Edging higher ahead of Thanksgiving (NWH, TLS)

WHAT MATTERED TODAY

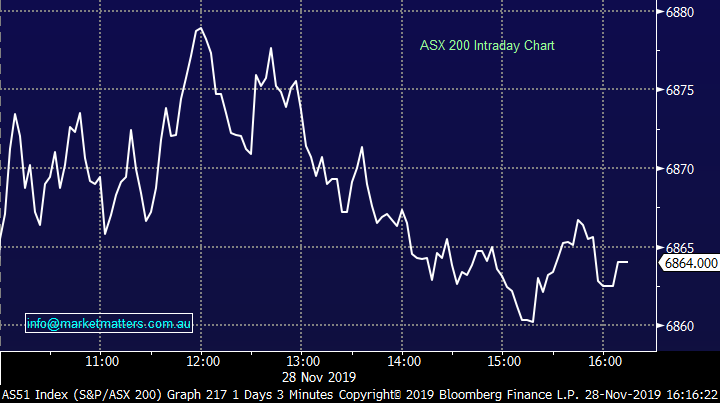

Stocks were strong again on open this morning trading up to a new all-time high for the ASX 200 of 6879 – marginally eclipsing the August milestone by 5pts, however given no US trade tonight (closed for Thanksgiving) and a quiet half day on Friday the market tapered off late in the session the to close more or less flat on the day, although 6864 represents a new closing all-time high – the most hated decade long bull continues!

Around the region today, Asian market were all lower but not by a lot while US Futures traded down during our time zone. On the sector front, the healthcare sector continued to fire as stalwarts CSL and Cochlear (COH) continued both hit all-time highs – CSL now closing on the $300 milestone.

Overall, the ASX 200 gained +13pts /+0.2% today to close at 6864. Dow Futures are trading lower by -82pts/-0.29%

ASX 200 Chart

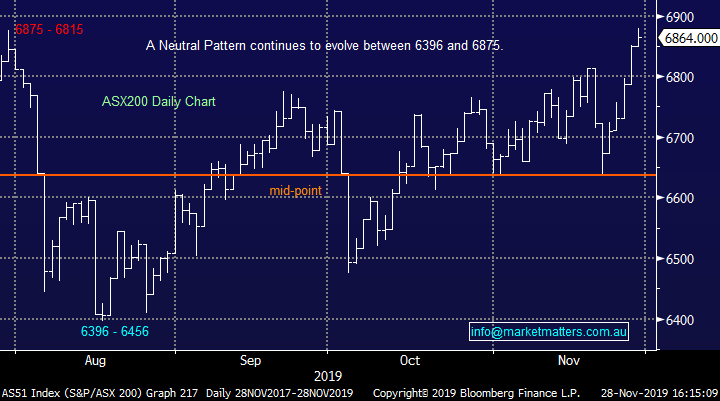

ASX 200 Chart

CATCHING OUR EYE

NRW Holdings (NWH) unch; the mining and construction services company spent the day in halt as it looks to raise money to fund the purchase of BGC Contracting. Not new news, with the deal in play for some time, but a deal we like for NWH, slotting in nicely alongside their current offerings and being touted as 14% EPS accretive pre-synergies. NWH are also very experienced in bringing in bolt on acquisitions including the purchase of RCR Tomlinson’s Mining and Heat Treatment businesses off administrators earlier this year one of a number of recent cash splashes.

NWH will pay a total of $310m for the businesses, but this includes taking on around $185m of debt, paying the remainder to the shareholders of BGC. They are paying a reasonable price and taking on some debt however the businesses is set to pay back a large portion of the costs in the first year. We own NWH in the Growth Portfolio, and at this stage will be applying for shares in the SPP launched alongside the institutional offer.

NRW Holdings (NWH) Chart

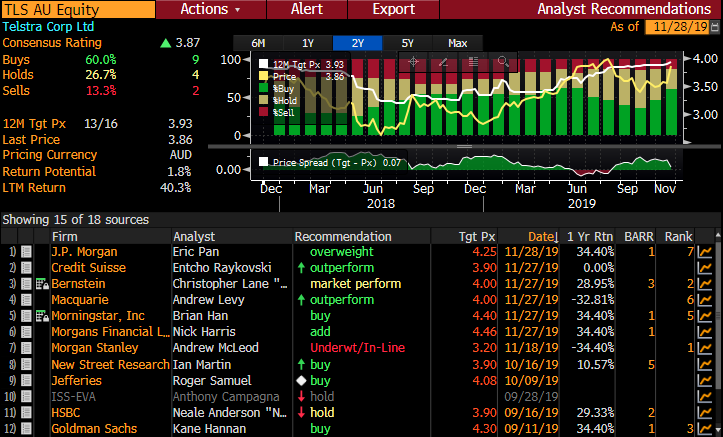

Telstra +4.04%: Not many sessions where TLS rallies +4% however today a rare day in the sun for Aussie telco following a string of broker upgrades. Macquarie increased their target to $4/sh with a reduction in longer-term capex estimates the main driver underpinning their increase of ~6%, Credit Suisse also sharing that view increasing their TP from $3.70 to $3.90 primarily driven by lower capex assumptions. JP Morgan retained their bullish view on the stock and kept a $4.25 target price.

Current Broker Calls on Telstra (TLS)

Source: Bloomberg

Telstra (TLS) Chart

Broker moves;

· Mineral Resources Resumed Outperform at Macquarie; PT A$20

· Collins Foods Cut to Neutral at UBS; PT A$10.60

· Collins Foods Cut to Sell at Canaccord; PT A$9.50

· Collins Foods Raised to Add at Morgans Financial Limited

· EBOS Raised to Buy at UBS; PT NZ$25.50

· Telstra Raised to Outperform at Macquarie; PT A$4

· Telstra Raised to Outperform at Credit Suisse; PT A$3.90

· Perpetual Cut to Underperform at Macquarie; PT A$35.50

· SCA Property Rated New Hold at Jefferies; PT A$2.63

· Vicinity Centres Rated New Hold at Jefferies; PT A$2.52

· Charter Hall Retail Rated New Buy at Jefferies; PT A$4.86

· GUD Holdings Cut to Market-Weight at Wilsons; PT A$11.05

· Soul Pattinson Cut to Sell at Morningstar

· Medical Developments Rated New Buy at Canaccord; PT A$8.70

· NextDC Rated New Buy at Jefferies; PT A$8.09

· Viva Energy REIT Rated New Neutral at Goldman; PT A$2.62

· Cleanaway Reinstated Buy at Goldman; PT A$2.30

· Home Consortium Rated New Neutral at Goldman; PT A$3.69

· Independence Group Cut to Hold at Shaw and Partners; PT A$5.90

OUR CALLS

No changes to the portfolios today.

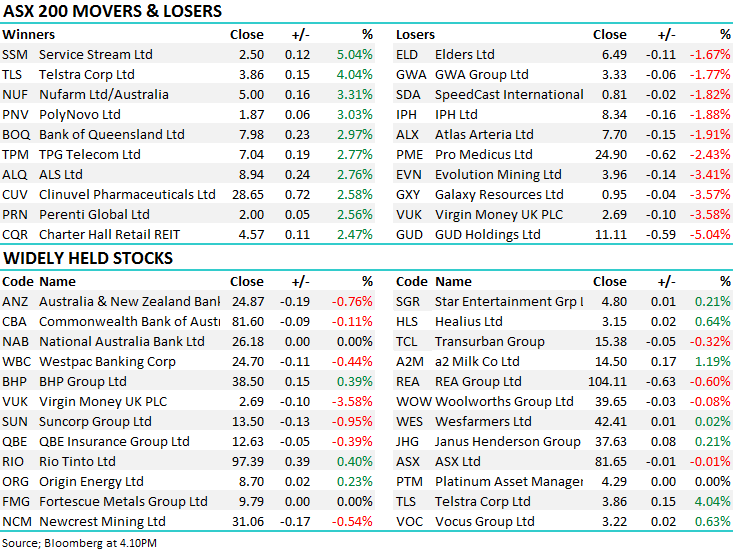

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.