ASX starts the week on the front foot (JBH, ANN)

WHAT MATTERED TODAY

A strong Monday for the ASX which has proven to be a rarity in recent times with the market opening lower, before staging a strong recovery throughout the session, the ASX adding an impressive +348pts from the early session low. A good move by the Government to announce a new, large wage subsidy costing around $130bn over 6 months providing around 70% of the median wage, and 100% of the median wage in heavily hit sectors such as retail and hospitality, with payments flowing from the 1st May.

Buying today was targeted towards the banks which are heavily exposed to unemployment / bad debt increases and the like, and todays move by the Govt is a clear positive in this regard, however the healthcare stocks were also very strong after a poor session on Friday. When CSL rallies ~12% and Commonwealth Bank (CBA) puts on more than ~10% its clear we’re in for a good move on the index, those two companies alone contributing +85pts of the days gains.

In terms of the virus, we’ve seen 213 new cases in Australia today taking the total count to 4193, however the rate of growth nationally is just 5.4%, although growth in NSW is nearer 12%. While this is still troubling, that rate of growth is low and implies that social policies are working.

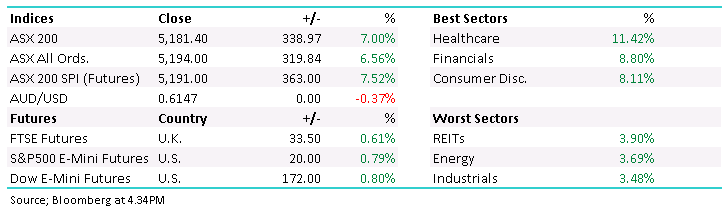

Today the ASX 200 added +339pts /+7% to close at 5181 - Dow Futures are trading up +172pts/+0.80%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

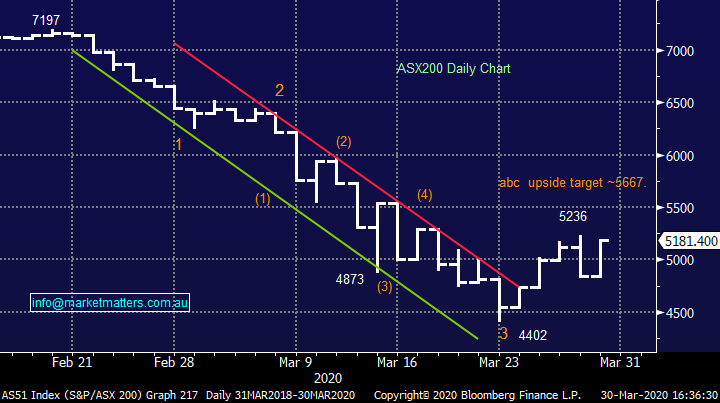

Retailers: This is the pointy end of the spectrum at the moment with the sector garnering headlines for all the wrong reasons, however after a tough Friday the sector bounced back hard today buoyed by the governments move on wage subsidies and better domestic news flow around the virus. Nick Scali (NCK) today confirmed they would close stores adding to a long list of retailers who have. That said, the sector has been hit for six and value is emerging, we wrote about being positive on JB Hi-Fi (JBH) and Premier Investments (PMV) in reports last week. JB added more than ~10% today.

JB Hi-Fi (JBH) Chart

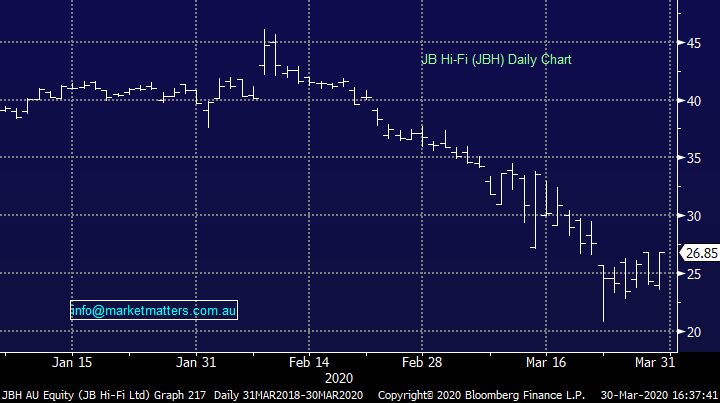

Ansell (ANN) +25.08%: one of the more immune companies to the current crisis is protective products manufacturer Ansell, and shares popped today on the company reaffirming their full year guidance. Ansell noted an increase in demand for their examination and surgical gloves, and at this stage hasn’t seen any impacts on production by lockdowns or implementing steps to mitigate risks at the production sites.

This increase in demand though is expected to be offset by softening in the company’s industrial products arm which supplies safety gear for industrial applications. This side of the business has been more impacted by the slowdown in activity while also noting trade restrictions has limited its ability to move product. For now though, the strength in medical supplies being offset by weakness in industrial was enough to please the market. While Ansell stood by guidance, Bank of Queensland (BOQ) and QBE Insurance (QBE) walked away from theirs.

Ansell (ANN) Chart

BROKER MOVES:

- ALS Raised to Add at Morgans Financial Limited; PT A$6.90

- GUD Holdings Raised to Buy at Citi; PT A$10.30

- Alumina Raised to Neutral at UBS; PT A$1.50

- Aristocrat Raised to Buy at Goldman; PT A$29

- Monadelphous Cut to Neutral at Goldman; PT A$12.70

- Orica Raised to Buy at Goldman; PT A$20.10

- Seven Group Raised to Buy at Goldman; PT A$15.90

- Emeco Cut to Neutral at Goldman; PT A$1.20

- Western Areas Raised to Buy at UBS; PT A$2.50

- IGO Raised to Buy at UBS; PT A$6

- AGL Energy Raised to Neutral at Macquarie; PT A$17.38

- Atlas Arteria Raised to Add at Morgans Financial Limited

- Ramsay Health Raised to Neutral at Goldman; PT A$52

- Afterpay Raised to Buy at Goldman; PT A$25.10

- Tassal Group Raised to Outperform at Credit Suisse; PT A$3.90

- Vicinity Centres Raised to Neutral at Evans & Partners Pty Ltd

OUR CALLS

No changes today, we’ll be covering some proposed portfolio amendments in the am report tomorrow

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence