Trump finally addresses the nation (BLD, Z1P, IRE)

WHAT MATTERED TODAY

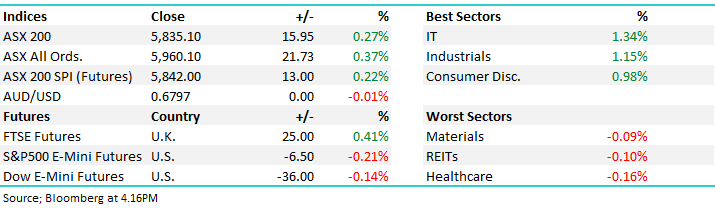

Another session where the market rallied from the early lows showing a decent underbelly of buying into any remanence of weakness – although it was a fairly tight trading range overall today. While US markets edged higher overnight, their futures opened lower this morning and that put some pressure on our market early - however as the day progressed, we saw a gradual recovery.

President Trump addressed the nation for the first time since the riots began and promoted a harder line rather than a conciliatory one, showing his hand in the process. As the divisions grow deeper in the US, the President’s underlying message was about law and order and a use of greater force, a message that would resonate with typical Trump voters that are outraged by the riots. Those protesting are not typical Trump voters which is a reason in itself to suggest we could unfortunately see the situation escalate further.

For now, the markets are not blinking however given how fragile the recovery is thanks to the economic damage inflicted by COVID-19, I think we have a right to be somewhat concerned in the short term.

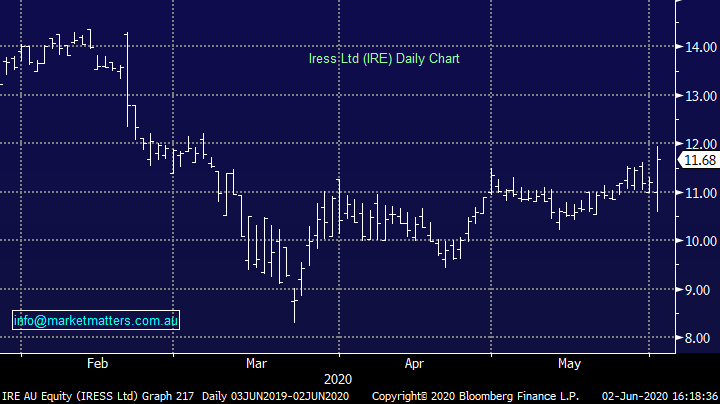

The IT stocks led the buying today thanks largely to Z1P Co (Z1P) after they announced the purchase of a US payments company, more on that below, while Iress (IRE) also offered support after completing their capital raise to buy OneView (OVH) – Openpay (OPY) also worth a mention after adding another 22% today following a strong move yesterday.

Asian markets were all higher today while US futures recovered some of the losses set early on.

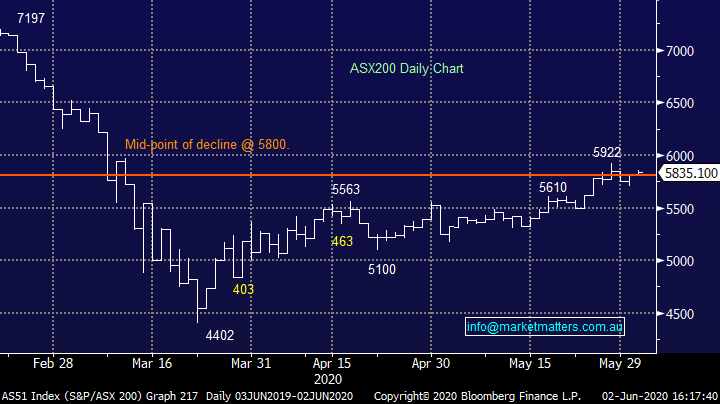

Overall, the ASX 200 added +15pts / +0.27% today to close at 5835 - Dow Futures are trading down -36pts/-0.14%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

RBA: The RBA kept rates on hold today at 0.25% as expected, however the statement was a touch more upbeat. "Notwithstanding these developments, it is possible that the depth of the downturn will be less than earlier expected," it said.

"The rate of new infections has declined significantly, and some restrictions have been eased earlier than was previously thought likely. And there are signs that hours worked stabilised in early May, after the earlier very sharp decline. There has also been a pick-up in some forms of consumer spending.

"However, the outlook, including the nature and speed of the expected recovery, remains highly uncertain and the pandemic is likely to have long-lasting effects on the economy.

