Stocks rebound from early weakness (MQG)

WHAT MATTERED TODAY

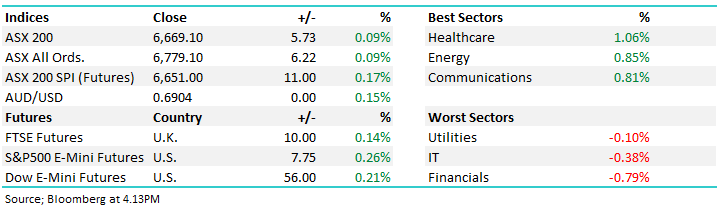

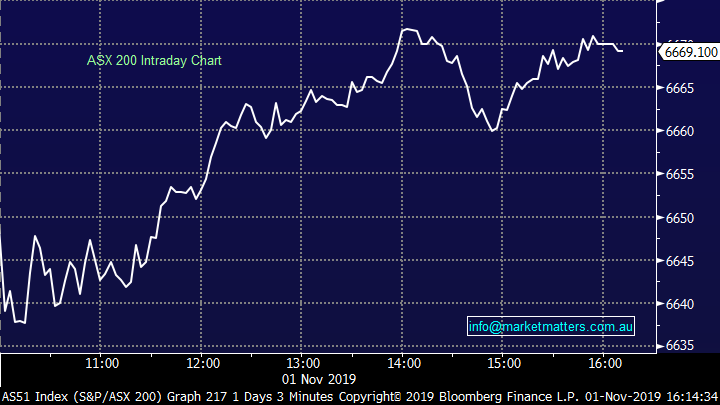

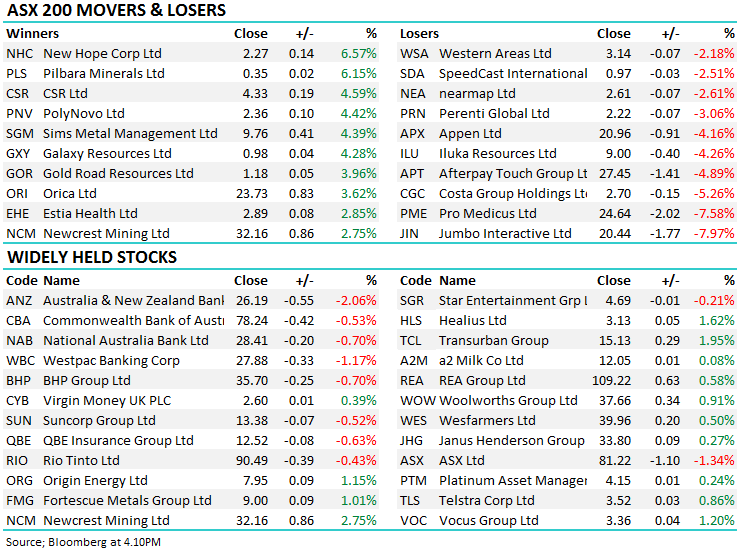

After opening lower this morning , the market chopped around in a tight range till around 11am before finding its mojo and rallying strongly in the afternoon session to cap off a fairly volatile week for equities. As a sector level, the banks were again under pressure with ANZ leading the weakness as the cut to franking credits worked though the market….we had the CFO from ANZ in this morning however we maintain the view that ANZ will now underperform the others from here – of course, WBC reports on Monday which is the variable. Today we saw ANZ down -2.06%, CBA off by 0.53%, NAB off -0.70% while Westpac fell by -1.17%.

Overall, the ASX 200 closed up +5 or +0.09 % today to 6669, Dow Futures are trading up +56pts /+0.21%

ASX 200 Chart

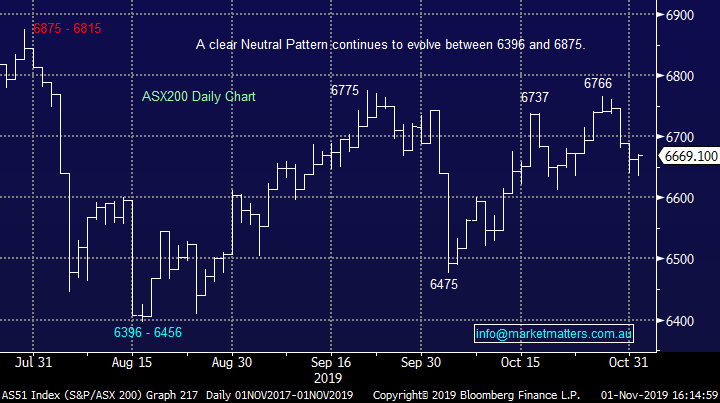

ASX 200 Chart

CATCHING MY EYE;

