Stocks edge lower into the weekend, special guest on this afternoon recording (MLD)

WHAT MATTERED TODAY

A solid week of reporting this week and overall, it’s been a reasonable one. A number of our holdings have updated the market and at this stage we’re reasonably happy, although a few more +20% pops would be nice! The best performers this week for MM have been Emeco (EHL), NRW Holdings (NWH), Perpetual (PPT), Boral (BLD) & Evolution (EVN), while a better result in terms of margins supported NAB, which is a large holding in both domestic portfolios.

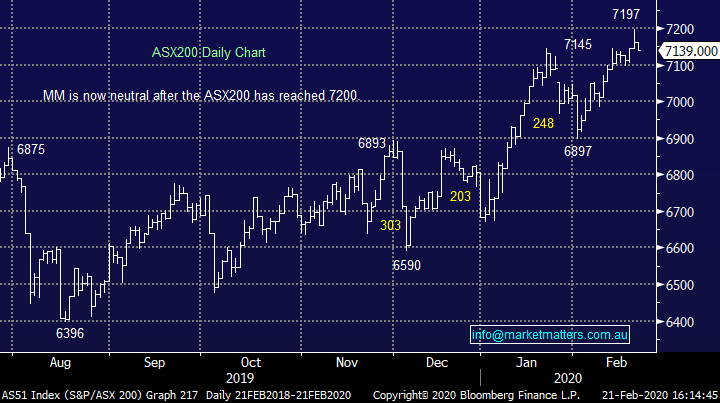

At the index level, the market traded up to our ~7200 target yesterday, although we’re yet to see any meaningful selling. Some tepid weakness today but nothing of real note.

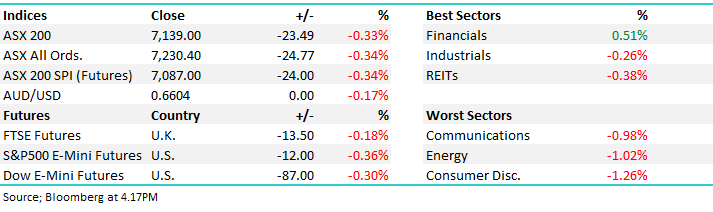

Overall, the ASX 200 closed down -23pts or -0.33% today to 7139, Dow Futures are trading down -87pts/-0.30%.

Another solid week of reporting coming up next week – 4 big days peaking on Thursday.

Reporting schedule available here: CLICK HERE

ASX 200 Chart

ASX 200 Chart

Direct From The Desk: I had a quick chat this afternoon about results during week from some of our portfolio holdings and was joined by Roger Gamble who sits on our institutional desk, he’s got a good handle on Bingo (BIN), which is a stock we focus on.

Let me know if you want more from Roger, or others, we might just increase the width of our Direct from The Desk style updates if members find them beneficial.

Within the recording, Roger also calls out Maca (MLD) as an interesting smaller cap idea in the contracting space, about to get a new CEO.

Maca Limited (MLD)

CATCHING MY EYE;

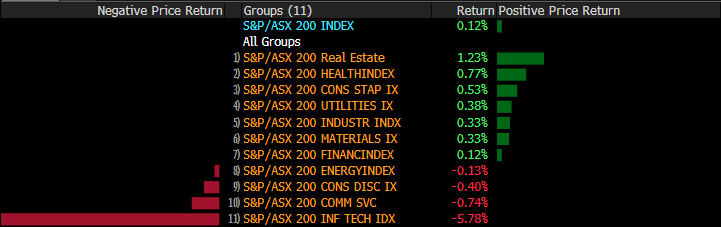

Sectors this week: IT stocks hit as lofty expectations fail to be met.

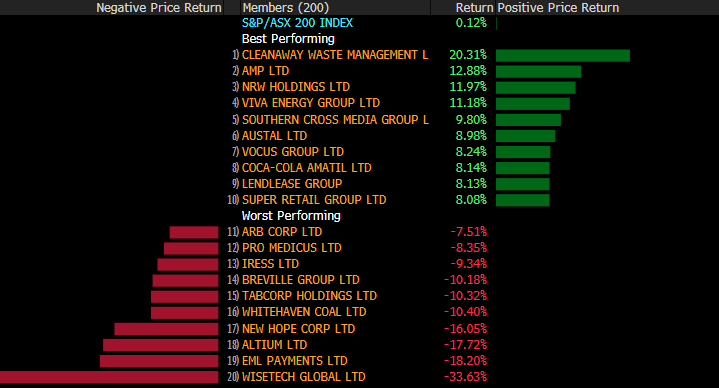

Stocks this week: 3 tech & 2 coal stocks round out the bottom 5. Interesting to see Mitsubishi sell its 11.2% holding in New Hope Coal (NHC), a position they’ve held for more than 30 years. On the flipside, AMP was the 2nd strongest stock in the 200 this week thanks to rumours that Macquarie is running the ruler over AMP Capital.

BROKER MOVES; NWH saw two upgrades today which saw the stock do well

· Accent Group Cut to Neutral at Citi; PT A$2.04

· Accent Group Raised to Add at Morgans Financial Limited

· Perpetual Cut to Sell at Citi; PT A$42.30

· Perpetual Cut to Sell at Morningstar

· Perpetual Raised to Overweight at Morgan Stanley; PT A$55

· Domain Holdings Raised to Neutral at UBS; PT A$3.60

· Southern Cross Media Cut to Underperform at Macquarie

· Iress Cut to Underperform at Macquarie; PT A$11.99

· ANZ Bank Raised to Buy at Bell Potter; PT A$28.50

· ANZ Bank Cut to Hold at Morningstar

· Vital Healthcare Cut to Neutral at Forsyth Barr; PT NZ$2.76

· Sydney Airport Raised to Sector Perform at RBC; PT A$8

· Sydney Airport Raised to Add at Morgans Financial Limited

· nib Raised to Buy at Morningstar

· Boral Raised to Neutral at Credit Suisse; PT A$4.70

· Boral Raised to Buy at Jefferies; PT A$6

· Precinct Properties Raised to Buy at Deutsche Bank; PT NZ$1.97

· Super Retail Raised to Overweight at JPMorgan; PT A$10.50

· Whitehaven Raised to Neutral at Goldman; PT A$2.30

· Coca-Cola Amatil Cut to Hold at Jefferies; PT A$13.50

· Coca- Cola Amatil Cut to Underperform at Credit Suisse

· Cochlear Cut to Sell at Goldman; PT A$214

· EBOS Raised to Buy at Deutsche Bank; PT NZ$25.60

· EBOS Raised to Add at Morgans Financial Limited; PT NZ$25.78

· Integral Diagnostics Cut to Hold at Jefferies; PT A$4.50

· Wesfarmers Raised to Hold at Shaw and Partners; PT A$47

· McPherson’s Cut to Hold at Shaw and Partners; PT A$2.85

· NRW Holdings Raised to Buy at Hartleys Ltd; PT A$3.70 * I also saw Moelis upgrade them

· Fortescue Cut to Sell at Bell Potter; PT A$8.61

· Santos Raised to Overweight at JPMorgan; PT A$9.20

· Nearmap Raised to Positive at Evans & Partners Pty Ltd

OUR CALLS

No changes to the portfolios today.

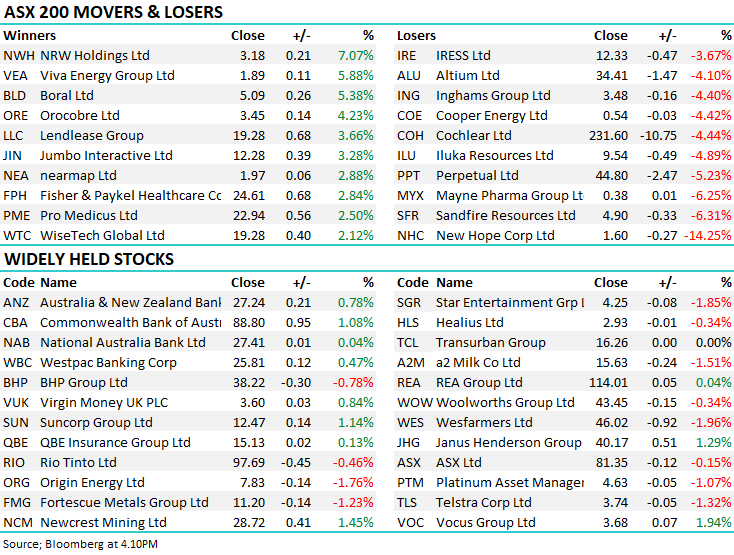

Major Movers Today

Have a great weekend all

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.