2nd worst day in 27 years, ASX falls ~7%

WHAT MATTERED TODAY

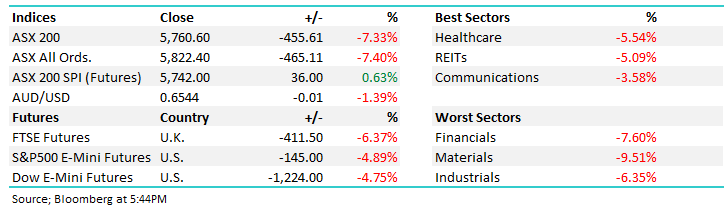

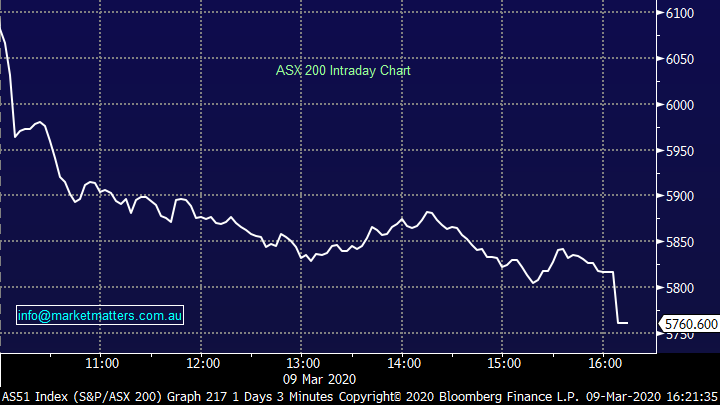

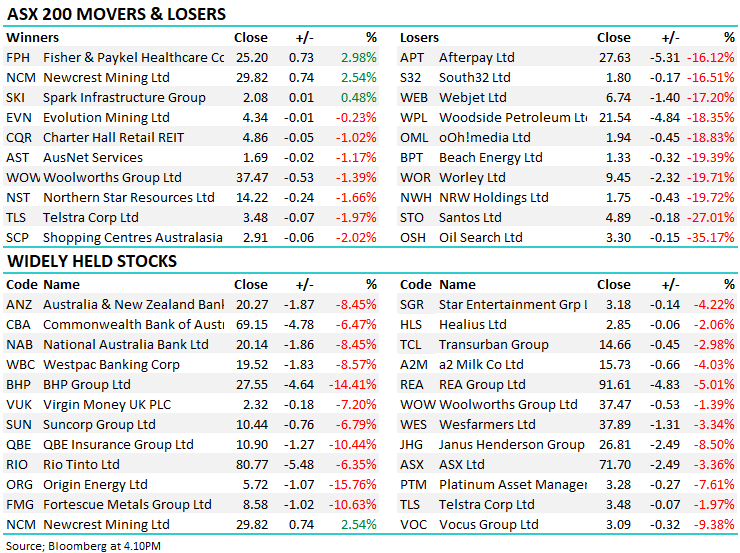

A savage sell-off hit stocks today with the ASX recording its 2nd biggest sell-off in the last 27 years, only one session during the GFC was worse being the 10th October 2008. The ASX was whacked 455 points today with the market closing right on the lows, US Futures were down ~5% during our time zone while Oil traded ~25% lower in Asia after being hit 10% Friday night – yes that’s right, 35% down thanks to the Saudi’s and Russians. Banks were down between 6.47% (CBA) and 9.51% (BEN), large cap resources were down hard, BHP off -14.41% closing the day at $27.55 – a huge move. Margin pressure throughout today with forced sellers hitting very thin bids – I could feel the pit of my stomach today, totally underestimated the savage nature of this selling.

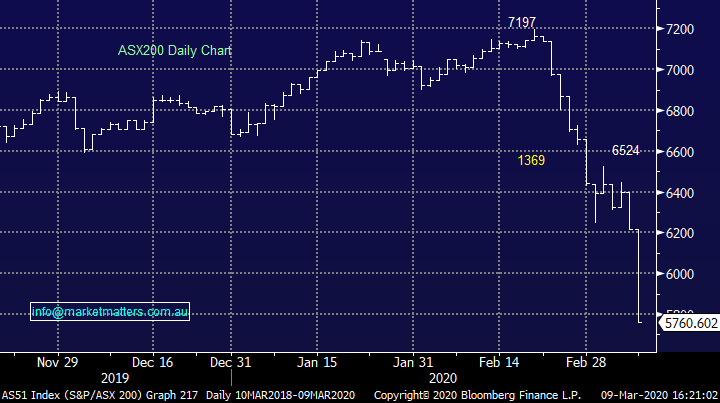

From the peak of 7197 just 12 trading days ago, the mkt closed today at 5760, a drop of 1437pts / ~20%.

Overall, the ASX 200 fell -455pts / -7.33% today to close at 5760 - Dow Futures are trading down -1220pts/-4.75%

ASX 200 Chart

ASX 200 Chart

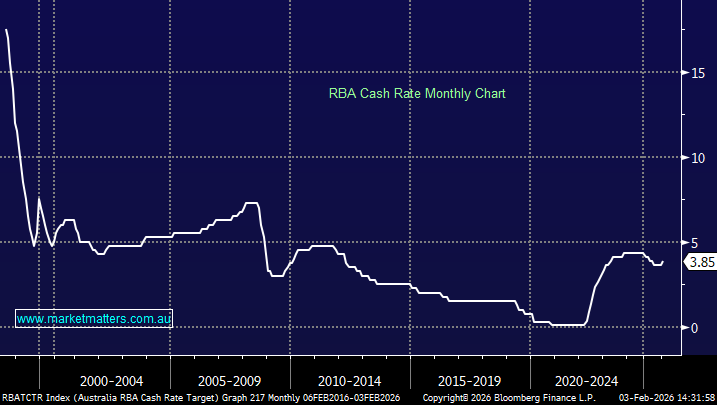

CATCHING MY EYE

NO WHERE TO HIDE: its hard the really offer much value after a day like this…. markets have clearly gone into panic mode, pure and simple. The Coronavirus was enough however the ructions between the Russians and Saudis has thrown another spanner in the works. The Saudi’s pledging to flood the global oil market with supply, in order to exert their will over oil prices, that has a flow on effect in the credit markets where a lot of energy companies struggle, and bond holders take a bath as a consequence, just look at NBI today which has exposure to US high yield credit markets, it fell 10% amid panic selling, other more defensive ASX securities did the same as investors looked to cash up in any way possible – a clear panic sell-off.

The obvious concern being Coronavirus will slow global growth and cause a recession, central banks have very little room to move in terms of policy response and credit markets could freeze as a consequence. Markets clearly have little faith in the ability for emergency support to stem the tide right here and so we see an aggressive move to the exits. The more the panic, the closer we are to intervention, however the bigger the intervention needs to be.

Looking at the longer term chart of the ASX 200 puts things into context, some sever pain felt today right across the board as the market has aggressively rejected to top of its channel and is now close to testing the lower extremity…more on this tomorrow morning.

ASX Chart – Long term

BROKER MOVES

· Santos Cut to Underperform at Bernstein; PT A$5.90

· Woodside Cut to Market Perform at Bernstein; PT A$24.40

· Orora Raised to Overweight at Morgan Stanley; PT A$3.50

· Sonic Healthcare Cut to Sell at Morningstar

· AMP Raised to Buy at Morningstar

· Harvey Norman Raised to Hold at Morningstar

· Downer EDI Raised to Buy at Morningstar

· Alumina Raised to Hold at Morningstar

· Magellan Financial Raised to Hold at Morningstar

· Tabcorp Raised to Buy at Morningstar

· Aurizon Raised to Hold at Morningstar

· Breville Cut to Neutral at JPMorgan; PT A$20

· ARQ Group Ltd Raised to Hold at Bell Potter

OUR CALLS

We tweaked the Platinum Portoflio today, cutting Pact Group (PGH) and Boral (BLD) as they both hold higher debt, while we topped up on Bingo, Macquarie & BHP into weakness.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.