Prospa – anything but today (PGL, APX, SIQ)

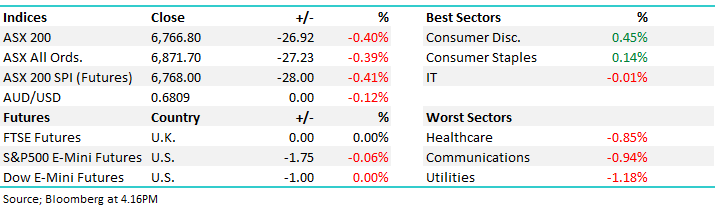

WHAT MATTERED TODAY

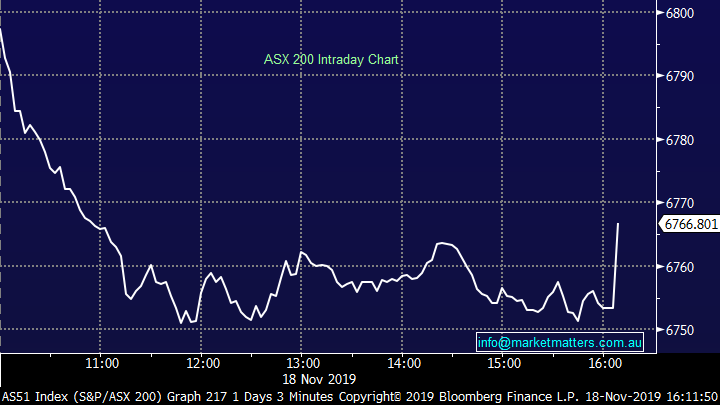

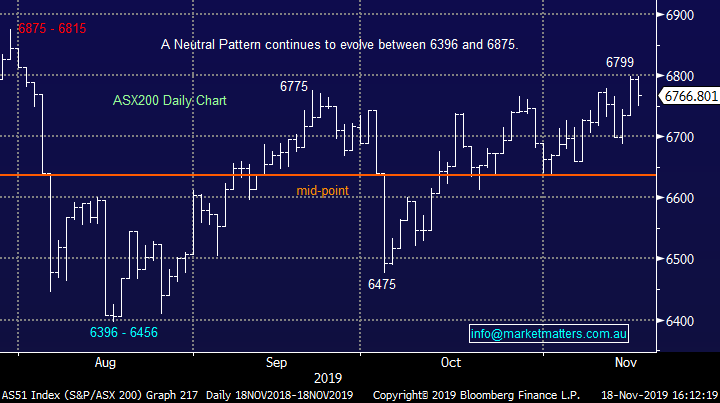

A weaker day than the futures traders were predicting this morning with the market opening around par before selling off into a midday low. While the selling lacked any real fortitude this choppy range bound market continues, strength is being sold but no one seems prepared to shuffle out of stocks into weakness. The market will break this range at some point - it seems to MM that the break will happen on the upside however second guessing the market at the index level in recent times has left plenty of egg on a few faces, ours included.

US Futures were quiet during our time zone today while Asian markets traded higher, the Hong Kong based Hang Seng bounced 1% after a torrid time of late. At a sector level, the retailers were strong thanks to a +5% move by Coca-Cola (CCL) on two broker upgrades while the Utility sector was the main drag.

Overall, the ASX 200 fell -26pts/-0.40% today to close at 6766. Dow Futures are trading flat

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Prospa (PGL) –27.46%; one of the biggest deals for the ASX in 2019 saw its shares tank today on news it had missed prospectus forecasts. Prospa, the small to medium business lending specialist, revised its FY20 guidance lower blaming a premiumisation of the loan book for falling net interest income after losses. Originations were marginally better than what was posted in the offer document, but the interest rate missed markedly, coming in at 19.2% vs 19.7% advertised. As a result, EBITDA is expected to come in at $4m for the calendar year, vs $10.6m. Shares were sent to a 52-week low – or at least a new low 25-weeks after listing – as a result of the announcement but the company tried to cosy up to investors by pitching the longer term opportunity of this more ‘premium’ loan book.