Macquarie Bank (MQG) 0.34%; traded lower this morning before pegging much of the loseesas the session rolled on as the bank announced first half number pre market. The numbers were mixed with growth of 11% vs the 1st half of 18 coming in slightly ahead of guidance of 10%. The result was a touch low on quality however with a falling tax rate bolstering the beat. Income was up 8% while expenses grew 9% but despite the 11% growth in the first half, Macquarie are still guiding to a slight decline in profit for the full year. The dividend also grew, up 16% to $2.50 a share at 40% franking. We like MQG into further weakness

Macquarie (MQG) Chart

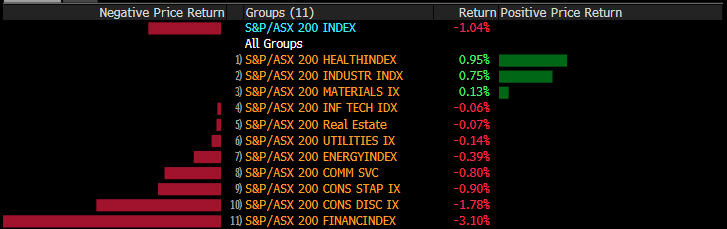

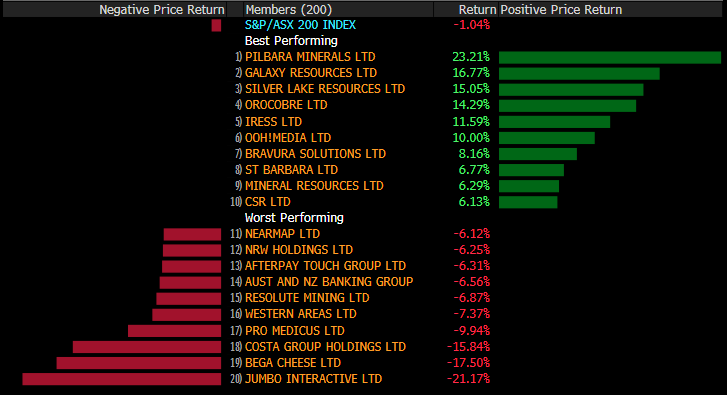

Sectors this week:

Stocks this week:

BROKER MOVES;

· Adelaide Brighton Raised to Neutral at UBS; PT A$3

· Regis Resources Raised to Add at Morgans Financial Limited

· Regis Healthcare Cut to Neutral at JPMorgan; PT A$3.15

· Japara Cut to Underweight at JPMorgan; PT A$1

· Vocus Raised to Hold at Morningstar

· Iluka Cut to Hold at Morningstar

· REA Group Rated New Hold at Jefferies; PT A$107.78

· Seek Rated New Hold at Jefferies; PT A$24.52

· Carsales.com Rated New Buy at Jefferies; PT A$18.06

· Domain Holdings Rated New Hold at Jefferies; PT A$3.53

· ANZ Bank Rated New Underperform at Jefferies; PT A$23.60

· ANZ Bank Cut to Underperform at CLSA

· ANZ Bank Cut to Hold at Bell Potter; PT A$28

· Blackmores Cut to Underperform at Credit Suisse; PT A$69

· Scentre Group Raised to Overweight at JPMorgan; PT A$4.20

· Vicinity Centres Cut to Neutral at JPMorgan; PT A$2.80

· Avita Medical Raised to Speculative Buy at Bell Potter

· Caltex Australia Rated New Outperform at RBC; PT A$32

OUR CALLS

We sold ANZ and switched into NAB & WBC today in the Growth Portfolio. We also switched from ANZ into WBC in the Income Portfolio.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.