Energy stocks lead the ASX higher (TCL, NWH)

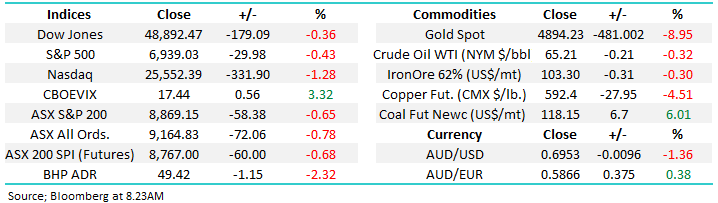

WHAT MATTERED TODAY

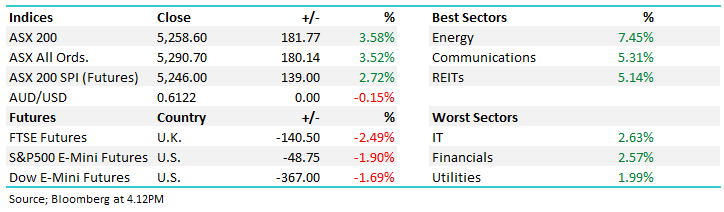

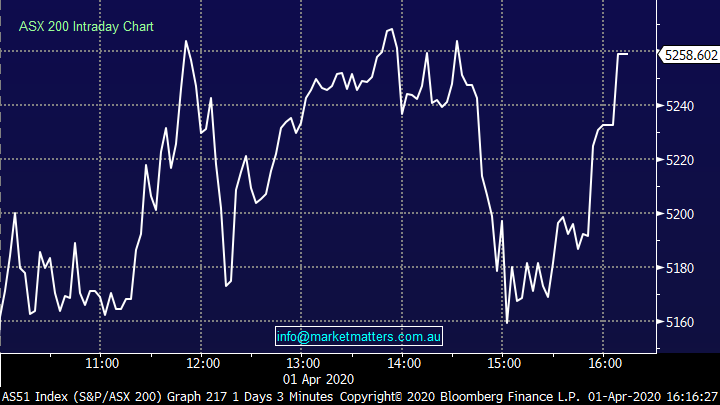

Yesterday we wrote about strength early before sellers took hold while today the opposite played out, with the market opening marginally higher but went on with it throughout the day – although it was choppy under the hood.

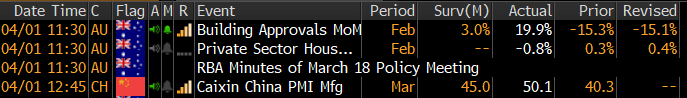

Despite weakness in US futures, our market keyed off better than expected data both locally and in China with building approvals better than expected MoM while the Chinese manufactured an almost too good to be true Caixin PMI print, which hit 50.1 v 45 expected. This measures expectations for future manufacturing and while its worth looking at this number with some scepticism, it does suggests some optimism about China getting over the hump and firing up their factories, the real test comes when they realise their customers are in lockdown!

Economic Data Today

Source: Bloomberg

From a sector perspective today, energy stocks the clear standout adding more than 7% as investors start to price in the obvious conclusion of more upside than downside from current levels. There is a lot of negative news already in prices and we think upside potential exists for the local energy names.

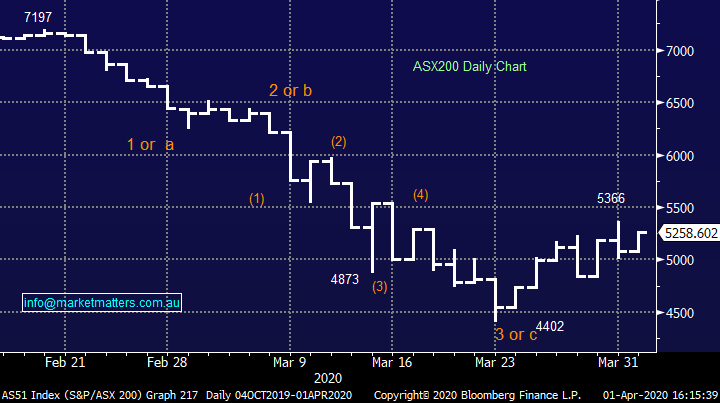

Today the ASX 200 added +181pts /+3.58% to close at 5258 - Dow Futures are trading down -367pts/-1.69%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

RBA Minutes: The RBA released the minutes from their special March meeting today providing some insight into their thinking in the process. Ultimately they think the COVID-19 slowdown will last into the second half of the year and therefore they will remain supportive of the economy – that said, they’re very much against negative rates implying QE and other measures will the approach… "While it was not possible to provide an updated set of forecasts for the economy given the fluidity of the situation, it was likely that Australia would experience a very material contraction in economic activity, which would spread across the March and June quarters and potentially longer," the minutes said

"Members strongly supported the proposed policy response as a comprehensive package to complement the fiscal response announced by governments in Australia in the preceding week or so," the minutes say.

Clearly they remain supportive, although their toolkit needs to be more unconventional than simply cutting rates.

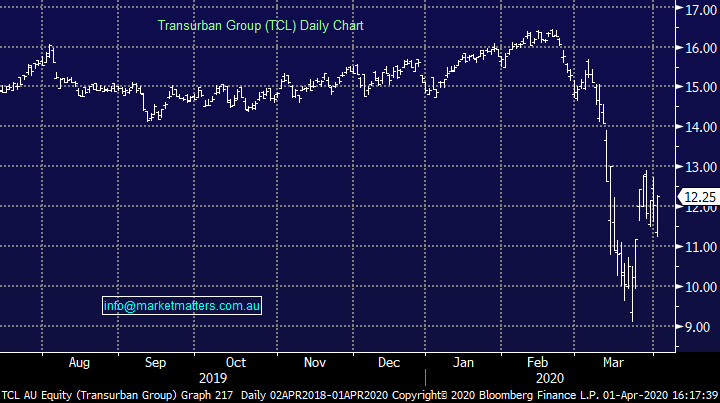

Transurban (TCL) 1.74%: the toll road operator managed close higher today despite spending much of the session in the red after withdrawing its distribution guidance as traffic numbers plummet across the company’s infrastructure portfolio. Transurban reaffirmed guidance at the half year result early in February of 62 cents and at the time was seeing stable growth in toll usage. Since then, with governments limiting the movement of people, numbers are down significantly – and pull back distribution guidance to “in line with Free Cash excluding Capital Releases.”

Across the book, the 4th week of March saw a 36% hit to traffic, and 14% down for the month of March against last year.

Despite the hit to cash flow, Transurban says it has enough flexibility in the balance sheet to meet its requirements for the next 15 months and continues to push on with the West Gate tunnel project, covering themselves through FY21. Despite all of the negativity, these issues will pass, and traffic will return. TCL is down around 25% from its highs and is a stock squarely on our radar.

Transurban (TCL) Chart

NRW Holdings (NWH) +13.55%: We trimmed our weighting in NWH yesterday by less than 1% however that’s certainly not a reflection on the stock itself. While it’s clearly a higher beta play, this is a very well-run business, it has a strong committed order book and is exposed in the right areas of mining services. We like NWH, we would be conformable buyers here if we had a smaller weighting or no weighting at all.

NRW Holdings (NWH)

BROKER MOVES:

- DMP AU Cut to Hold at Morgans Financial Limited; PT A$57.19

- InvoCare Raised to Buy at Citi; PT A$13.50

- GPT Group Raised to Positive at Evans & Partners Pty Ltd

- Technology One Cut to Lighten at Ord Minnett; PT A$7.30

- BWP Trust Cut to Hold at Morningstar

- Netwealth Cut to Sell at Morningstar

- Sydney Airport Cut to Underperform at Credit Suisse; PT A$4.50

- Coca-Cola Amatil Raised to Outperform at Credit Suisse

- Qantas Cut to Underperform at Credit Suisse; PT A$2.20

- Aurizon Raised to Buy at Goldman; PT A$5.43

- Sims Cut to Hold at Jefferies; PT A$6.20

- South32 Raised to Buy at SBG Securities; PT A$2.19

- Mirvac Group Raised to Positive at Evans & Partners Pty Ltd

- IGO Raised to Buy at Bell Potter; PT A$5.55

- Fortescue Cut to Hold at Bell Potter; PT A$8.54

OUR CALLS

No changes today

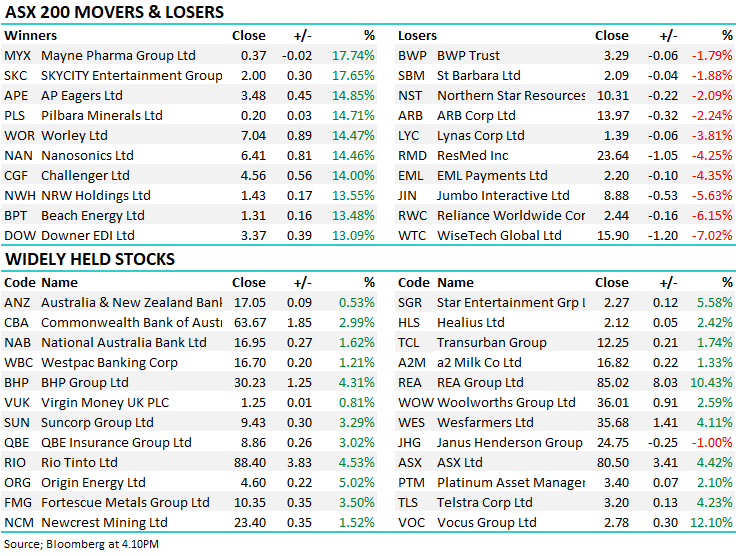

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.