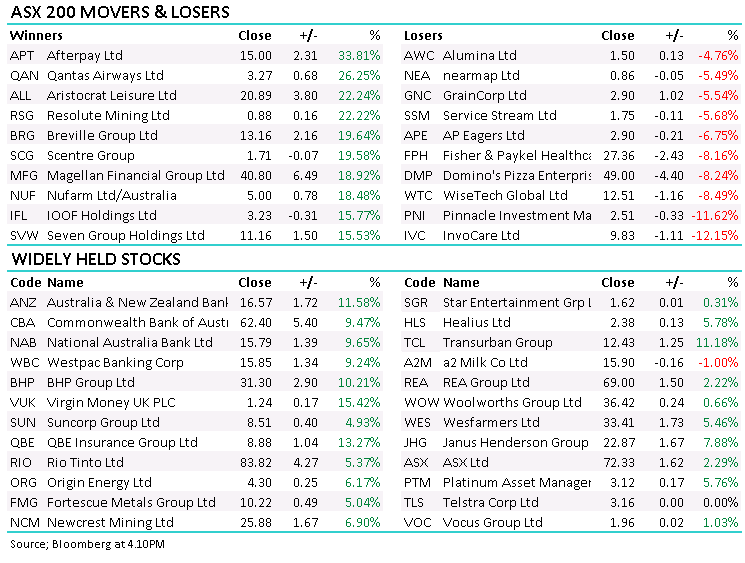

US Senate reaches deal, stocks rally (QAN, IVC)

WHAT MATTERED TODAY

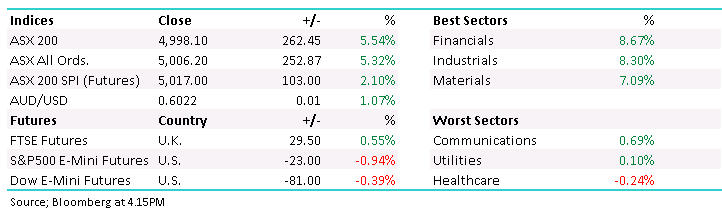

The ASX came out of the blocks hard early this morning following a ~10% rally in the US overnight, however the early optimism was sold into and the market traded well off intra-session highs. The market peaked at 5024 around 10.30am before sellers emerged, weakness in US Futures which traded down ~2% during our time zone + news that Cochlear (COH) were tapping the market for $850m through an institutional placement also sapped some buying, particularly from CSL which ended marginally lower (was down more so earlier). However, right on our close the US Senate reached an agreement around fiscal measures and the market spiked hard. The index was up around 110pts just before the close and ended +262pts / 5.54% higher.

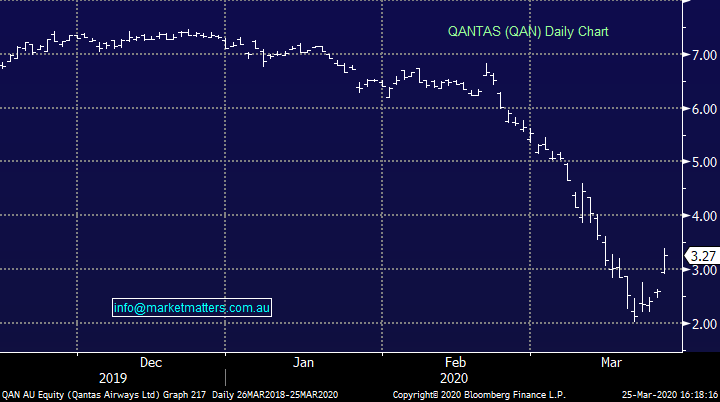

Some of the fallen angels picked themselves up off the mat today, Qantas rallied +26%, Afterpay (APT) put on 33% while Funeral Operator Invocare fell by -12%, travel stocks up, funeral businesses down, seems optimistic! More on that below from Harry.

Overall, the ASX 200 added +262pts / +5.54% today to close at 4998 - Dow Futures are trading up +44pts/+0.21% (they rallied late, there were down 2% during out time zone)

ASX 200 Chart - US senate reached a deal, stocks spiked late

ASX 200 Chart

CATCHING MY EYE:

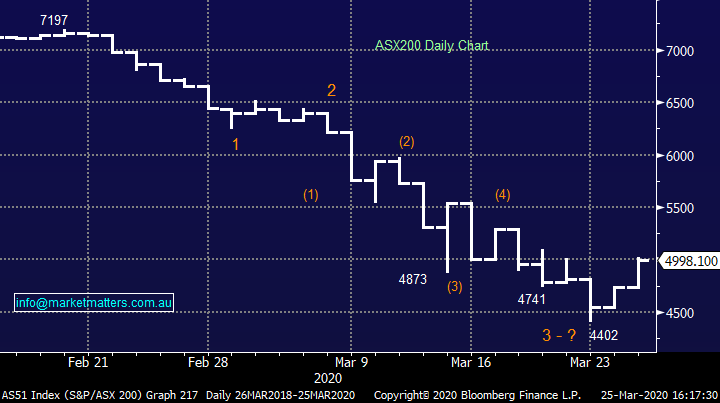

Qantas (QAN) +26.25%: had its best day out in a long while as the airline moved to secure it's balance sheet. In what's been a tough time for all travel related stocks, Qantas managed to secure a little over $1b in liquidity at an interest rate of just 2.75%, secured against a few unencumbered aircraft. The deal takes the cash balance to nearly $3b, with another $1b in undrawn facilities, while the net debt position remains around $5b. Qantas is in a strong position despite the issues in the industry and today's announcement shows the amount of balance sheet flexibility they have. Webjet on the other hand remain stuck in a trading halt, now going for a 5th session as they struggle to complete a capital raise.

Qantan (QAN) Chart

InvoCare (IVC) -12.15%: had largely been spared from the broader market sell off until this week, funeral home operator InvoCare fell on its own sword today. Scott Morrison specifically talked to attendance at funeral's in a press conference last night in limiting gatherings to 10 people, forcing the hand of InvoCare to cut some of their services. As a result of the impacts, IVC has already implemented a hiring freeze and pushed back a number of capital expenses. InvoCare continues to operate in the meantime however - not the same can be said for a number of other businesses. The longer term impacts of delaying growth projects will hurt their value though.

InvoCare (IVC) Chart

BROKER MOVES:

- Transurban Raised to Neutral at Credit Suisse; PT A$10.65

- Iluka Raised to Overweight at Morgan Stanley; PT A$10.05

- IGO Raised to Overweight at Morgan Stanley; PT A$5.15

- Evolution Raised to Overweight at Morgan Stanley; PT A$4.10

- OZ Minerals Raised to Overweight at Morgan Stanley; PT A$10

- Fortescue Raised to Equal-Weight at Morgan Stanley; PT A$10.05

- REA Group Raised to Outperform at Macquarie; PT A$90

- Aurizon Raised to Buy at UBS; PT A$5.55

- Magellan Financial Raised to Buy at Citi; PT A$40

- Healius Raised to Buy at Citi; PT A$2.80

- Newcrest Raised to Buy at Citi; PT A$30.40

- Navigator Global Raised to Outperform at Macquarie; PT A$3.36

- Domino's Pizza Enterprises Cut to Hold at Morningstar

- Adairs Cut to Neutral at Goldman; PT 70 Australian cents

- Integral Diagnostics Raised to Buy at Jefferies; PT A$3.55

- GrainCorp Cut to Hold at Bell Potter; PT A$3.15

OUR CALLS

No changes to the portfolios today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence