Japan adds liquidity, market stages turnaround from lows

WHAT MATTERED TODAY

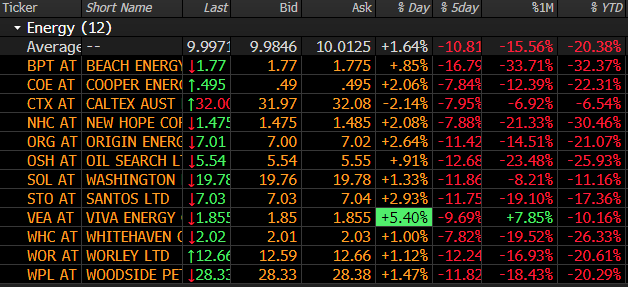

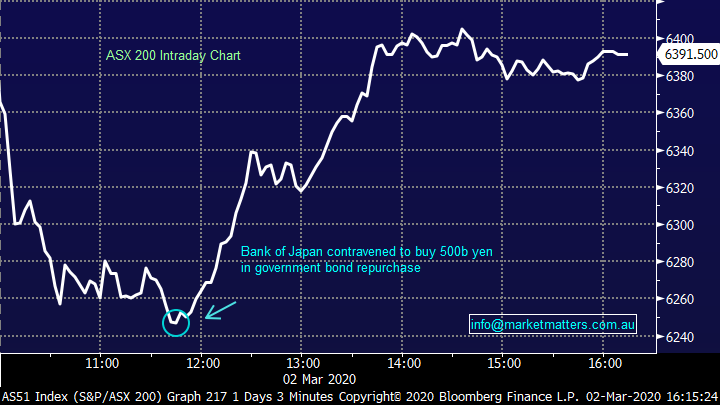

Volatility continued first up this morning with the weekend’s news flow hitting our market on open. We were pricing in a decline of 60pts based on Fridays trade in the US, however that number was vastly undercooked by around 11.30am this morning, with the market down around 200pts at the lows. The Japanese stepped up to the plate announcing liquidity measures + a reassurance that they would maintain market stability - that saw markets around the region start to trade higher, a good rally ensued with the ASX 200 closing just shy of ~6400, still down on the session but a lot better than it was in early trade.

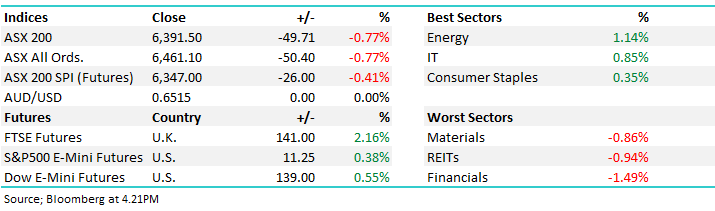

The Energy stocks were supported by a strong rally by Crude in Asia today, the sector saw the most broad based gains as shown below, all constituents bar Caltex finishing the session higher, Santos (STO) the major that enjoyed most upside ahead of the OPEC+ this week to discuss new output cuts at a time when Russia says they are content with current prices…interesting week expected for these stocks below.

Energy Sector Today – best on ground

Source: Bloomberg

– US Futures were trading +0.70% higher at our close this afternoon while Asian markets were also in the green, Chinese stocks up +3% in Shanghai which is a positive sign.

Overall, the ASX 200 lost -49pts / -0.77% today to close at 6391. Dow Futures are trading up +182pts/+0.72%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

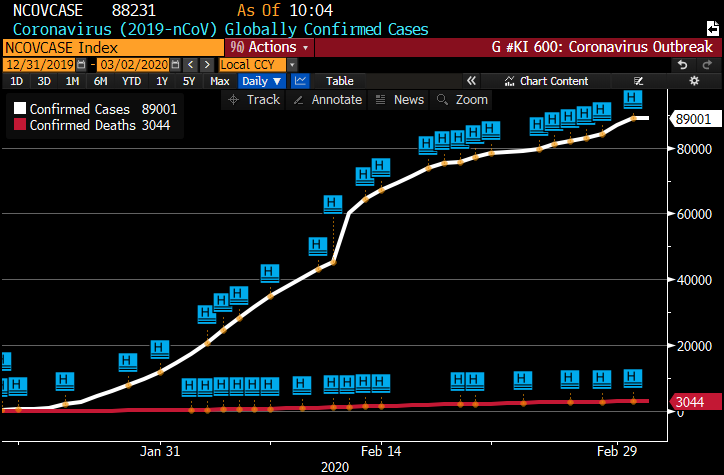

Virus Update: Death toll passes through 3000 as Trump plans to meetPharma Executives. There was the first case reported in New York while South Korea saw its total climb past 4,200. Indonesia reported its first cases. In Australia, we reported our first case of human to human transmission of the virus. The total number infected now sits just shy of 90,000 according to Bloomberg.

Virus Cases and Death Toll

Source: Bloomberg

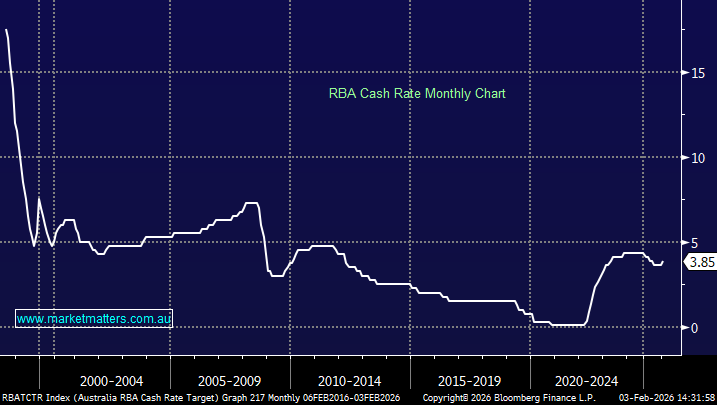

Central Banks: The Bank of Japan says it offered to buy 500b yen in government bond repurchase for future delivery with the announcement following a statement from Governor Haruhiko Kuroda that it’s closely monitoring future developments and will strive to provide ample liquidity and ensure stability in financial markets through appropriate market operations and asset purchases….Tomorrow we have the RBA front and centre with the market now pricing in a 100% chance of a 25bp cut while there also a slight chance for a bigger 50bp cut.

BROKER MOVES -

· Coles Group Raised to Outperform at Macquarie; PT A$17.20

· Cromwell Property Raised to Neutral at Macquarie; PT A$1.20

· Regis Resources Raised to Overweight at Morgan Stanley

· Newcrest Raised to Overweight at Morgan Stanley; PT A$32.20

· Costa Raised to Market-Weight at Wilsons; PT A$2.95

· ANZ Bank Raised to Buy at Morningstar

· Super Retail Raised to Hold at Morningstar

· Star Entertainment Raised to Buy at Morningstar

· GrainCorp Raised to Buy at Morningstar

· Blackmores Raised to Buy at Morningstar

· Sonic Healthcare Raised to Hold at Morningstar

· Boral Raised to Buy at Morningstar

· Qantas Raised to Hold at Morningstar

· Iluka Raised to Buy at Morningstar

· Premier Investments Raised to Hold at Morningstar

· QBE Insurance Raised to Hold at Morningstar

· NAB Raised to Buy at Morningstar

· Harvey Norman Raised to Neutral at JPMorgan; PT A$3.75

· Perenti Raised to Buy at Moelis & Company; PT A$1.70

· Charter Hall Group Cut to Neutral at JPMorgan; PT A$12.50

OUR CALLS

No changes today

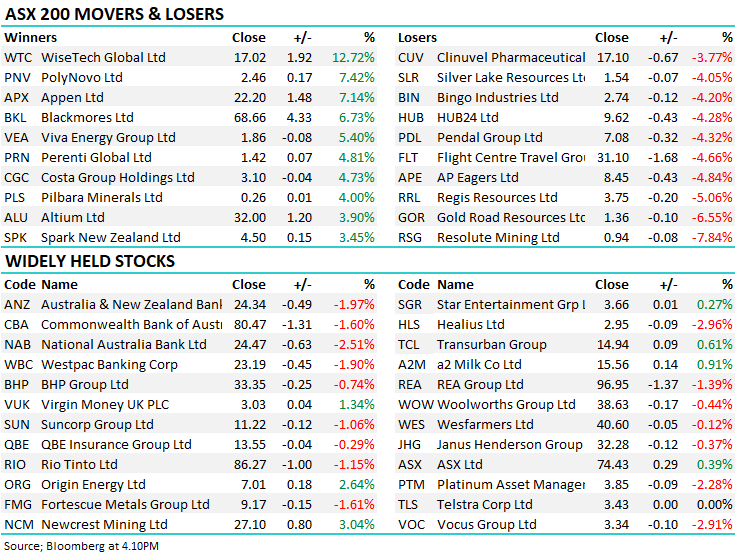

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.