Industrials, Energy take the ASX within a whisker of 7000 (RSG, PPT)

WHAT MATTERED TODAY

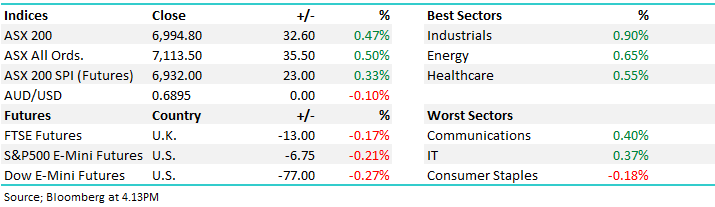

Another storming session for the ASX today with the 200 approaching the 7000 milestones, at its best today it got within 3.2 points with a high of 6996.8. Buying was more selective today however the stocks that saw a bid got a good run on, a number of which we hold across the MM Portfolios. Gold names were strong today playing some catch up with the Gold price after lagging recently while a number of deeper value stocks outperformed higher value growth. Long mining services and gold today = outperformance while some of the recently hot Lithium stocks gave back recent gains.

Overall, the ASX 200 added +32pts / +0.47% today to close at 6994. Dow Futures are trading marginally higher up by +18pts/+0.06%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Stocks running: Things catching the eye included Service Stream (SSM) which was up more than +4% today and looks strong. Fund Manager Naos named SSM as their No 1 pick for the year on Livewire at the start of Jan and that pick is looking good so far – we agree with the rationale and remain content holders. Other stocks in that same video were WISR (WZR) picked from Elley Grifiths, through Shaw we raised $30m for them yesterday in a placement that was massively oversubscribed, a speculative peer to peer lending business that looks good. EML Payments (EML) was named by QVG Capital, Nufarm (NUF) by Firetrail, City Chic (CCX) by Orphir and Bid energy (BID) by Centennial. Ben Clark from TMS is keen on Amazon overseas while Magellan tipped Alibaba which we hold in our international equities’ portfolio.

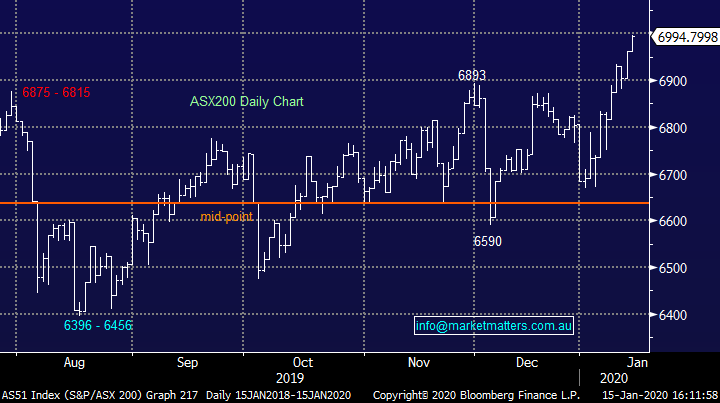

NRW Holdings (NWH) also strong today adding +4.32% as the capital raise is now complete, and the stock hit a new 8-year high today. We’re long and see further upside here.

NRW Holdings (NWH) Chart

Resolute Mining (RSG) +0.85%; traded higher today after confirming the sale of their Ravenswood mine in Queensland for $100m upfront, along with the potential for another $200m contingent to performance of the mine and medium-term gold prices. The sale has been speculated for some time with EMR Capital having exclusive negotiation rights with Resolute set to expire this afternoon. EMR just made cut off, securing the deal this morning and bringing in Singapore’s Golden Energy & Resource Ltd to finalize the offer. The deal relieves a bit of balance sheet stress for Resolute, owing having some leeway to drive growth in other projects. We prefer Newcrest for our gold exposure although we are sellers of strength.

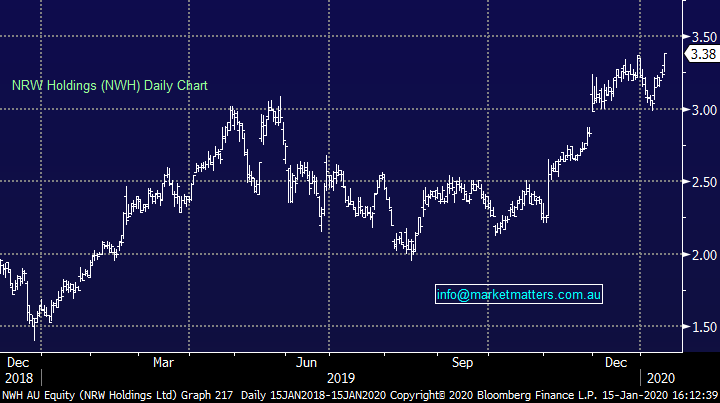

Resolute (RSG) Chart

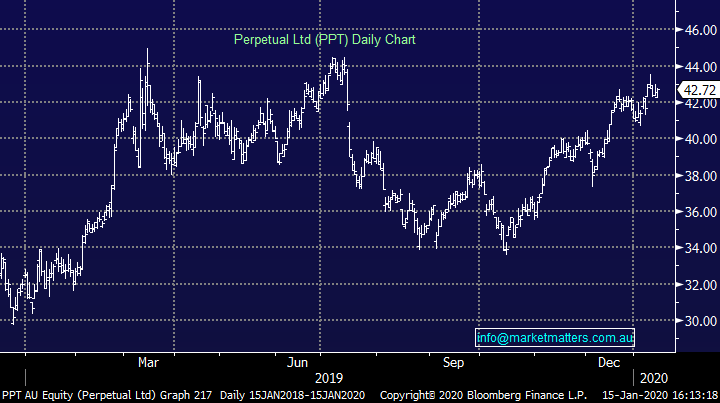

Perpetual (PPT) +0.35%; released Funds Under Management (FUM) for the quarter this morning with outflows in equities offset by inflows into fixed income products, all in all total FUM ended the month at $26.3b, an increase of $200m. Shares were higher today, but still underperformed the broader market which is uncharacteristic of how Perpetual normally trades on an up day. It shows the result was a touch behind what the market would have liked. FUM growth remains key and it did grow, even if it was just +0.75% it’s hard to take today’s announcement as a negative. We like PPT given it is reasonably priced vs historical metrics and continues to pay a good dividend.

Perpetual (PPT) Chart

Broker moves;

· Ardent Leisure Cut to Hold at Baillieu Ltd; PT A$1.55

· Carsales.com Cut to Sell at Morningstar

· Platinum Asset Cut to Sell at Morningstar

· Dexus Rated New Buy at Jefferies; PT A$13.67

· Tyro Payments Rated New Overweight at JPMorgan; PT A$3.75

· Saracen Mineral Raised to Buy at Goldman; PT A$4.30

· Mosaic Brands Cut to Hold at Morgans Financial Limited

· Metcash Raised to Neutral at Credit Suisse; PT A$2.64

OUR CALLS

No changes across portfolios today

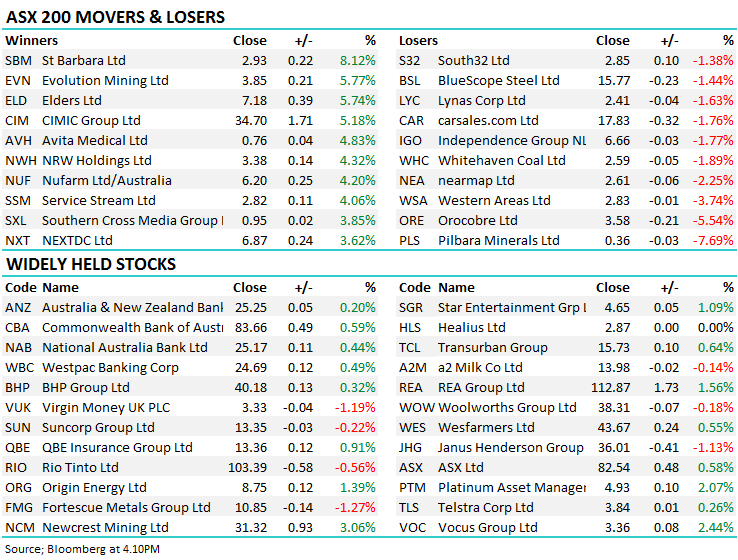

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.