ASX up but off session highs – go the Sea Eagles!

WHAT MATTERED TODAY

A big week comes to a close with a weekend filled with footy headlined tonight with the Mighty Sea Eagles taking on Souths, while I’m not trekking out to ANZ Stadium like a true supporter (not many from the insular north do) I’ll be in front of the screen...then of course the Wallabies kick off their World Cup campaign tomorrow at 2.45pm.

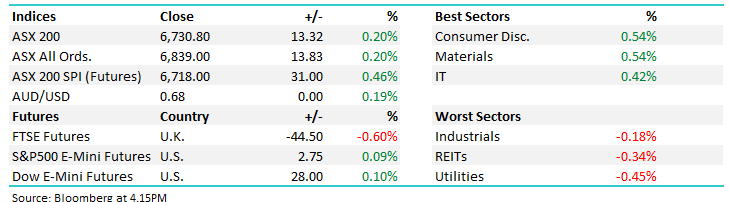

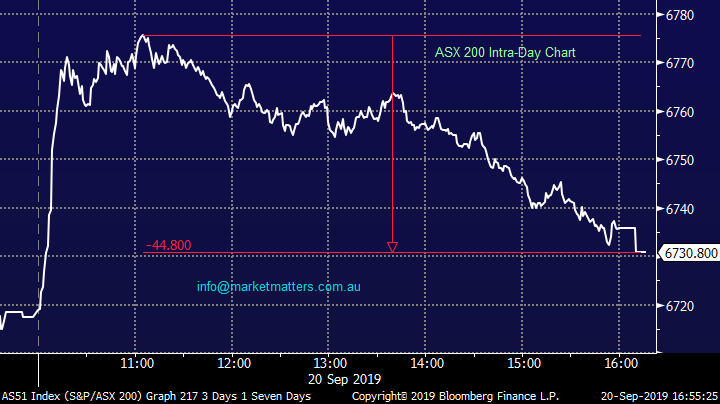

The market peaked early again today with the index ripping up into an 11am high as what looked like a decent size program buying of futures which flowed through to stocks. The buying picks up when the AUD pulls back and vice versa, overseas money drifting towards the region that is more likely to cut interest rates by the look of it. These sort of moves are often transient, they last for days rather than weeks. It’s been a theme the last few sessions which have been stronger than the overseas markets implied. Anyway, they were back at it this morning before the market drifted away into the close – finishing on session lows.

While our ‘gut feel’ is the local market is losing steam, no sell signals have been generated for now – although the weak close today with the index finishing -45pts from the high is a bearish indicator. We’ve turned our portfolios more defensively into the recent strength – increased cash + defensive positions like Gold – Evolution (EVN) and Newcrest (NCM) in the Growth Portfolio, both doing well today adding +2.8% & 2.3% respectively .

Asian markets were quiet today, ditto for US Futures which were marginally higher through our time zone. After a week where Central Banks / Monetary policy has been front and centre, the focus will switch back to trade next week with the trade deputies from the US & China set to meet. I have the feeling that a trade resolution will be a buy the rumour, sell the fact sort of scenario, but time will tell.

Overall today, the ASX 200 closed up +13pts or +0.20% to 6730. Dow Futures are trading up +24 points or +0.09%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE:

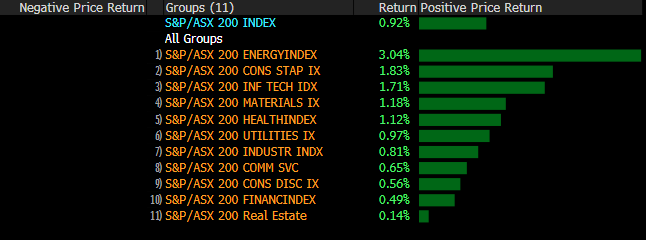

Sectors this week: Energy down from earlier highs this week however some optimism still being priced for tighter supply. All sectors closed higher this week while the index added +0.92%

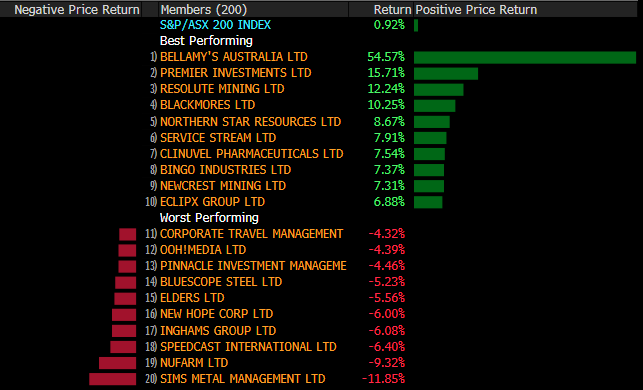

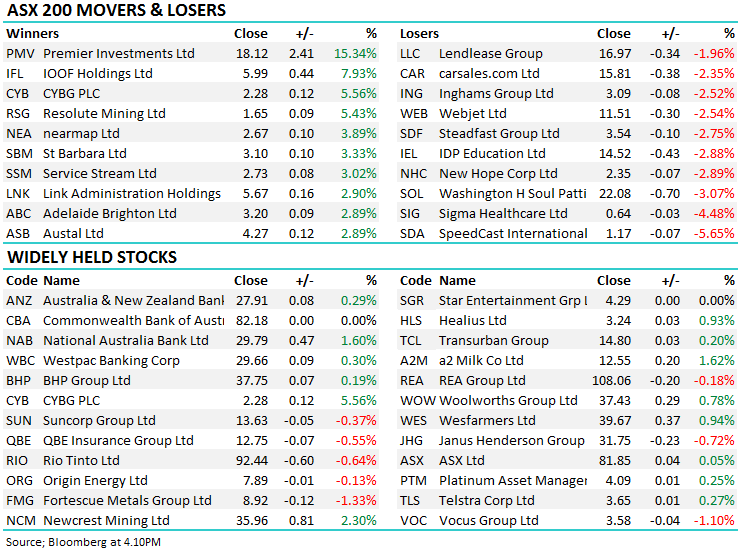

Stocks this week: Bellamy’s bid, Premier Investments (PMV) delivered strong results today thanks to Smiggle, while the Gold stocks found form. Bingo (BIN) remains on our radar to re-enter but we’re remaining patient for now – they had a good week adding +7% . The main risk ahead being their AGM in November where they’ll provide FY20 guidance.

Broker Moves; We have a new property analyst at Shaw & Partners and she’s just initiated on Goodman (GMG) with a BUY. I’ll try and have a chat on camera with Peter O’Connor next week around resources.

· GMG AU: Goodman Group Reinstated Buy at Shaw and Partners; PT A$15.25

· OZL AU: OZ Minerals Downgraded to Hold at Morningstar

· RBL AU: Redbubble Upgraded to Buy at Goldman; PT A$1.65

OUR CALLS

No changes today

Watch out for the weekend report.

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.