The CEO Greg Moshal had this to say, “While we are experiencing some short term impacts on our forecasts, we’re confident we have the right growth strategies to deliver long term shareholder value and solve the funding challenges of small business owners across Australia and New Zealand.” Propsa’s market is high cost, higher risk lending and we would expect a declining loan book quality given the movements in the bank’s bad debt charges of late. Not one for us at this stage in the cycle.

We have no interest in PGL

Prospa (PGL) Chart

Appen (APX) +13.38%: Rocketed higher today after the company upgraded earnings guidance. They now expect full year EBITDA to be in the range of $96-$99m which is the above their previous guidance of the upper end of the $85-$90m. The market had oscillated to an expectation of ~$93m so today’s announcement equates to an upgrade versus consensus of around 5%. The language technology company’s stock was higher on open however the gains were added to throughout the day to close near session highs. APX is a net beneficiary of a lower Australian Dollar which has declined from around 74c 12 months ago. APX was on our radar below $20 however frustratingly we didn’t add it to the portfolio.

Appen (APX) Chart

Smartgroup (SIQ) -13.65%; provider of salary packaging, fleet management and a range of other employee management services, has seen its shares tumble on news the CEO Deven Billimoria would be leaving the company after 19 years with the group. The company confirmed today that Deven would exit the role in February next year but remain on the payroll as an advisor for another 12 months with another long standing employee, CFO Tim Looi, taking over the top job.

The announcement also came with FY19 NPATA guidance of circa $81m for the December year end which is bang in line with consensus expectations. The market’s concern here is not the company’s performance, or the replacement given Looi has spent 10years working with Deven, but the overhang of stock – Deven unlikely to hold shares, or at least such a significant portion, after his departure. Deven has accumulated shares over his time in charge and currently owns 3.3m, or 2.5% of the company making him the 6th largest shareholder - that’s a big overhang of stock potentially up for sale. We are pondering SIQ.

Smartgroup (SIQ) Chart

Broker moves;

· Virgin Australia Raised to Neutral at UBS

· AP Eagers Raised to Buy at Bell Potter; PT A$12

· Coca-Cola Amatil Raised to Neutral at Macquarie; PT A$11.20

· Coca-Cola Amatil Rated New Buy at Jefferies; PT A$12.10

· Qantas Raised to Outperform at Macquarie; PT A$7.90

· Bluescope Cut to Equal-Weight at Morgan Stanley; PT A$13.50

· Star Entertainment Rated New Sell at Citi; PT A$4.30

· Crown Resorts Rated New Neutral at Citi; PT A$12.80

· Independence Group Raised to Hold at Morningstar

· Metals X Cut to Neutral at Hartleys Ltd; PT 18 Australian cents

OUR CALLS

No trades across portfolio’s today

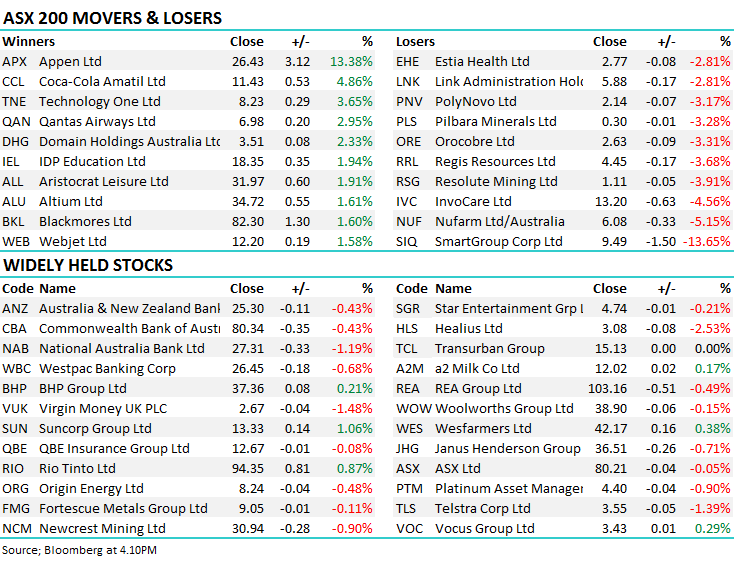

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.