ANZ misses the mark – drags the banking sector lower (ANZ, ILU)

WHAT MATTERED TODAY

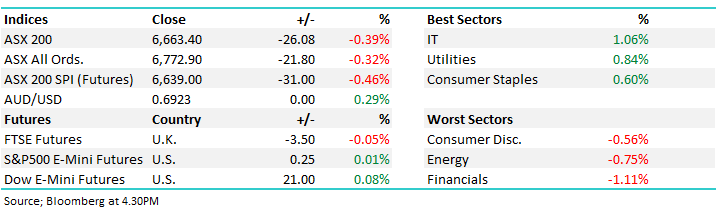

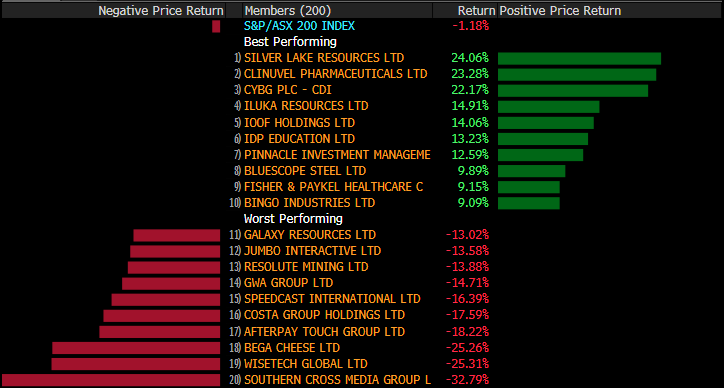

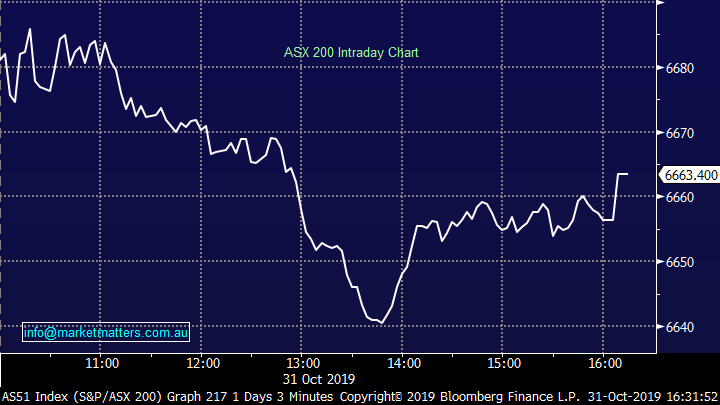

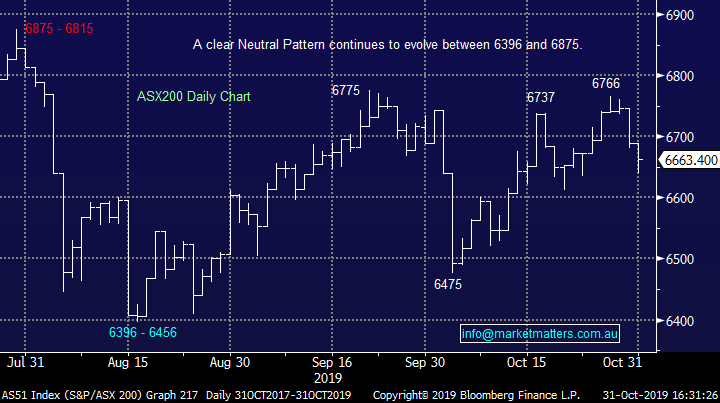

The final trading day of October was a another negative one for the ASX capping off a negative month overall for the market with the ASX 200 down -1.18%. Today it was a weak earnings result from ANZ and surprise cut to the amount at which they’ll frank their dividend, more on this below however the stock ended down -3.26% to $26.74 to be the biggest index drag. The other banks were also down, although less so than ANZ, CBA-1.26%, NAB -1.11% & WBC off -1.19% + they did recover from session lows by the close of trade. There’s no sugar coating the result from ANZ today, it was weak on a number of levels and should provide the basis for underperformance for ANZ in the short term.

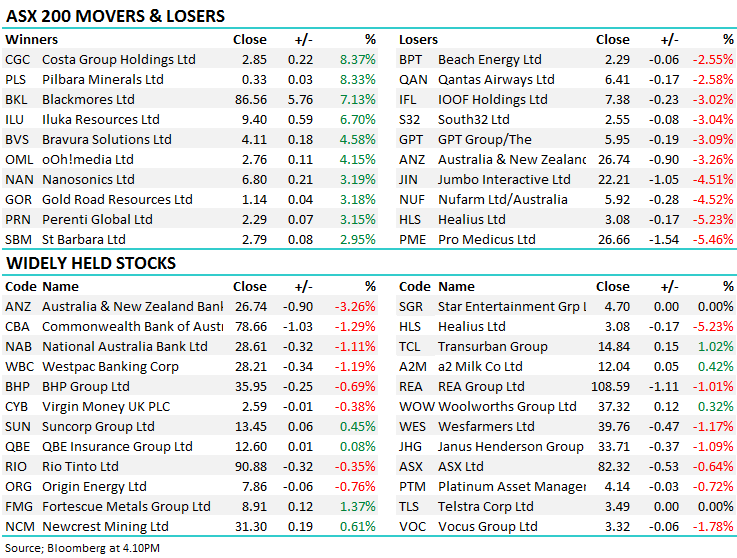

On the flipside today, the IT stocks were well bid in a soft market while our recent nemesis Costa (CGC) rallied by +8.37% to close at $2.85 today as we saw some good buying across the session, looked to be strong institutional interest – the rights (CGCR) also closed today at 67c.

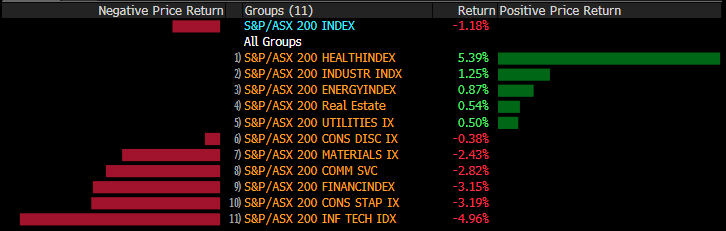

End of month stats - sectors: At a sector level for the month of October, Healthcare was again strong while the IT stocks lagged. The ASX 200 index fell by -1.18%.

End of month stats - stocks: Wisetech (WTC) fell from grace over the month however there was also some wreckage across other names in that area, Afterpay (APT) + Jumbo( JIN) also feeling some heat. Of stocks we hold, Bluescope (BSL) did well.

Overall today, the ASX 200 closed down -26pts to 6663, Dow Futures are trading up +21pts / +0.08%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

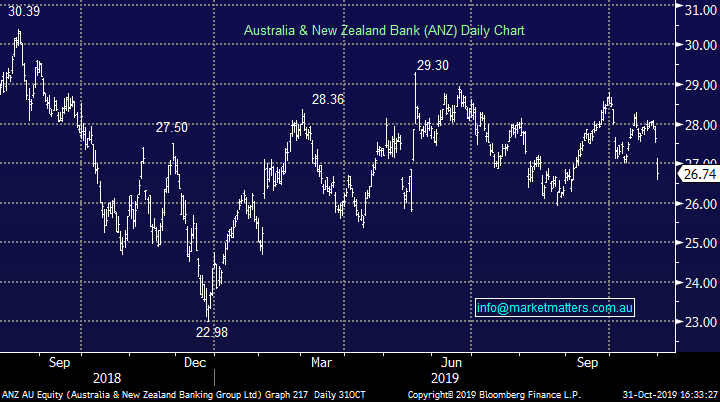

ANZ Bank (ANZ) -3.26%; the first of the banks to report this season and it certainly didn’t set the bar high.Net Interest Margin (NIM) decline accelerated in the second half, with the margin dropping 8bps as a result of increasing customer remediation as well as funding costs falling at a slower rate to lending rates. Income fell 1% as the home loan book struggles, and expenses rose 2% with compliance costs continuing to bite. There were some signs of life with the business lending growth of 10% in 6 months (if you need a business loan – go to ANZ for approval by the look!!) however this also drags NIM given the tighter market. Bad debts were flat half on half, however this masks rising past due loans in a sign credit is starting to be squeezed.

All this added up to a 5% fall in profit in the half, and a soft result. ANZ were able to keep their dividend however they did have to drop the franking amount to just 70% - the first time a dividend from ANZ wasn’t fully franked this millennium. A soft result, and rightfully hit on the back of it. Other banks were sold off however the main issues here are ANZ specific. Our ANZ position will likely be cut.

ANZ Bank (ANZ) Chart

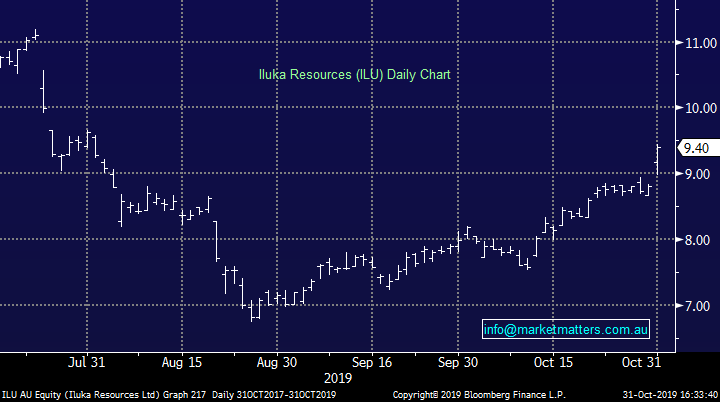

Iluka (ILU) +6.7%; shares were higher on the release of their 3rd quarter production report as well as announcing a review into the business. Iluka’s main operations in zircon and rutile continue to track well with production substantially higher than the previous quarter. The mineral sands, a group of key ingredients in tile manufacturing, market has been mixed however, but Iluka has been keeping a lid on costs helping sustain margins at this point. More relevant to today’s move however is the announcement the company will review its iron ore royalties. Iluka currently receive 1.232% of sales out of a BHP run iron ore mine South Flank. Production at the mine has been steadily increasing over recent years and BHP has now guided capacity higher from 2023 as the development continues, expecting a minimum yield of 135mtpa from 2023 onwards, up from ~55mtpa.

Iluka received $41m in the first half as a result of the royalties and even with factoring in a lower iron ore price in outer years, the royalties could be yielding a solid $100m+ a year. Today the company announced a review into the handling of the money from BHP with a number of options being assessed including a potential spin off sale. We have traded Iluka well in the past, however we’re not on this current move – one we have on the radar for weakness.

Iluka (ILU) Chart

Broker moves;

· Kiwi Property Cut to Underperform at Jarden Securities

· Codan Cut to Hold at Moelis & Company; PT A$6.40

· Codan Raised to Buy at Canaccord; PT A$6.70

· Costa Cut to Underweight at Wilsons; PT A$1.88

· Xero Rated New Outperform at RBC; PT A$80

· AGL Energy Raised to Hold at Morgans Financial Limited

OUR CALLS

No changes today, however we are likely to switch our ANZ holding to WBC & NAB. Watch for alerts

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.