Buyer emerges for Sydney office space (DXS)

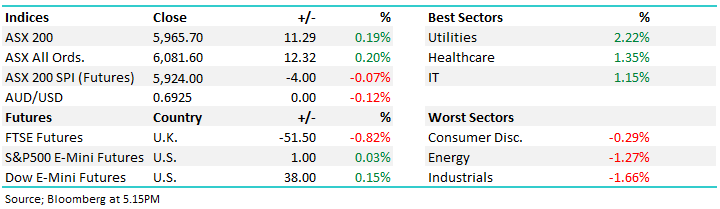

WHAT MATTERED TODAY

A choppy day today with the index knocking on the door of 6000 for now the 6th straight session but once again failing to move meaningfully higher. Utilities were strong, with gas infrastructure company APA announcing they expect to meet previous dividend guidance of 50c/share for the full year. CSL closed at its best level in 3 weeks to see healthcare higher. Materials were also strong with both gold and iron ore names catching a bid – both commodities moving higher together is rare, and its unlikely to last. TPG-Vodafone merger received shareholder approval today with very little resistance from the owners, the final hurdle to jump is the NSW court hearing on Friday this week.

Overall, the ASX 200 added +11pts / 0.19% today to close at 5965 - Dow Futures are trading up +38pts/0.15%

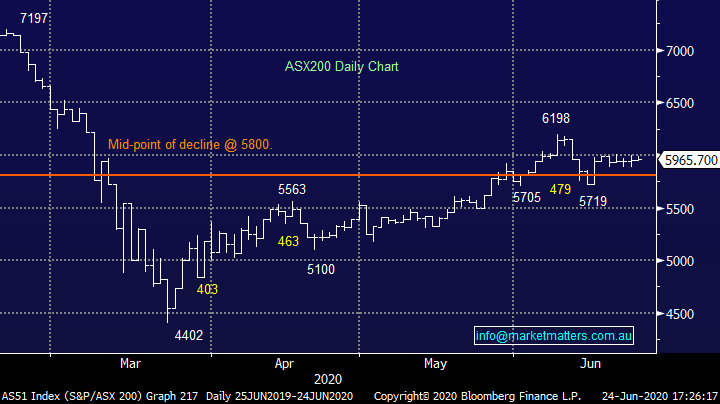

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

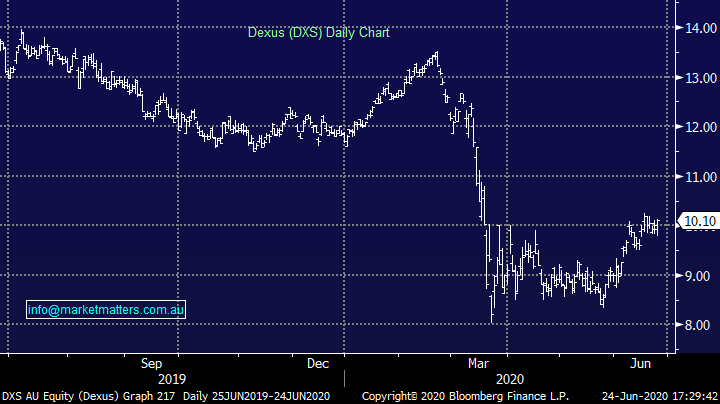

Dexus (DXS) +0.90%: property manager Dexus is poised to sell one of their prime Sydney office blocks for $530m. Singapore’s Peakstone approached Dexus with an offer for 45 Clarence Street in line with the carry value seen at the half year result which was enough for the current owner to take notice. The deal will still require FIRB approval, while when the money lands it will be used to pay down some debt. What caught my eye was the keen buyer despite the uncertainty – particularly around office space in a rapidly evolving work environment. In an afternoon release, Dexus announced it had undertaken external valuations of 90% of its assets with the book value falling just 1.2%. CEO Darren Steinberg said it highlighted the resilience of the book, particularly given book values actually increased in the industrial portion. The operating environment seems hazy for the medium term as companies re-work office requirements for staff, but for the moment, land still has a buyer. We are cautious the space for the moment, though DXS is fairly priced at around 0.9x book value.

Dexus (DXS) Chart

BROKER MOVES:

· Qube Cut to Neutral at Citi; PT A$3.15

· Transurban Cut to Neutral at UBS; PT A$14.85

· Appen Rated New Outperform at Macquarie; PT A$38

· Premier Investments Cut to Sell at Morningstar

· Western Areas Raised to Overweight at JPMorgan; PT A$3.30

· Qube Cut to Reduce at Morgans Financial Limited; PT A$2.45

· SCA Property Cut to Hold at Jefferies; PT A$2.23

· Qube Cut to Hold at Jefferies; PT A$2.83

· Altium Cut to Lighten at Ord Minnett; PT A$29.50

OUR CALLS

No changes today

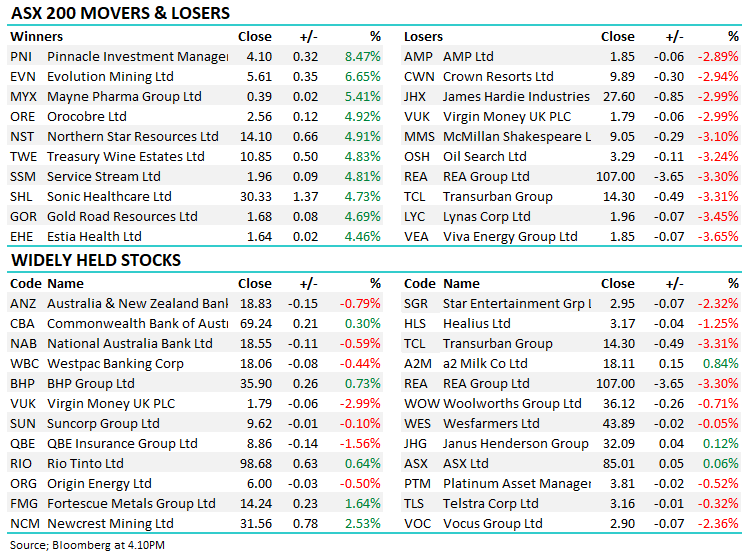

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.