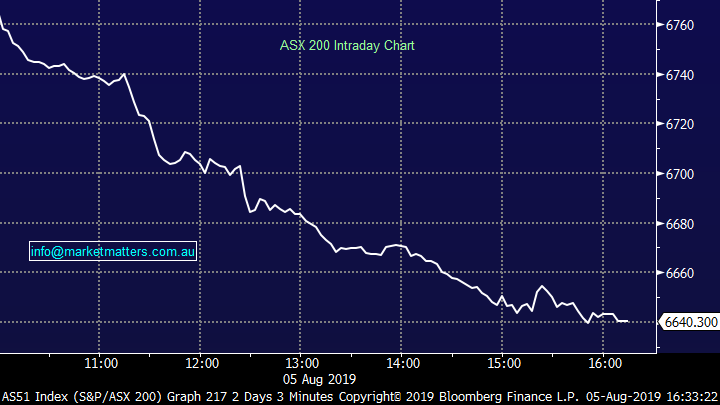

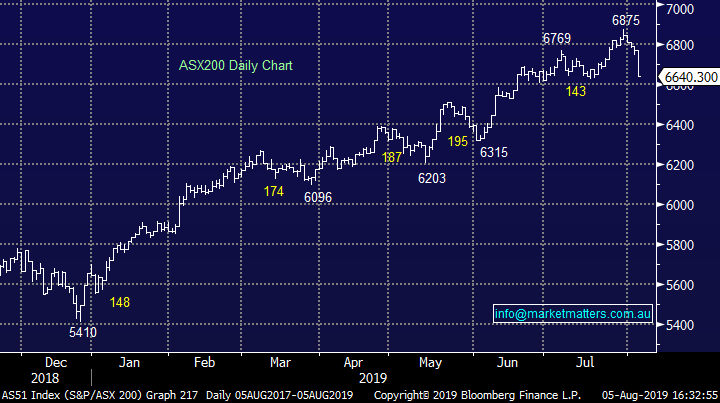

Australian stocks played catchup on the downside after outperforming last week, down ~2% with selling strong across the board. More in First Reactions below.

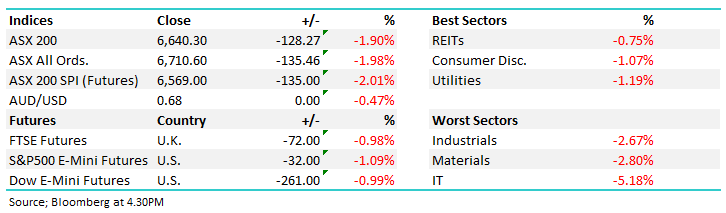

Overall, the ASX 200 lost -128pts today or -1.90% to 6640. Dow Futures are trading down -250pts /- 0.95%.

ASX 200 Chart – sustained selling throughout the session

ASX 200 Chart

CATCHING OUR EYE;

Reporting: No company reports out today given it was a bank holiday however we have 3 property stocks out tomorrow with BWP, SCP & CMA before it heats up on Wednesday and Thursday. Wednesday see’s CBA, SUN & TCL while on Thursday, AGL, AMP, IAG & MGR are all out with results.

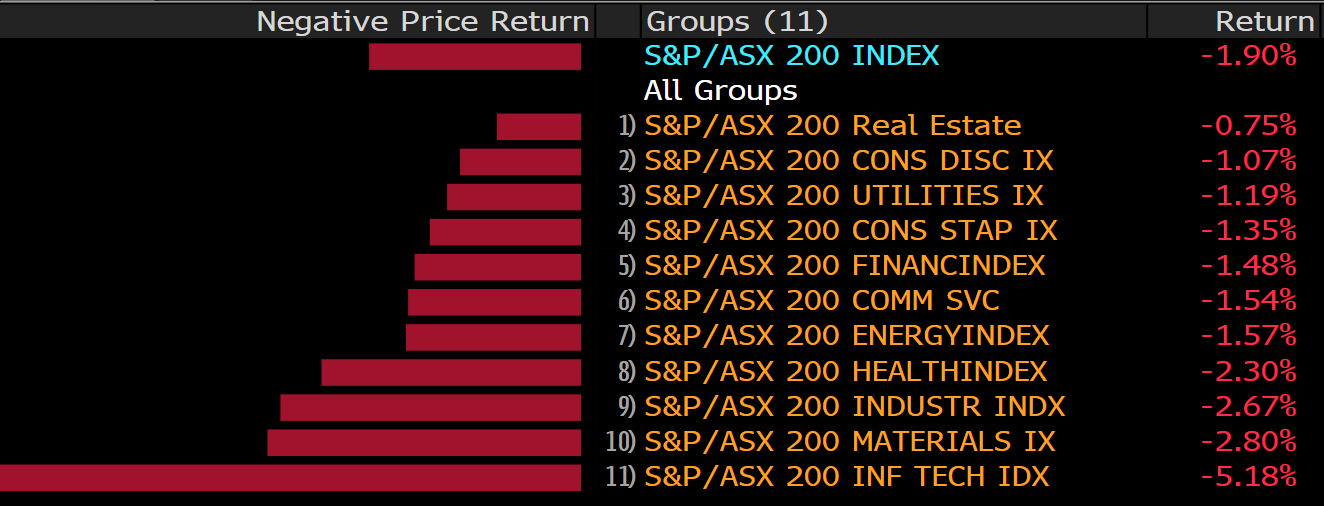

Widespread risk off: Sustained and broad based selling across the board today – no sectors closing in the black – the high flying sectors of recent times hit the hardest and none more so than the IT stocks – down 5% at the index level however there was a number of stocks hit harder, Appen (APX) the worst of them down by 10.61%.

Appen (APX) Chart

Oil Search (OSH) +2.88%; On a more positive note, one of the better movers today was energy company Oil Search, leaving its peers behind. Oil Search had recently been dealing with some push back from the PNG government over the agreed upon tax and royalty schemes that were negotiated with the previous government. The newly elected group had seemed intent on including additional fiscal terms in the Oil Search agreement, raising questions over their LNG expansion in the area. Today the company announced the PNG cabinet had agreed in principle to stand by the current arrangement helping to lift some weight off the OSH share price. The project remains years away with full scale production not expected until 2026, however it does justify up to a third of Oil Search’s value.

Oil Search (OSH) Chart

Broker moves;

- Australian Dairy Nutriti Rated New Buy at Blue Ocean; PT A$0.18

- Western Areas Upgraded to Buy at Bell Potter; PT A$2.74

- Sims Metal Downgraded to Neutral at Macquarie; PT A$11.60

- Saracen Mineral Downgraded to Neutral at Hartleys Ltd; PT A$4.14

- Independence Group Cut to Neutral at Hartleys Ltd; PT A$4

OUR CALLS

We added Rio to the Growth Portfolio this afternoon after the Iron ore miner was hit hard on the back of China / US trade tensions that have the capacity to hurt global growth…We’d written about the sub $92 target for some time and today the stock arrived. We took a 3% position as a start and will look to average in time. RIO goes ex-dividend for ~$3.07 fully franked on the 8th August, representing a 4.7% yield for the half (grossed for franking)

Rio Tinto (RIO) Chart

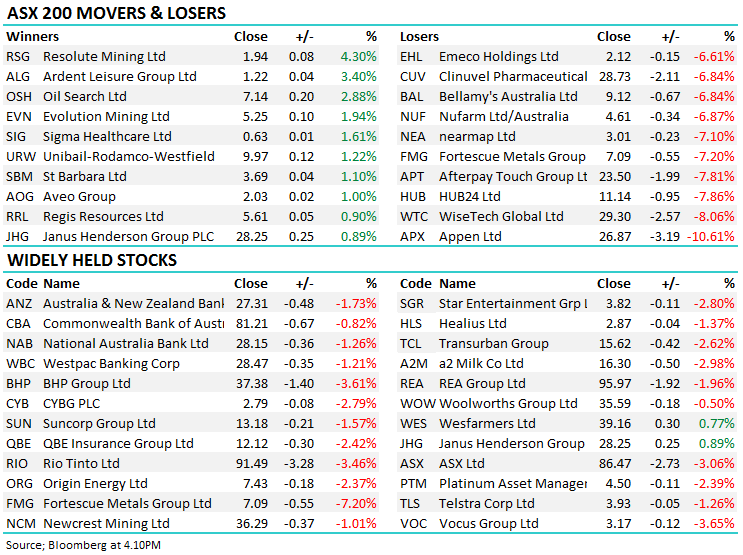

Major Movers Today

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence