I’ve never seen a close like it – ASX stages massive turnaround

WHAT MATTERED TODAY

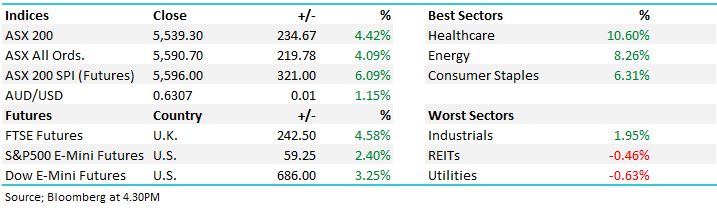

A tough week ends on a more positive note with the market rallying hard from the morning lows today to end more than 4% higher. Some incredible turnarounds today, particularly in the banking space following RBA intervention – more on this below. I’ve never seen a market match like it did today, it finished 4pm at 5383 and in 10 mins was pushed +156pts to a 5539 close, incredibly aggressive buying in a short window, although there’s been a few moments that have surprised this week. Today’s move was a staggering +13.67% bounce for the cash market off the lows while SPI Futures were up more being nearer +17% off the 4810 low this morning.

News this afternoon that the RBA is pumping $8.8 billion into short-term commercial bank funding to ease a squeeze in global credit markets was taken very well, particularly by the banks. This injection into what’s known as the ‘repo’ market effectively provides short term loans to commercial banks in return for collateral under what’s called repurchase agreements. We’ve written about these before with a focus on the US market, and in particular how the US had pulled back on these in recent times. By improving liquidity as the RBA did today it goes a long way to supporting banks which are the lifeblood of the market / economy. We also saw the Bank of Japan stimulate today while we’re getting more talk coming from Europe...coordinated global stimulus is getting closer.

Clearly, it seems volatility will persist however this is a positive step, and buying this afternoon was aggressive, on decent volume and shows an underlying demand for equities when available liquidity is in the system.

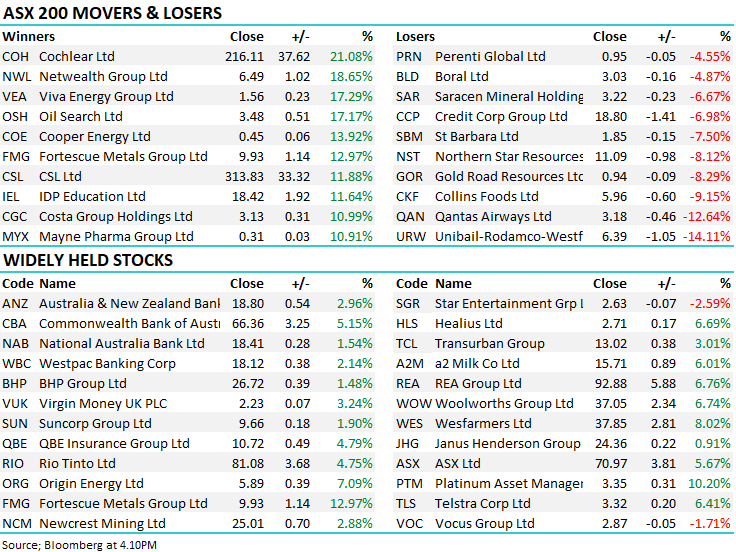

At a sector level today, healthcare stocks had an impressive time, CSL and Cochlear rallied hard from their morning lows – the sector closed up +10% e.g. CSL had a $256.09 low today before closing at $313.83 – unbelievable, we paid $57.57 for CBA this morning and it closed at $66.36…that’s not a normal market.

Anyway, the week comes to a close, there is a virus hanging over the country (although Canada claims to have found a cure ) and while our (my) world is mostly consumed by numbers on screens, generally red ones this week, its always important to remember that health remains the no 1 priority. Have a good / safe weekend all, go the Sea Eagles and look out for the Weekend Report on Sunday where we asses things with a cooler head.

Overall, the ASX 200 closed up +234pts or +4.42% today to 5539. Dow Futures are trading down +766pts/+3.60%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

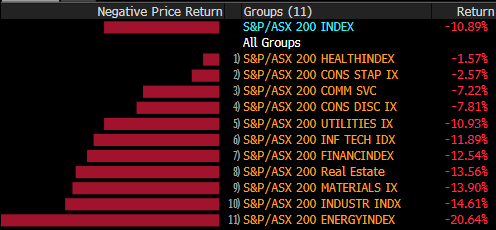

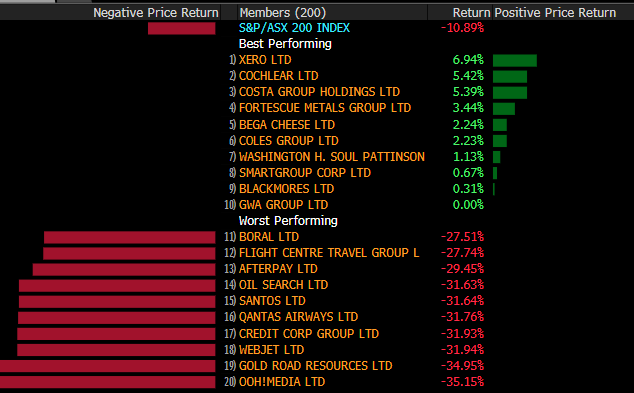

Sectors this week: While we were positive today, the week still ended down 10%, a long way to go.

Stocks this week: Costa Group (CGC), very resilient.

BROKER MOVES;

· Atlas Arteria Raised to Outperform at Macquarie; PT A$8.14

· Flight Centre Cut to Underperform at Macquarie; PT A$17.95

· Orocobre Raised to Neutral at JPMorgan; PT A$2.60

· Mineral Resources Raised to Overweight at JPMorgan; PT A$16

· Iluka Raised to Overweight at JPMorgan; PT A$10.30

· IGO Raised to Overweight at JPMorgan; PT A$5.40

· Regis Resources Raised to Overweight at JPMorgan; PT A$4.40

· Bendigo & Adelaide Raised to Neutral at UBS; PT A$6.50

· NAB Raised to Neutral at UBS; PT A$19

· CBA Raised to Neutral at UBS; PT A$65

· ANZ Bank Raised to Buy at UBS; PT A$21

· Domino’s Pizza Enterprises Raised to Outperform at Macquarie

· Coca-Cola Amatil Raised to Outperform at Macquarie; PT A$13.60

· Xero Raised to Outperform at Credit Suisse; PT A$80

· Santos Raised to Add at Morgans Financial Limited; PT A$7.97

· Stockland Raised to Hold at Morningstar

· Lendlease Group Raised to Buy at Morningstar

· CBA Raised to Buy at Morningstar

· IGO Raised to Buy at Morningstar

· Brambles Raised to Buy at Morningstar

· Macquarie Group Raised to Buy at Morningstar

· Magellan Financial Raised to Buy at Morningstar

· Iress Raised to Buy at Morningstar

· Growthpoint Raised to Hold at Morningstar

· Premier Investments Raised to Buy at Morningstar

· Sonic Healthcare Raised to Hold at Morningstar

· Super Retail Raised to Buy at Morningstar

· Healius Raised to Buy at Morningstar

· AGL Energy Raised to Buy at Morningstar

· REA Group Raised to Hold at Morningstar

· QBE Insurance Raised to Buy at Morningstar

· Transurban Raised to Hold at Morningstar

· Atlas Arteria Raised to Hold at Morningstar

· Bingo Industries Raised to Buy at Morningstar

· National Storage REIT Raised to Buy at Morningstar

· APA Group Raised to Hold at Morningstar

· Medibank Private Raised to Buy at Morningstar

· Domain Holdings Raised to Buy at Morningstar

· Coles Group Raised to Neutral at Evans & Partners Pty Ltd

· CSL Raised to Buy at Citi; PT A$32

· nib Raised to Overweight at JPMorgan; PT A$4.64

· APA Group Raised to Add at Morgans Financial Limited

OUR CALLS

We switched from NAB into CBA & Pendal (PDL) into Magellan (MFG) today

Major Movers Today

Have a great Weekend all

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.