Building Materials: Stocks in this sector have enjoyed a good run of late on expectations of Government stimulus – we hold Bingo (BIN) and Reece (REH) which have been edging higher. The AFR now reporting that Kerry Stokes’ Seven Group Holdings is believed to be the buyer of more than ~10% of Boral (BLD). The trade was done of Friday, the same day as the MSCI rebalance in an attempt to hide the large transactions (this is a day when volumes are very high). Watch for a substantial holder notice to confirm however the market is clearly taking this as a positive. We remain positive building companies overall however suspect BLD needs an equity injection.

Boral (BLD) Chart

Z1P Co (ZIP) +38.67%: Ripped higher today after they announced theacquisition of QuadPay. QuadPay is a US buy now pay later (BNPL) firm with over 1.5m customers, a pay in 4 instalment product the same as AfterPay Alongside this transaction Zip has announced $100m in convertible notes and further funding instruments to a large US PE investor ‘Heights Capital Management’, putting funding likely out of the narrative. The transaction is at only 5.7x EV/rev for Quad, which seems cheap in a relative sense. The announcement was clearly very well received as it gives Zip another leg of growth and puts the company into the global payments space.

Zip Cp (Z1P) Chart

IRESS (IRE) +4.19%: back on the boards after yesterday launching a $170m capital raise and lobbing a bid at Onevue Holdings (OVH). Onevue is fund administration platform that handles managed fund, super and individual investments, with around $500bn under administration, the bulk coming from managed funds. Onevue reported a first half EBITDA of $3.4m earlier in the year but reported NPAT at a $27.1m loss given they were forced to significantly write-down receivables on the sale of Diversa Trustees to Sargon which fell into voluntary administration. FY19 saw OVH report NPAT of $1.4m. IRESS have offered 40c/share to OVH, which the board has unanimously recommended, which equates to around $107m in total.

The deal is expected to be dilutive to earnings per share in the first year for IRE, but with $3-4m p.a. of synergies once integrated and ability to leverage strengths between the businesses, the IRESS board is hopeful the purchase will deliver long term value. The OVH board unanimously recommended the offer, unsurprising given it was a 67% premium to Friday’s close, but it will still need shareholder and regulatory approval. IRESS has managed to secure $150m of the raise in Institutional money, while the final $20m is expected from the SPP offer to retail holders. The extra money will help sure up the balance sheet. For mine, it looks a pretty stretched deal, and a long run way before benefits are really seen by IRESS shareholders.

IRESS (IRE) Chart

BROKER MOVES:

· Pro Medicus Cut to Neutral at UBS; PT A$29.65

· Steadfast Rated New Buy at UBS; PT A$3.90

· Super Retail Cut to Neutral at UBS; PT A$8.70

· Stockland Raised to Outperform at Macquarie; PT A$4.17

· Star Entertainment Cut to Neutral at Citi; PT A$3.10

· Adbri Raised to Overweight at Morgan Stanley; PT A$3.70

· Super Retail Cut to Sell at Morningstar

· Ansell Cut to Sell at Morningstar

· Scentre Group Raised to Buy at Morningstar

· Vicinity Centres Cut to Neutral at JPMorgan; PT A$1.70

· Pro Medicus Cut to Neutral at Evans & Partners Pty Ltd

OUR CALLS

No changes today

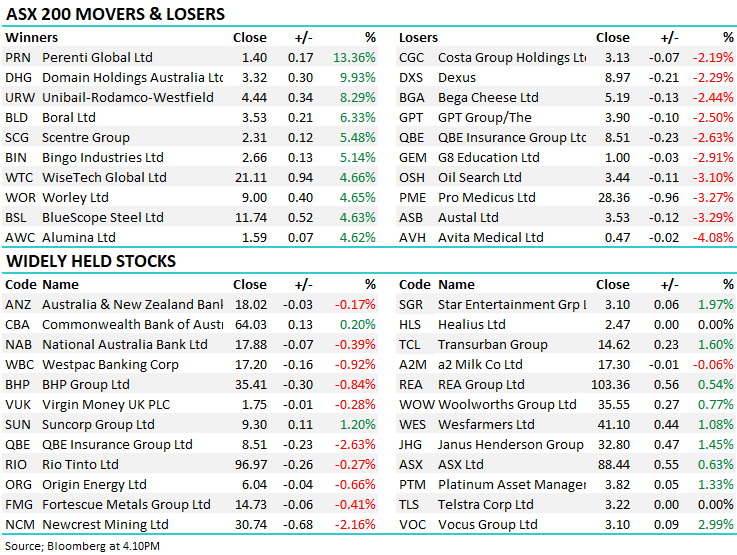

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.