Bullish day as market rallies +120pts from the low (SGP, CBA)

WHAT MATTERED TODAY

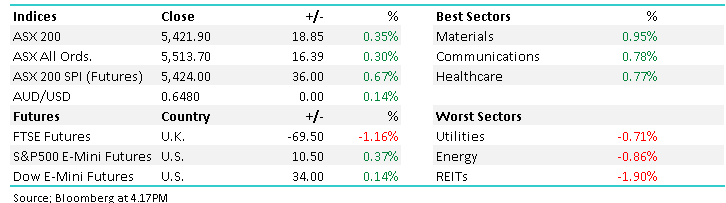

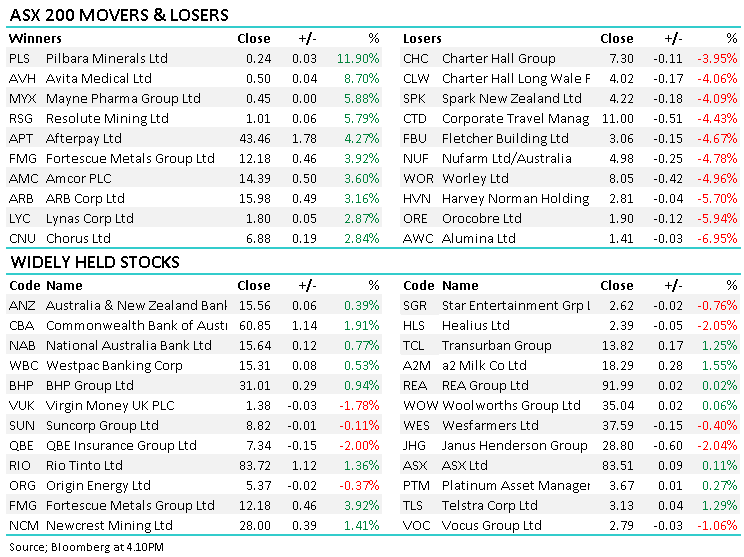

A very strong recovery from the ASX today after trading to a 5301 low this morning the index put on +120pts to end the session higher - a clear example of buyers emerging into weakness. Materials stocks well supported today, particularly the Iron Ore names as concern bubbles away around Brazilian production if the virus took hold of that part of the world.

The Australian Government today issued a record tranche of bonds totalling $19bn to fund its spending package, it was nearly covered 3x over with bids totalling more than $53bn…Lots of liquidity about.

Today the ASX 200 added +18pts / +0.35% to close at 5421 - Dow Futures are trading up +34pts/+0.14%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

DIRECT FROM THE DESK: Covering trading updates from Commonwealth Bank (CBA) + Stockland (SGP)

Stockland (SGP) –1.1%: choppy day for the diversified property group. They provided an update to the market for the first three quarters of the year, with investors keen to see the impact COVID is having on the residential, industrial and office markets as well as retirement homes. Residential sales fell to 1,121 for the quarter, down 17% on the previous quarter, though 876 lots settled which was up on the 2nd quarter highlighting the delayed impact of COVID. A similar impact seen in retirement lots with net sales reaching its highest level in 2 years at 225, but sales falling to just 25 in the month of April. Stockland said that sales would be impacted for the foreseeable future as potential new residents see a longer runway on sales of their existing homes.

For the commercial segment, workspace occupancy rose to 94.2%, though the WALE fell showing falling demand for longer term leasing. Logistics space continues to show strength, occupancy climbed here to nearly 99%. Stockland’s retail offer is largely skewed to staples with centres often built with a supermarket anchor tenant. As a result, even though speciality store sales fell 18% in March, turnover grew across the portfolio by 5.2%. Conditions are expected to remain challenging through the fourth quarter through even as stores reopen. Shares in SGP finished the day lower, largely as a result of comments around a rise in defaults in April, climbing to around 4%in the residential business (very slightly above long-term average). Currently trading around 50% below pre-corona virus levels, SGP looks reasonable over the longer term though it may be some time before the residential market fully recovers.

Stockland (SGP) Chart

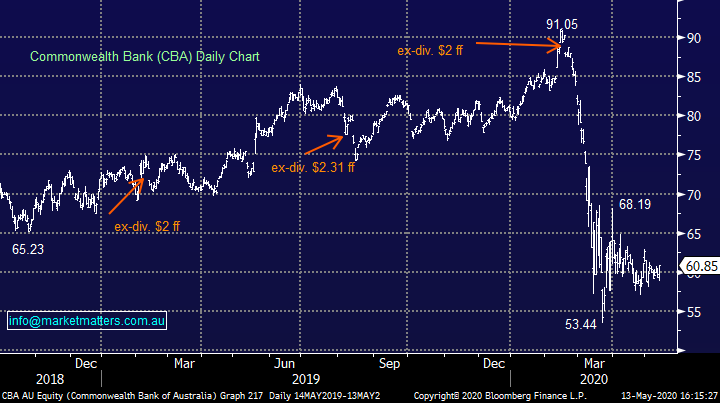

Commonwealth Bank (CBA) +1.91%: CBA has this morning showed (again) why it’s the No 1 pick of local banks delivering a decent trading update in a very difficult period. They announced 3Q20 profit of $1.3B which included a bad debt charge of $1.6B, $1.5B of that is a forward-looking estimate on impacts from COVID-19.

In terms of the underlying result, they had no change in income from 1H20 quarterly average to 3Q20 with a small increase in lending being offset by a similarly small reduction in margins thanks to a lower cash rate. They had a bigger remediation provision ($135m) however excluding that, expenses were down a touch.

Capital for CBA is strong at 10.7% after paying the 1H20 dividend plus they announced the sale of 55% of Colonial First State, the total unit being valued at $3.3b. This and other announced sales should add 70 bps to CET1 capital which takes it well above the level of unquestionably strong. All in all, a reasonable performance in a tough market with few surprises.

Commonwealth Bank (CBA) Chart

BROKER MOVES:

- Incitec Raised to Buy at Citi; PT A$2.43

- Santos Cut to Hold at Morgans Financial Limited; PT A$4.39

- Woodside Cut to Hold at Morgans Financial Limited; PT A$22.56

- Oil Search Cut to Hold at Morgans Financial Limited; PT A$2.82

- AusNet Cut to Neutral at Macquarie; PT A$1.94

- Altium Cut to Neutral at Macquarie; PT A$35

- AusNet Cut to Underperform at RBC; PT A$1.70

- AusNet Cut to Underweight at Morgan Stanley; PT A$1.88

- Alacer Gold GDRs Cut to Neutral at Credit Suisse; PT A$8.60

- CSR Raised to Neutral at Credit Suisse; PT A$4.10

- CSR Raised to Hold at Jefferies; PT A$3.40

- CSR Raised to Equal-Weight at Morgan Stanley; PT A$3.75

- AusNet Cut to Underweight at JPMorgan; PT A$1.75

OUR CALLS

No changes

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.