All rallies must come to an end (BHP, PGH)

WHAT MATTERED TODAY

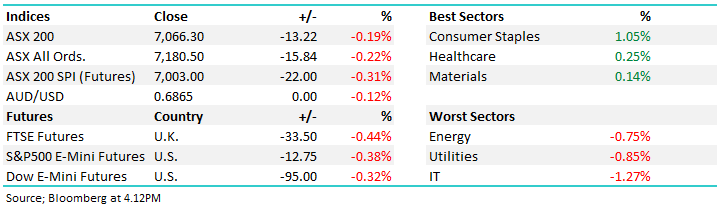

The ASX sold off after being left with its own thoughts given there was little in the way of overnight leads today with the US closed observing MLK day last night. The slip ended a 5-day winning streak for the index which had put on ~180pts/2.4% in 5 sessions, with today’s small 13pts fall just the third red day for 2020. There was large futures led buying into the close today which managed to cut around half of the index’s losses in the final match for the afternoon, a sign that even though the 5-day run is done, the rally may not be over in the short term.

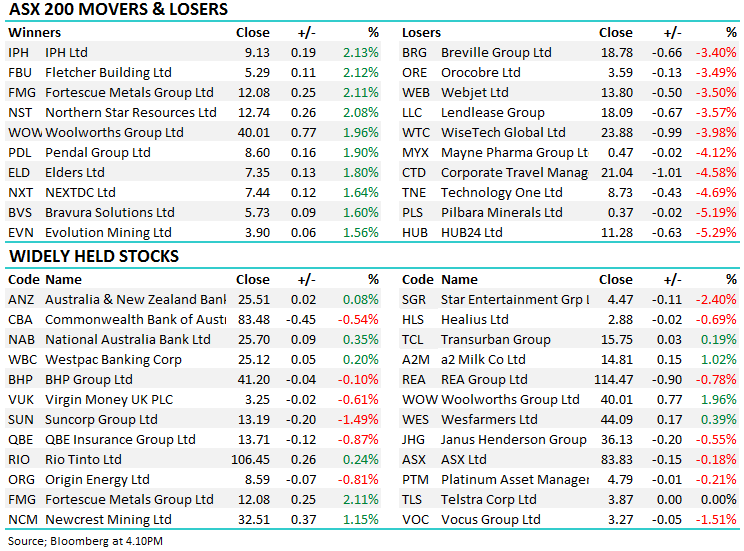

Asian markets were lower today, more so than the local index, on fears the coronavirus outbreak would impact stocks. Airlines have felt some selling on the back of travel fears, Qantas down again today while Corporate Travel (CTD) was the hardest hit travel leveraged play, falling –4.58%. Three of the big 4 closed higher in the down day with CBA giving back some of its outperformance of late. The supermarkets continued to storm higher, carrying the consumer staples sector with them. Growth was on the nose with energy following a softer night for oil lower and tech on the nose with Wisetech’s (WTC) biggest fall of the year. US futures are pointing to a softer start to the week when they pick up trading tonight following Asian markets lower.

Overall, the ASX 200 fell -13pts / -0.19% today to close at 7066. Dow Futures are trading lower by -95pts/-0.32%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

BHP Group (BHP) -0.1%: traded lower today but didn’t greatly underperform peers or the market by any means after posting their 2nd quarter production report. The four main segments for BHP are tracking in line with expectations, and guidance was maintained as is as a result, although petroleum production has been talked to the lower end of the guidance range. Iron ore was production was down quarter on quarter, but only marginally so, with BHP finishing up some maintenance projects it’s now set to storm home in the second half.

Copper production grew 9% on 2Q19 as their Escondida mine ramped up – although realised grade was lower than previous quarters. Coal production was mixed with metallurgical coal showing strong growth while thermal coal fell year on year. Costs were all in line with expectations. As BHP head into the second half of the year, we doubt there will be too many changes to analyst models after today’s report, although if the iron ore price remains elevated, upgrades will be forced in.

BHP Group (BHP) Chart

Pact Group (PGH) +3.35%: shares climbed today after engaging the bankers to sell the contract manufacturing division after completing a strategic review of assets. The business up for sale provides a range of packaging solutions for manufacturers across a wide range of products contributed $25m EBITDA for FY19 which was down from $40m the prior year with higher input costs and some weaker demand hurting earnings. The sale was taken well by the market with the proceeds with the MD saying it will “strengthen our balance sheet and improve our financial flexibility.” We own PGH - they have done well to improve their debt position as capital raise fears subside, the share price has managed to edge higher.

Pact Group (PGH) Chart

Broker moves;

- Collection House Cut to Hold at Baillieu Ltd; PT A$1.20

- Dexus Raised to Outperform at Macquarie; PT A$13.26

- Charter Hall Retail Raised to Outperform at Macquarie

- nib Raised to Neutral at UBS; PT A$5.85

- nib Raised to Neutral at Goldman; PT A$5.66

- Sydney Airport Cut to Neutral at Macquarie; PT A$8.68

- SCA Property Raised to Neutral at Macquarie; PT A$2.91

- Charter Hall Long Raised to Neutral at Macquarie; PT A$5.88

- Boral Cut to Hold at Morningstar

- GrainCorp Cut to Hold at Morningstar

- Fletcher Building Raised to Overweight at JPMorgan; PT NZ$6

- Silver Lake Cut to Sector Perform at RBC; PT A$1.40

- Silver Lake Cut to Hold at Canaccord; PT A$1.60

- Coats Cut to Hold at Berenberg; PT 80 pence

- Infigen Raised to Add at Morgans Financial Limited

OUR CALLS

No changes across portfolios today

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.