ASX gives up a solid start (PNV, JHX)

WHAT MATTERED TODAY

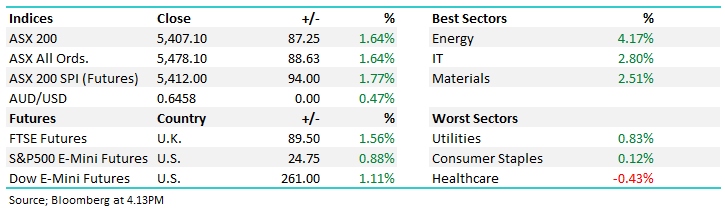

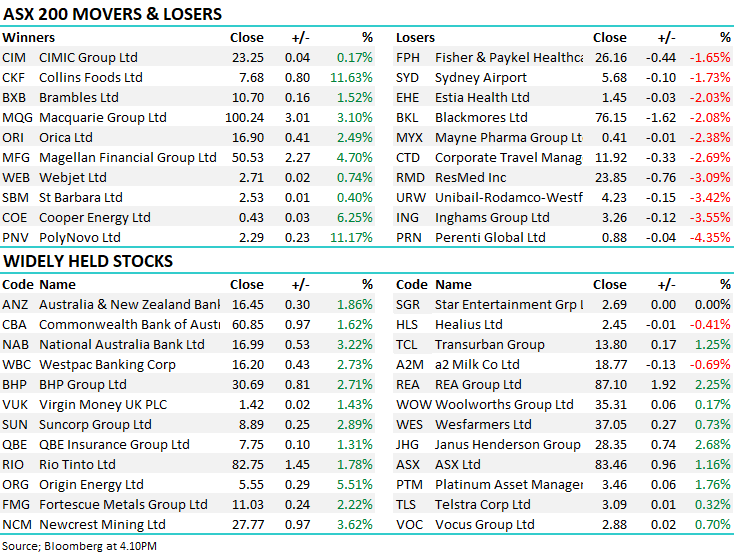

Another day where the local market climbed the wall of worry led by the energy sector but supported well by IT and Materials i.e. the risk on sectors seeing most love while the defensive areas lagged. Banks also saw a reasonable bid today led by NAB +3.22% & Westpac +2.72% following the latter’s 1H20 report on Monday.

Overall, the ASX 200 added +87pts / +1.64% today to close at 5407 - Dow Futures are trading up 261pts/1.11%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

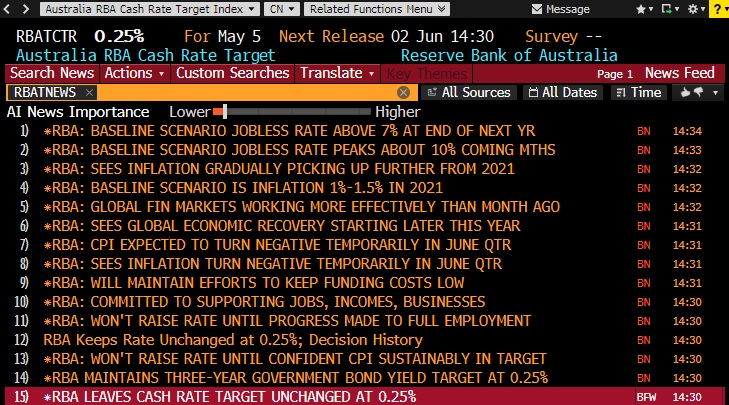

RBA Today: The RBA left rates on hold today and talked down the prospect of raising rates until progress is made towards full employment – seems a long way off. They forecast that unemployment will peak at about 10% before settling nearing 7% by the end of next year. They also outlined their view that the economic recovery will start later this year and pick up steam from there – highlights below.

RBA Highlights

Source: Bloomberg

Macquarie Conference: a new look Macquarie conference kicked off today as presenters moved online to reach investors. The virtual conference will continue through until Thursday with a broad range of companies presenting. Investor presentations like these are a chance for the executives to talk up activity, with most stocks that presented closing higher in the session. PolyNovo (PNV) was the biggest winner from the presentation, jumping 11.17%. The company which manufactures dermal regeneration technology jumped after saying that they have seen little impact to the supply chain while a more digital focus on sales had helped support revenue.

Bravura Solutions (BVS) caught a bid today after reiterating guidance for the full year with NPAT growth in the mid-teens. The presentation showed little new news – a large chunk of the slides were directly copy and pasted from the half year presentation in Feb. But that is all the market needed to hear, the financial SaaS business is one of the few stocks that haven’t been too phased by the virus turmoil.

Dexus (DXS) rose ahead of market despite flagging the various issues COVID is currently having, and will have on the business including reduced office demand with more flexible working arrangement. The property manager talked up their premium exposure, high occupancy levels and strong pipeline. Some names expected to present tomorrow include Bingo (BIN) & Cleanaway (CWY), Western Areas (WSA) and Medibank Private (MPL).

PolyNovo (PNV) Chart

James Hardie (JHX) +4.85%: shares in JHX were higher today with the company updating the market on business activities and guidance. They talked up their early response to the pandemic with strict social distancing guidelines and hygiene focus coming into effect ahead of the virus allowing many manufacturing sites to continue businesses as usual. The company still did tighten guidance to the lower end of the range with FY20 Adj. NOPAT at $US350-$355m with revenue remaining on track, but costs climbing on some operational sections in Europe and “government-mandated closures of manufacturing plants in Spain, New Zealand and the Philippines.” The Australian business was singled out as a strong driver of performance. 4th quarter results will be released in a fortnight.

James Hardie (JHX) Chart

Direct from the Desk: Ausbiz this morning talking market open…click here

BROKER MOVES: It's Now or Never to Buy Bruised Asia Oil Stocks, Bernstein Says “If you don’t want to buy oil equities now, will you ever?,” Sanford C. Bernstein analysts said in a note, upgrading their view on Asia-Pacific based companies including Woodside, Santos, Inpex, Cnooc and PetroChina to outperform.

· Bapcor Rated New Buy at Citi; PT A$6

· Transurban Cut to Hold at Morgans Financial Limited; PT A$13.52

· New Hope Cut to Neutral at Citi; PT A$1.60

· Orora Cut to Neutral at Macquarie; PT A$2.75

· Qube Raised to Buy at UBS; PT A$2.70

· Santos Raised to Outperform at Bernstein; PT A$6.30

· Oil Search Raised to Outperform at Bernstein; PT A$3.50

· Woodside Raised to Outperform at Bernstein; PT A$27

· Qube Cut to Hold at Morningstar

· Monadelphous Raised to Buy at Morningstar

· Alumina Raised to Hold at Morningstar

· Transurban Cut to Neutral at JPMorgan; PT A$13.50

· IGO Raised to Buy at Hartleys Ltd; PT A$5.20

· Transurban Cut to Hold at Jefferies; PT A$14.37

· Monash IVF Raised to Add at Morgans Financial Limited

· Adairs Raised to Add at Morgans Financial Limited; PT A$2.17

· FBR Cut to Speculative Hold at Bell Potter

OUR CALLS

No changes to portfolios today.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.