ASX puts on 2% to kick off the week (FLT, RHC)

WHAT MATTERED TODAY

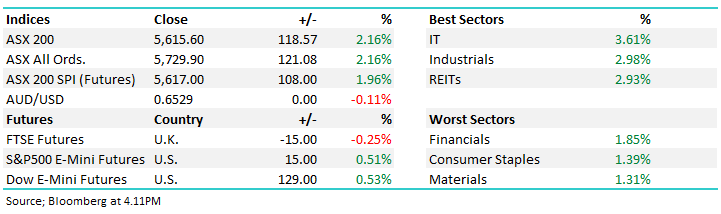

A good session to kick off the week in Oz with the index putting on +2%. No trade in the US tonight given Memorial Day holiday although US Futures were trading through our time zone today and they were positive throughout.

IT stocks led the charge today with the buy now pay later stocks doing particularly well. The Treasurer’s comments this morning that the government has not ruled out offering more support to some sectors of the economy now they’re suddenly $60bn better off helping. More support to tourism and travel + hospitality is a positive for the credit quality of the BNPL stocks while its also a positive for the operators themselves, Flight Centre (FLT) and Webjet (WEB) up 15% a piece today.

Today the ASX 200 added +118pts / +2.16% to close at 5615 - Dow Futures are trading up +129pts/0.53%

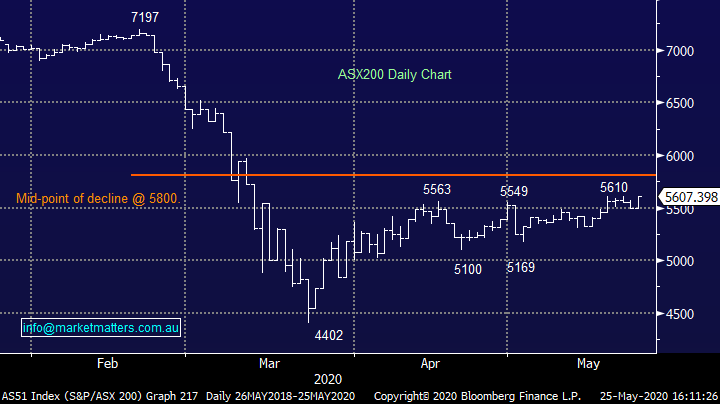

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Direct From The Desk: Wrap up of todays trade

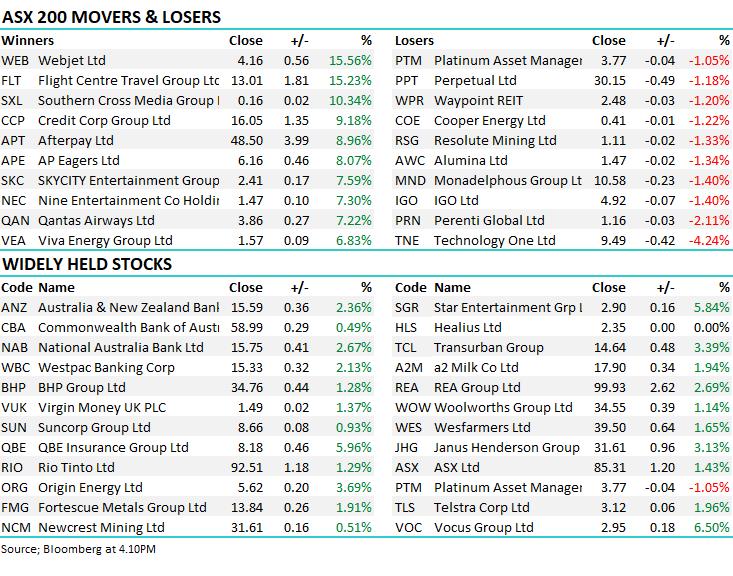

Travel Stocks: the two big winners in the top 200 today were Webjet (WEB) and Flight Centre (FLT) both jumping over 15% in the session. The turnaround in travel exposure has been swift, but it still comes ahead of an earnings rebound. States are looking to open up boards, and chatter surrounding a Aus-NZ travel bubble grows every day so investors are becoming more confident recreational and business travel will return ahead of schedule.

Buying the sector is an interesting call option on COVID – a bet that the market remains overly pessimistic around the pace at which restrictions will ease. We have a close eye on a number of related stocks on top of today’s two best – Corporate Travel (CTD), Qantas (QAN), IDP Education (IEL) as well as Sydney Airport (SYD) which we own in the Income Portfolio.

Flight Centre (FLT) Chart

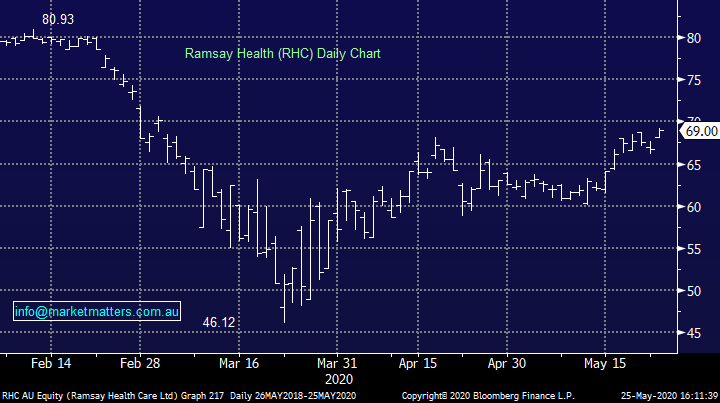

Ramsay Healthcare (RHC) +3.45%: announced the results of the SPP today, with more than half of eligible shareholders applying for shares Ramsay opted to upscale the offer by an additional $100m. A total of $695m was applied for, with allocations being scaled based on the holding as at the 21st of April when the deal opened. An interesting approach from the Ramsay board here, not one often seen in SPP offers. Usually applicants are scaled based on their bid amount rather than holding and throws a spanner in the works for those holding a handful of shares hoping for a capital raise to come along.

It also could mean RHC will see less selling pressure once the shares are allotted – with smaller holders receiving a relative allocation, it may mean less need to reweight portfolios. We own Ramsay in the growth portfolio, picking up shares at a discount through the SP is great, but we like the medium trend in hospital exposure as people return to elective surgeries and emergency departments. We remain bullish.

Ramsay Healthcare (RHC) Chart

BROKER MOVES:

- Tabcorp Rated New Sell at Citi; PT A$2.80

- TPG Telecom Raised to Add at Morgans Financial Limited

- oOh!media Raised to Buy at Morningstar

- Ramelius Raised to Add at Morgans Financial Limited; PT A$1.93

OUR CALLS

No changes

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence